Market Commentary

Key Takeaways: U.S. equity index futures diverge in their attempt to discover fair prices for two-sided trade.

Ahead: Economic data and earnings.

SPX, RUT, DJI firm. NDX tad weaker.

What Happened: Last week, U.S. stock index futures auctioned sideways to higher, only after enduring a brief liquidation alongside anxieties surrounding the spread of COVID-19 variants, as well as an evolution in monetary policy.

The liquidation, though, was not unwarranted. For weeks broad market indices, led by the Nasdaq 100, rose on narrowing breadth and tapering volumes.

Then, during the unraveling, a meaningful divergence was observed with the Nasdaq 100 trading relatively weak. This came as rates on the 10 Year T-Note rebounded after testing trend support near 1.25%.

Technical factors – issuance, short coverings, a fading reflation trade, and peak growth – are to blame for lower Treasury yields.

“Technical factors appear to be pushing rates lower and this should be temporary as current 10-year Treasury yield of 1.3% is well below its economic fair value,” Moody’s Corporation (NYSE: MCO) strategists wrote July 8.

Through an ordinary least squares regression using an estimate of monthly real U.S. GDP, CPI, the current effective fed funds rate, the Fed’s balance sheet as a share of nominal GDP, and a Fed bias measure via fed funds futures, Moody’s comes up with an implied “economic fair value” of 1.6% and 1.65% for the 10-year yield.

Going into year-end, on the heels of the strongest and quickest recovery in history, Moody’s sees the 10-year rising to 1.9% as the Fed announces its intent to taper in September. Once monthly asset purchases have been reduced to zero, “the Fed will reinvest proceeds from maturing assets to ensure its balance sheet doesn’t contract, which would be contractionary monetary policy. [L]ook for the first-rate hike in the first quarter of 2023.”

With that, Goldman Sachs Group Inc (NYSE: GS) suggests “[e]xpectations of higher interest rates and higher corporate tax rates by year-end are the primary reasons [to] forecast that the S&P 500 will trade sideways during the next six months.” Supporting that view are earnings estimates, the inventory positioning of participants, as well as early July seasonality metrics.

Risks Ahead: As discussed in prior commentaries, after mid-July, the window for fundamental dynamics (e.g., a shift in preferences from saving and investing to spending, monetary tightening, seasonality, or a COVID-19 resurgence) to take over is opened.

Why? Coming into the options expiration (OPEX) cycle, which starts on the third Friday of each month, associated hedging forces make it so there’s more liquidity and less movement. In other words, the market tends to pin.

Options Expiration (OPEX): Option expiries mark an end to pinning (i.e, the theory that market makers and institutions short options move stocks to the point where the greatest dollar value of contracts will expire worthless) and the reduction dealer gamma exposure.

Thereafter, according to SpotGamma, “[t]he week after expiration the market tends to experience its largest intraday volatility which corresponds to the reduction in large options positions, and the hedging associated with them.”

Considerations: Ahead are some releases on consumer, producer, and import prices, as well as industrial production, consumer sentiment, and retail sales. Also, big banks kick off the earnings season with reports on second-quarter results.

Moody’s notes: “data on inflation, retail sales and industrial production could alter … estimate[s] of second-quarter U.S. GDP, which [are] currently tracking 8.2% at an annualized rate.”

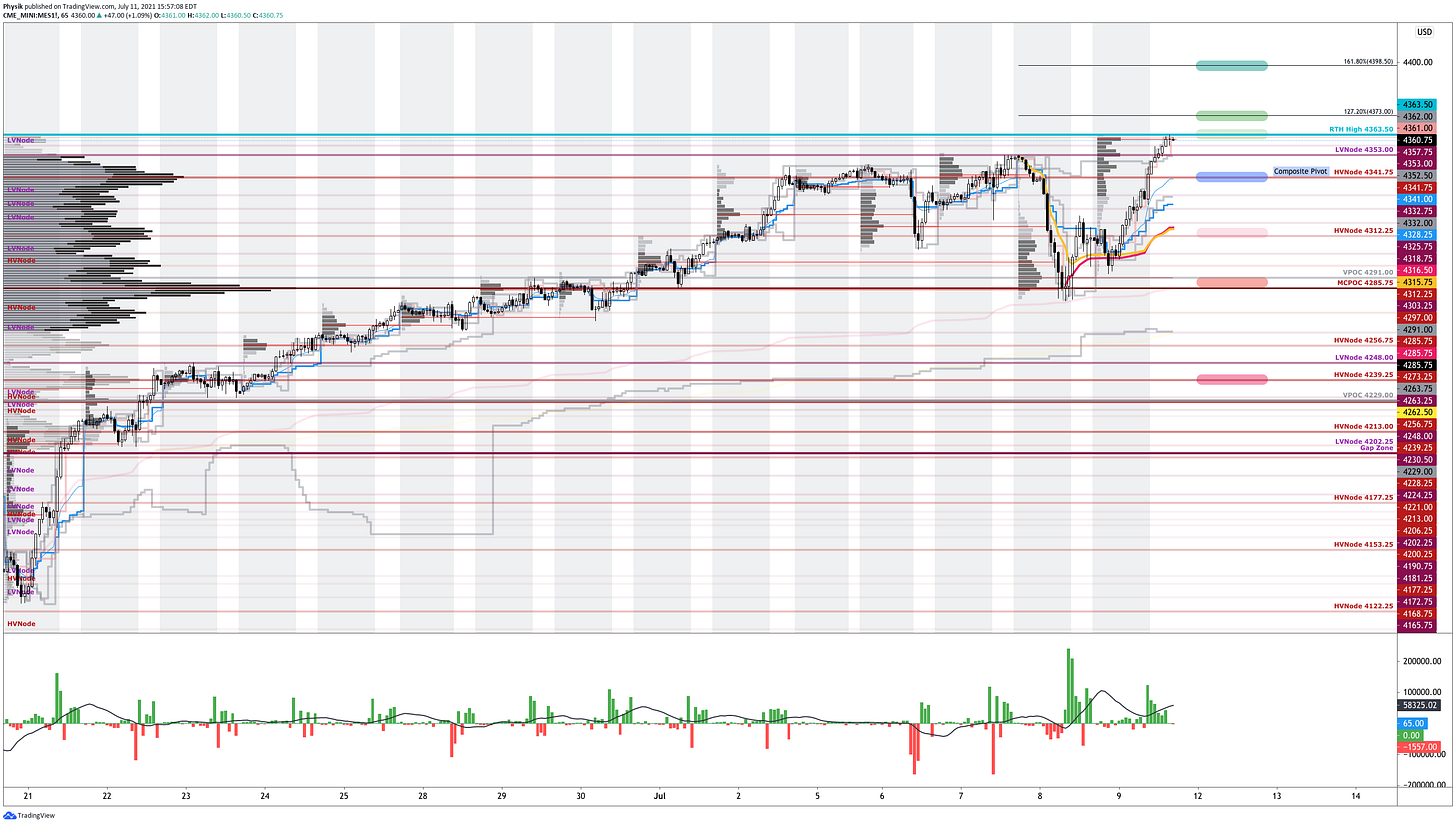

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to the $4,341.75 high volume area (HVNode) pivot.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

In the best case, the index trades sideways or higher; activity above $4,341.75 leaves in play the $4,363.50 regular trade high (RTH High). Initiative trade beyond the RTH High could reach as high as the Fibonacci-derived price targets at $4,373.00 and $4,398.50.

Significance Of Prior ATHs, ATLs: Prices often encounter resistance (support) at prior highs (lows) due to the supply (demand) of old business. These areas take time to resolve. Breaking and establishing value (i.e., trading more than 30-minutes beyond this level) portends continuation.

In the worst case, the index trades lower; activity below $4,341.75 puts in play the $4,312.25 HVNode. Thereafter, if lower, the $4,291.00 untested Point of Control (POC), $4,285.75 micro-composite HVNode, and $4,239.25 HVNode come into play.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

News And Analysis

Markets | Lower stress capital buffers a credit negative for many U.S. banks. (Moody’s)

Economy | A faster recovery boosting prices, but runaway inflation unlikely. (Fitch)

Economy | Is the Fed “tempting FAIT” by assuming inflation is just transitory? (BLK)

Economy | The Fed’s dot plots are not enough in a quantitative easing world. (S&P)

Economy | China’s fading ‘first-in first-out’ rebound sending a global warning. (BBG)

Markets | Commodity boom dwarfs oil spat as emerging markets set to win. (BBG)

Economy | Unpacking several paths to higher-than-expected interest rates. (Fitch)

FinTech | Meet Unbound, a new decentralized cross-chain liquidity protocol. (VV)

Travel | Richard Branson, Virgin Galactic pull-off key test for space tourism. (BBG)

What People Are Saying

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.