Market Commentary

Key Takeaways: U.S. equity index futures diverge in their attempt to discover fair prices for two-sided trade.

Economy is set for sustained boom.

Ahead is a light economic calendar.

SPX, NDX, DJI higher. RUT coiling.

Summary: Last week, U.S. stock index futures auctioned sideways to higher into Friday’s employment report. The release showed an addition of 850,000 jobs in June, the strongest employment gain since last summer.

The S&P 500 and Nasdaq 100 led the week-long rally, while the Dow Jones Industrial Average followed closely behind. Though the Russell 2000 did end lower, it has been building energy for a break.

Considerations: It was the beginning of April JPMorgan Chase & Co’s (NYSE: JPM) Jamie Dimon wrote strong consumer savings, an increased pace in COVID-19 coronavirus vaccinations, and unprecedented efforts to spur economic activity could mean that a boom lasts as long as 2023.

Dimon’s comments remain valid. Months after, officials are hard at work in helping the U.S. reach herd immunity with vaccines that produce antibodies for the most well-known variants of COVID-19. Additionally, the economy is making progress toward meeting the Federal Reserve’s objectives for employment and inflation; just a couple of weeks ago the institution brought forward the time frame on when it will raise interest rates.

In a statement, BlackRock strategists noted: “We believe the Fed’s new outlook will not translate into significantly higher policy rates any time soon. This, combined with the powerful restart, underpins our pro-risk stance.”

Alongside that news, the equity market sold violently, into Quadruple Witching, or the large expiry of futures and options. Thereafter, indexes staged a massive reversal, and the CBOE Volatility Index (INDEX: VIX), a measure of the stock market’s expectation of volatility, traded to its lowest level since February 2020.

According to SpotGamma models, up to 50% of the gamma in and across the S&P 500 complex was taken off the table that expiry.

This, as SpotGamma has said in the past, “creates volatility because, as large options positions expire[], are closed and/or rolled, dealers have large hedges they need to adjust.”

Put more simply, the initial action, into the expiry, may have been attributable to the sale of long stock that hedged expiring short exposure above the market (i.e., call side).

After that exposure was cleared, the prospects for a rally improved, boosted by the buying back of short put hedges as volatility imploded.

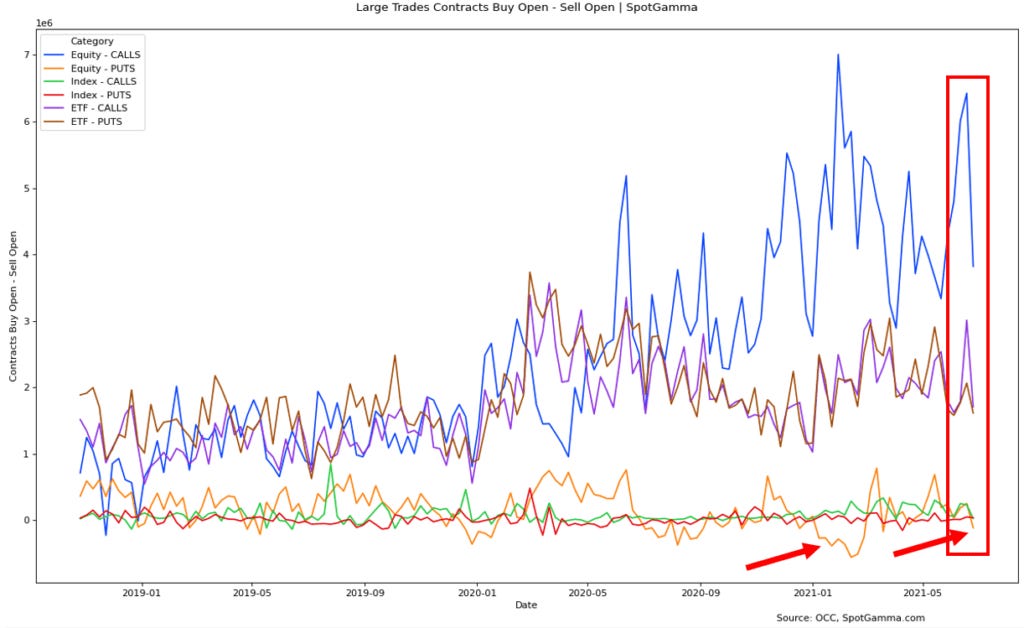

Last week, though, things became a tad frothy with the number of put options sold-to-open seeing heightened levels.

Put sales, which can be part of sophisticated volatility-based trading strategies, often suggest increased confidence as market participants look to options for income, and not insurance.

Historically, the returns after such developments are mixed; more often the appearance of strong initiative buying surfaces (e.g., August and January 2020) before a liquidation helps correct excess inventory, and bring sense back into the market.

Kris Sidial – co-chief investment officer at The Ambrus Group, a volatility arbitrage fund – and I recently held a conversation regarding meme stock volatility, market structure, and regulation. He noted that ongoing risk-on dynamics can be traced back to factors like Federal Reserve stabilization efforts, and low rates, which incentivize risk-taking.

“The growth of structured products, passive investing, the regulatory standpoint that’s been implemented with Dodd-Frank and dealers needing to hedge off their risk more frequently, than not,” are all part of a regime change that’s affected the stability of markets, Sidial notes. “These dislocations happen quite frequently in small windows, and it offers the potential for large outlier events,” like the equity bust and boom during 2020. “Strength and fragility are two completely different components. The market could be strong, but fragile.”

That dynamic is playing out as Cem Karsan, founder at Kai Volatility, notes volatility is dramatically oversupplied. As a result, as implied volatility drops, options gamma – an option delta’s sensitivity to market price changes – rises. Associated hedging forces make it so there’s more liquidity and less movement. In other words, the market tends to pin.

Still, in line with Sidial’s comments, Karsan believes expected distributions are fat-tailed, given “fragility.” In other words, it’s hard for the market to unpin. Should it unpin, however, there’s “not enough liquidity” to absorb leverage on the tails.

Given this, Karsan finds it interesting to sell at-the-money option structures to fund out-of-the-money structures. Alternatively, knowing what forces – e.g., charm or the rate at which the delta of an option changes with respect to time – decay poses on so-called “dealer positioning,” going into the July option expirations (OPEX), one could look into long calendar put spreads on the S&P 500.

In such a case, traders are short puts in July and long puts on forward. This way, you’re collecting decay as a result of realized pinning. Here’s Karsan’s full take, from the source.

After mid-July, though, the window for fundamental dynamics (e.g., a shift in preferences from saving and investing to spending, monetary tightening, seasonality, or a COVID-19 resurgence) to take over is opened.

In a note on COVID resurgence, to not venture too far off into the abyss, I cite strategists led by JPMorgan Chase & Co’s (NYSE: JPM) Marko Kolanovic who last year correctly suggested equities would continue rallying on the basis of low rates, improved fundamentals, buybacks, as well as systematic and hedge fund strategies.

“The delta variant should not have significant repercussions for the pandemic situation in developed markets (e.g. Europe and North America, which have [made] strong progress in vaccinations) due to the level of population immunity.”

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to Friday’s $4,323.00 untested Point of Control (POC).

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

That said, participants can trade from the following frameworks.

In the best case, the index trades sideways or higher; activity above the $4,323.00 POC puts in play the $4,347.00 excess high. Initiative trade beyond the excess high could reach as high as the $4,357.50 Fibonacci-derived price target.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

In the worst case, the index trades lower; activity below the $4,323.00 POC puts in play the untested POC at $4,299.00, as well as the POC and micro-composite HVNode at $4,285.00. Thereafter, if lower, participants may look for responses at the $4,263.25 LVNode, $4,247.75 LVNode, as well as the $4239.25 HVNode and $4,229.00 POC.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

For a full list of important levels, see the 65-minute profile and candlestick chart, below.

News And Analysis

Markets | The premium Elon Musk adds to Tesla, other ventures. (Kyla)

Markets | Forward-looking indicators point to improving credit trends. (S&P)

Travel | TSA screenings surpassed 2019 levels in a pandemic first. (CNBC)

Energy | WH is worried about high oil prices, sees enough supply. (REU)

Energy | An overview of data from IEA’s Energy prices database. (IEA)

Energy | OPEC ends Friday’s meeting without a deal for agreement. (CNBC)

Agriculture | Dry weather damage spells trouble for U.S. spring crops. (S&P)

Economy | States ending jobless benefits early hit labor milestones. (REU)

Markets | Spotlight turning to mergers, acquisition for fintech SPACs. (S&P)

Economy | Jobs gain largest in 10 months; employers up wages. (REU)

Energy | Cal-ISO, utilities ask consumers to conserve amid heatwave. (S&P)

Economy | Economic growth hiccup to derail credit spread stability. (BBG)

Markets | Record S&P 500 masks fear trade gripping stock market. (BBG)

Innovation And Emerging Trends

FinTech | BTC mining now easier, more profitable after crackdowns. (CNBC)

FinTech | ‘Flight to quality’ as private insurtechs draw big investments. (S&P)

FinTech | Bank customers cement relationships with digital channels. (S&P)

Markets | Money-losing companies sell record stock, flashing signal. (CNBC)

Markets | Wall Street rebels warning of ‘disastrous’ $11T index boom. (BBG)

Mobility | When do electric vehicles become cleaner than gas cars? (REU)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.