Market Commentary

Key Takeaways: Equity index futures struggle to discover higher prices.

Biden’s infrastructure deal back on track.

Week Ahead: Many economic releases.

SPX struggles. NDX weak at a key level.

What Happened: Last week, U.S. equity index futures discovered higher prices alongside some positive economic and political developments.

Of interest was an agreement on infrastructure, successful Federal Reserve bank stress tests, a record for U.S. factory activity, among other things.

Prior to the price rise, markets sold heavily on a shift in the Federal Reserve’s so-called dot-plot. Bond yields on the short-end of the curve rose while long-dated yields dropped in line with projections future inflation is easing. This flatter yield curve is a negative for cyclical-type companies which can’t pass on increased costs, thereby impacting sales and margins.

Moreover, both the S&P 500 and Nasdaq 100 established new all-time highs (ATHs). The Nasdaq 100, though, found responsive sellers at a zone of overlapping Fibonacci-derived price targets, weighing down the S&P 500, which had a difficult time expanding range, a usual sight for a healthy bull market.

Partially to blame is narrowing breadth at heightened valuations, as well as a shift in monetary and fiscal policy narratives. According to Bloomberg, while the broader market is near ATHs, the “[l]owest % of stocks [are] above 50-dma since 1999, when S&P hits record.”

This narrowing breadth, in conjunction with weak seasonality, potentially unsupportive market liquidity metrics, trade in the options market, as well as poor profile structures that offer little-to-no support on liquidations, suggests participants ought to beware of an increased potential to violently backfill.

To note, next week, participants will get more Fed speak, data on home prices, consumer confidence, employment, PMI, construction spending, home and vehicle sales, trade, and factory orders.

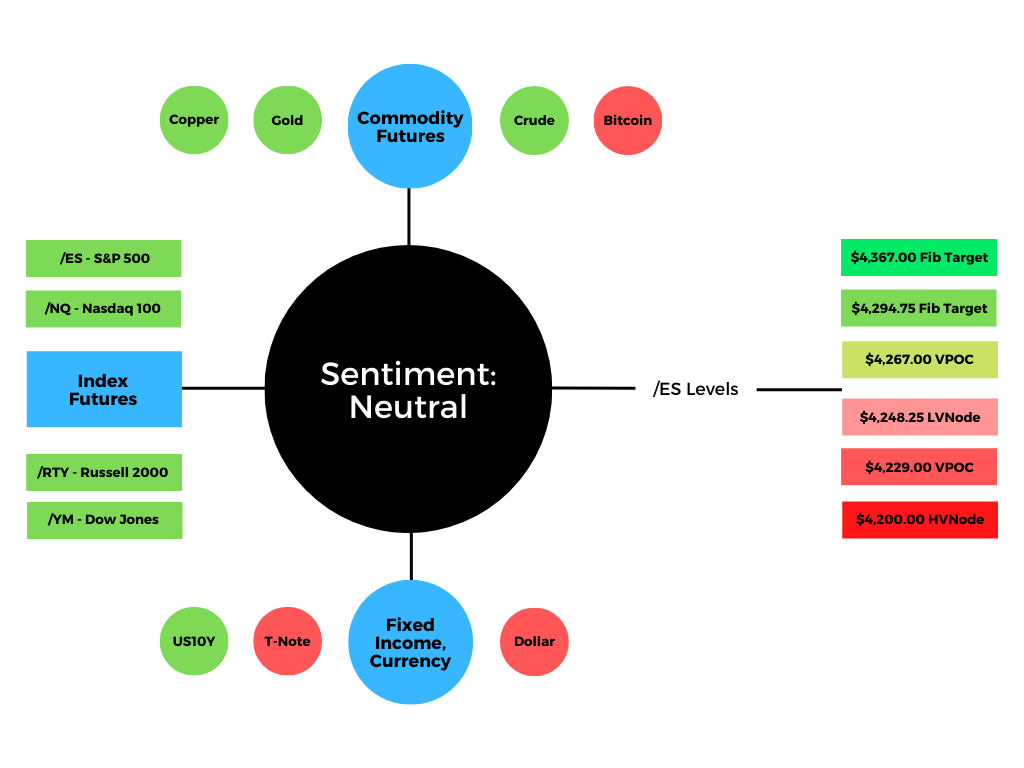

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to Friday’s fairest price or Point of Control (POC).

Point of Control (POCs): POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

In the best case, the index trades sideways or higher; activity above the $4,267.00 POC puts in play the $4,294.75 and $4,367.00 Fibonacci-derived price targets.

In the worst case, the index trades lower; activity below the $4,267.00 POC puts in play the $4,248.25 low volume area (LVNode) and $4,229.00 POC. Thereafter, if lower, participants ought to look for responses at the poor structure just below $4,200.00.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

News And Analysis

Economy | Support doesn’t provide a meaningful boost until mid-decade. (Moody’s)

Economy | Inflation jumps on base effects, supply; inflation largely transitory. (S&P)

Economy | Forecasts for eurozone growth revised up on stimulus, mobility. (S&P)

Markets | Tesla recalls nearly 300K cars in China over cruise control issues. (CNN)

Markets | El Salvador looks to hand out up to $117M in bitcoin to its citizens. (Block)

Media | Fast 9 propels box office to its biggest weekend since the pandemic. (BBG)

Markets | Boeing’s updated 777 hit with new safety concerns from the FAA. (BBG)

Weather | A record heatwave is set to scorch Pacific Northwest, South CA. (NPR)

FinTech | UK regulator bans Binance from regulated activities in the country. (Block)

Economy | Spreads and cost shocks could double the rate of loss-making. (S&P)

Markets | Chances of moderately big moves back-to-back are independent. (Tasty)

Markets | Banks clear stress tests; expecting a boost to buybacks, dividends. (REU)

What People Are Saying

Innovation And Emerging Trends

FinTech | New cryptocurrency startup funding is projected to continue rising. (CB)

FinTech | Elon Musk may debate Jack Dorsey at an upcoming bitcoin event. (Block)

FinTech | Citigroup launches digital asset units within wealth management. (Block)

FinTech | Morgan Stanley adds investment to bring blockchain to markets. (Forbes)

Work | An FBI body language expert on communicating back in the office. (BBG)

COVID | An ancient viral epidemic involving coronavirus impacted genes. (Cell)

FinTech | Xi and the CCP turn on Jack Ma, Ant, and other Chinese fintech. (BBG)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.