Editor’s Note: Happy Sunday, everyone!

A lot of new subscribers this week in light of Physik Invest’s webinar with Benzinga. If you want access to the slides presented, click here.

Additionally, I am honored for your decision to follow along and will do my best to provide an objective, “no fluff” view into the who, what, when, where, why, and how in finance and technology.

Quick note, from May 25 to May 28, the daily newsletter will be off as I will be on a trip. It would not be fair for me to provide lackluster content since I won’t have all the tools at my disposal.

That said, I’ll try to be objective and concise in today’s note to ensure you have the proper direction for the volatile trade ahead.

Market Commentary

Key Takeaways: Index futures in balance.

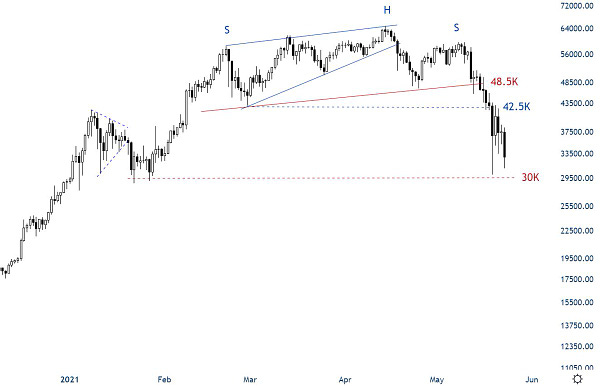

Bitcoin’s weekend crash churns stomachs.

Tone on adjusting monetary policy altered.

Indices were sideways-to-higher last week.

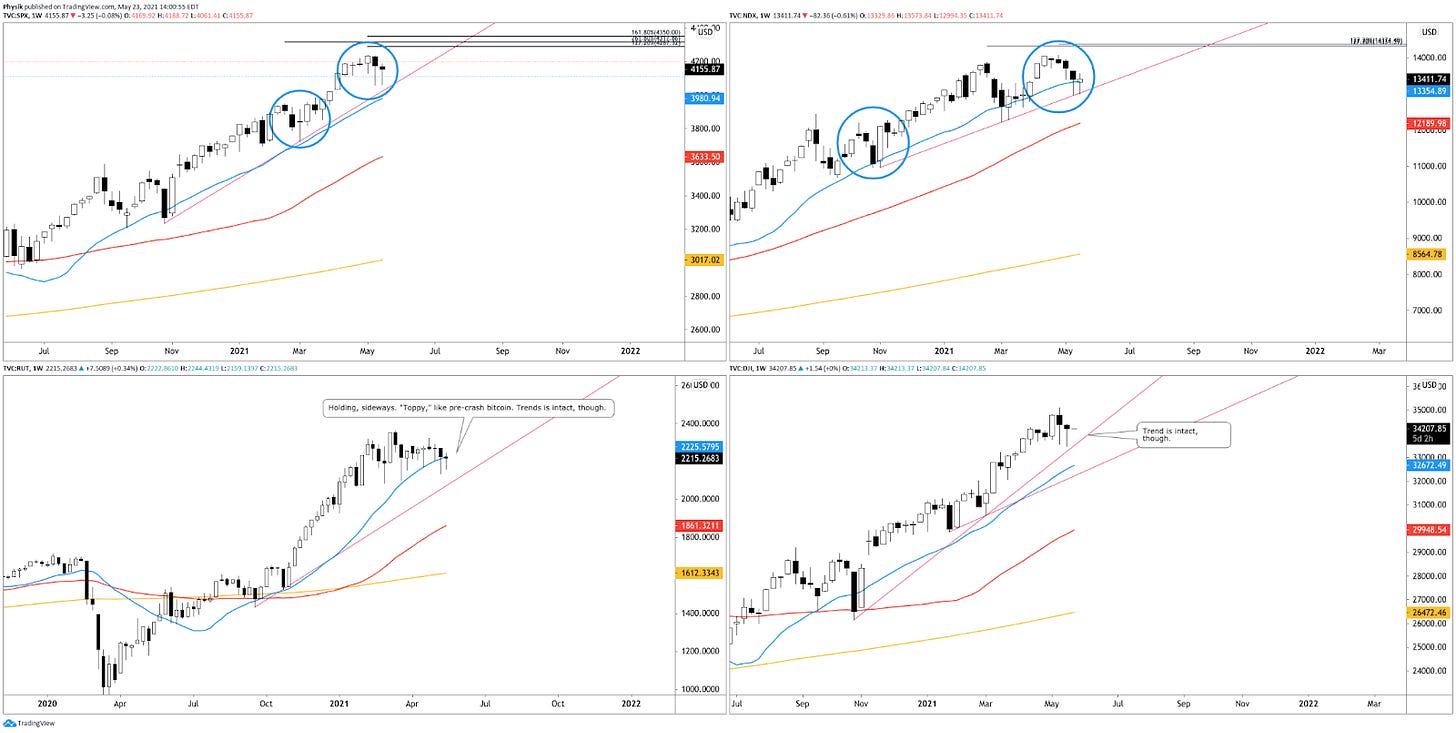

What Happened: Last week, U.S. stock index futures auctioned sideways-to-higher, as participants looked to price in emerging dynamics with respect to rising inflation, fiscal and monetary tightening, COVID-19 concerns, political risks, and the like.

In pricing in these dynamics, the movement was both volatile and mechanical, halting short of key visual references suggesting the participants involved were short-term (i.e., technically driven) in nature.

Adding, amid this rotation, quite a bit of poor structure was cleaned up (i.e., low volume areas), but still, judging by a lack of excess at certain points on the composite volume profile, odds point to limited conviction and commitment.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

Holistically, equities are in a seasonally weak period. At the same time, inflation and uninspiring economic data are major worries investors are attempting to price in.

Just last week, the Federal Reserve’s minutes showed that some on the committee were interested in tapering discussions.

“It was a surprise to hear the talk about Fed tapering,” Joyce Chang, JPMorgan’s chair of global research, said. “The market had been thinking there might be a couple of months before you really saw this particular issue come into focus.”

Generally speaking, inflation and rates move inverse to each other. Low rates stimulate demand for loans (i.e., borrowing money more attractive). With the rapid recovery, though, market participants fear that rates will rise to protect the economy from overheating.

Higher rates have the potential to reduce the present value of future earnings, making stocks, especially those that are high growth, less attractive. To note, however, rates remain range-bound; rates on the 10 Year T-Note sit below their March high and are likely to continue higher, which the market may absorb.

How may the market absorb a move higher in rates? Looking back, according to The Market Ear, during the so-called Taper Tantrum, in the early 2010s, rates settled in a wide range, and equities rallied big. Adding, research by JPMorgan Chase & Co (NYSE: JPM) suggests equities may be getting cheap with reflationary themes the go-to play, still.

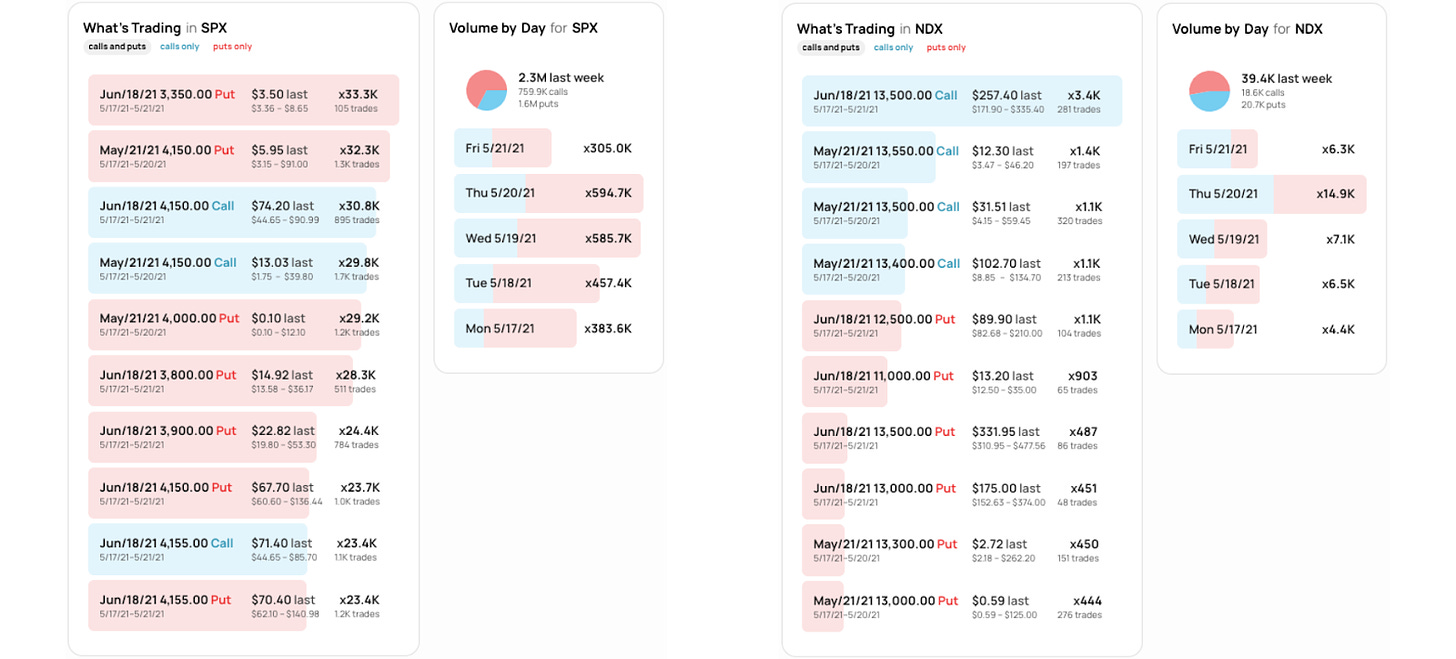

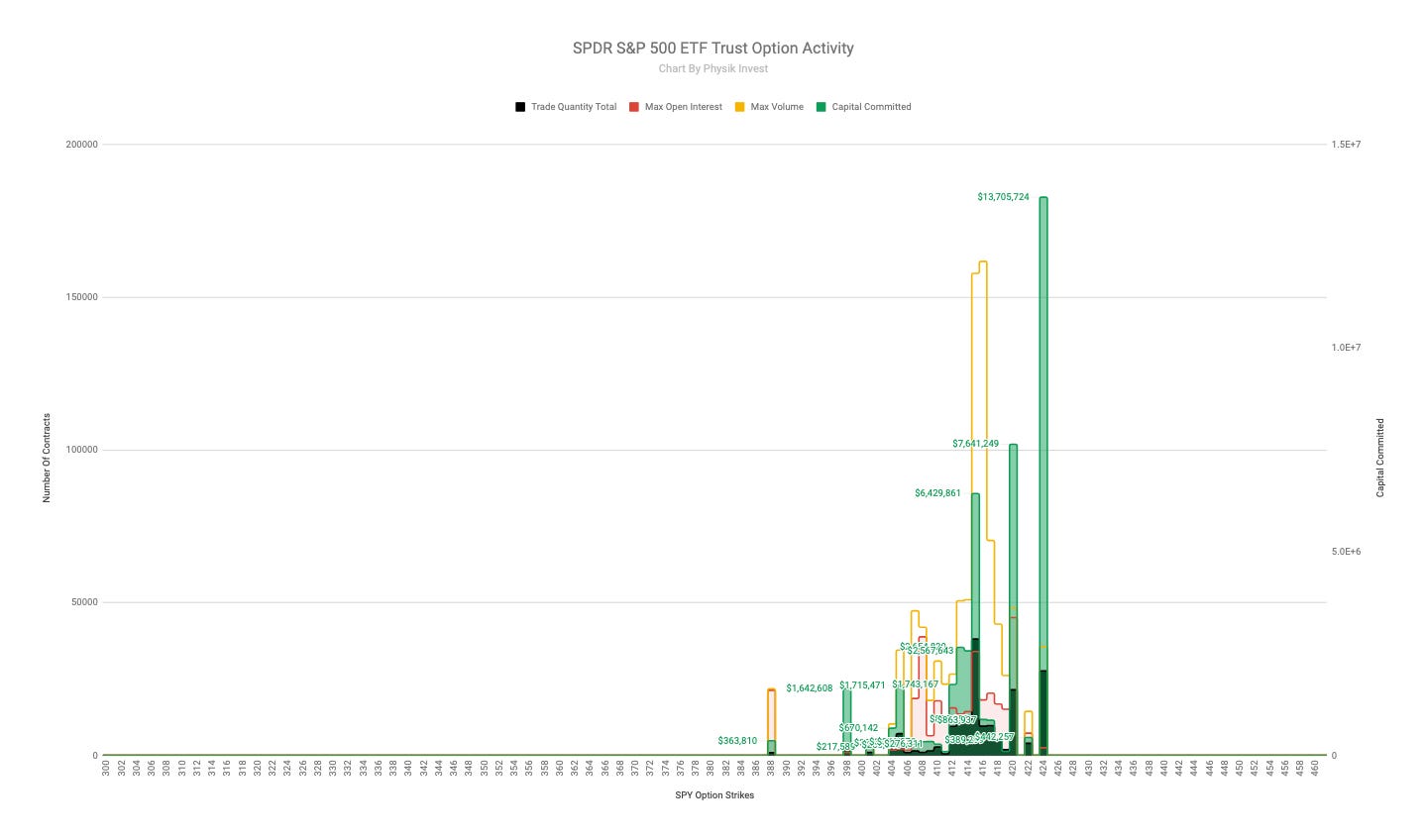

In support, during the May 19 reversal, in the S&P 500 and Nasdaq 100, participants increased exposure to the upside with relatively cheap, longer-dated calls.

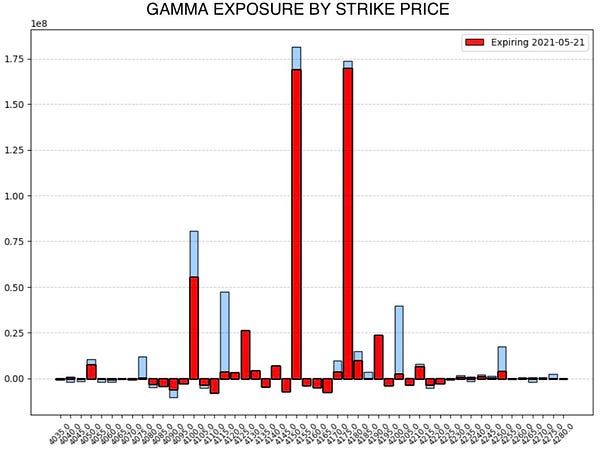

Still, overall, the flows point to a lot of opportunistic hedging (see graphic below).

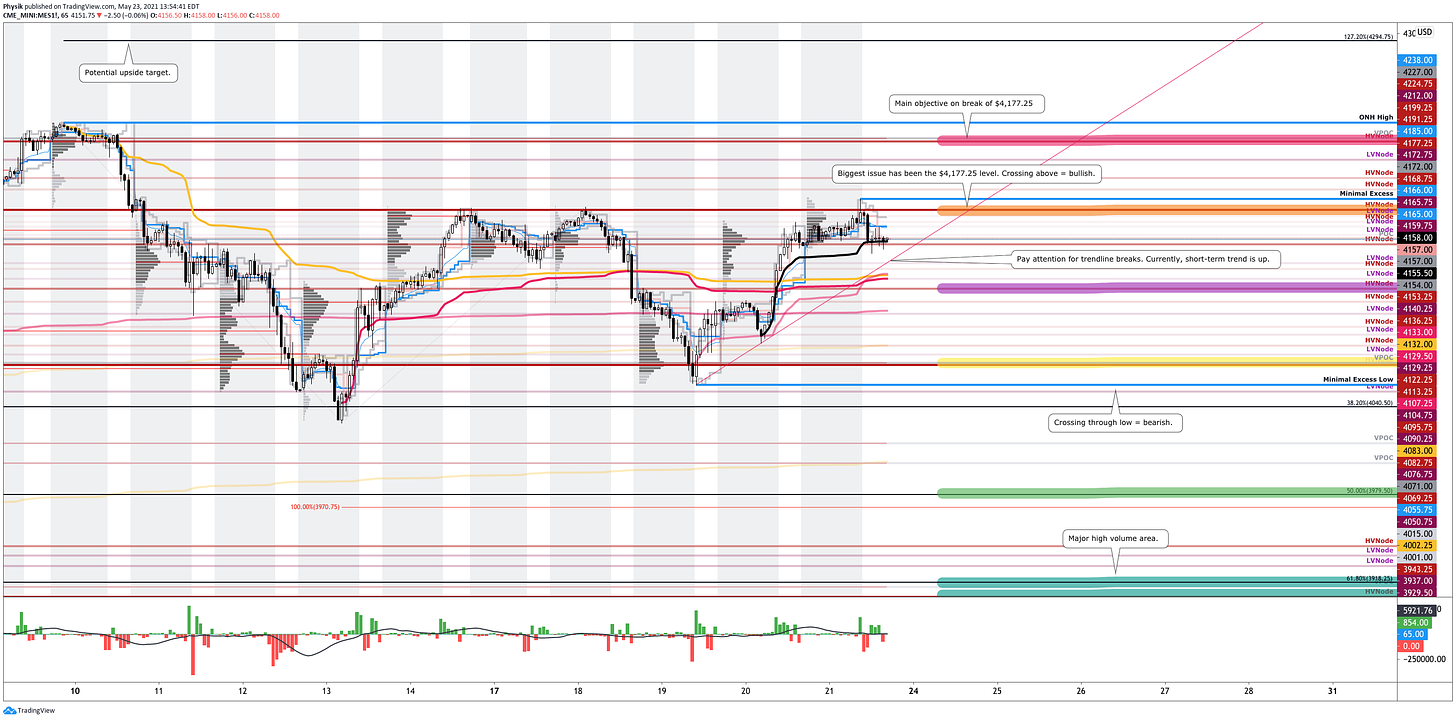

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to its $4,177.25 composite high volume area (HVNode).

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

In the best case, the index trades sideways or higher; activity above the $4,177.25 HVNode puts in play the $4,227.00 point of control (POC). Initiative trade beyond the POC could reach as high as first the $4,238.00 overnight all-time high and then, the $4,294.75 Fibonacci-derived price extension, a typical recovery target.

POCs: POCs (like HVNodes described above) are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

In the worst case, the index trades lower; activity below the $4,122.25 HVNode puts in play the $4,071.00 POC. Thereafter, if lower, on a cross through the $4,050.75 low volume area (LVNode), long-biased traders should beware of a rapid liquidation, as low as first the $4,015.00 and $4,001.00 POCs. In such a liquidation, odds favor a test of ~$3,970.00 50.00% retracement, as well as the $3,918.00 61.80% retracement and HVNode.

News And Analysis

Markets | Rotation from growth into value strengthens bull market. (ARK)

Recovery | Two COVID shots effective against the India variant. (REU)

Economy | U.S. inflation is transitory and consistent with recovery. (S&P)

Crypto | Google search volume for cryptocurrency breaks ATH. (Block)

Economy | PBOC will maintain its exchange rate basically stable. (BBG)

Markets | Global chip shortages cost automakers 5% of production. (Fitch)

Markets | JPMorgan cross-asset strategy head warns of drop. (BBG)

Markets | Nomura, UBS, UniCredit fined over bond trading cartel. (TT)

Recovery | CDC probes reports of myocarditis in the vaccinated. (Axios)

Economy | U.S. home prices push to record highs, buying slows. (WSJ)

What People Are Saying

Innovation And Emerging Trends

FinTech | How cryptocurrency fits into Brazil’s vision for banking. (Block)

FinTech | Major Asia-Pacific region banks upping their fintech bets. (S&P)

FinTech | U.S. Federal Reserve plans to publish a paper on CBDC. (Block)

Real Estate | Manhattan’s apartment vacancy rate stubbornly high. (WSJ)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.