Market Commentary

Key Takeaways: Index futures are back in balance.

Economic data failing to surprise.

JPM: “Market is a little oversold.”

Indices reject lower prices, rotate.

What Happened: Last week, U.S. stock index futures auctioned lower alongside the release of uninspiring economic data.

In particular, the S&P 500 advertised prices below a key consolidation area but failed to solicit aggressive selling. Thereafter, participants rotated the index back inside the aforementioned consolidation, suggesting they were seeking more information to base a directional move.

As stated in the last few weekly commentaries, participants have a lot to account for in positioning themselves during one of the weakest stretches of the year. Among their worries are inflation expectations – in part due to “choke points in global supply chains” – and stalling retail sales, as well as consumer price and job data misses. At the same time, sentiment and positioning metrics are waning while inflows remain strong, across the globe, and many year-end index targets remain clustered at and above current prices.

Of all the factors mentioned, inflation is a key concern. Why? Generally speaking, inflation and rates move inverse to each other. Low rates stimulate demand for loans (i.e., borrowing money more attractive). With the rapid recovery, though, market participants are fearful that rates may have to rise to protect the economy from overheating.

Higher rates have the potential to reduce the present value of future earnings, making stocks, especially those that are high growth, less attractive. To note, however, rates remain rangebound; rates on the 10 Year T-Note sit below their March high and are likely to continue higher, which, according to research by JPMorgan Chase & Co (NYSE: JPM), the market will likely absorb.

In fact, JPMorgan’s Marko Kolanovic, in a CNBC appearance, said that the market is a little oversold, and his S&P 500 target of $4,400.00 remains in play.

“I think market is now actually getting cheap, in some sense,” Kolanovic said. “I think we’re at the end of this upset. I think the market is going to go higher here. That said, we do still again prefer reflationary themes.”

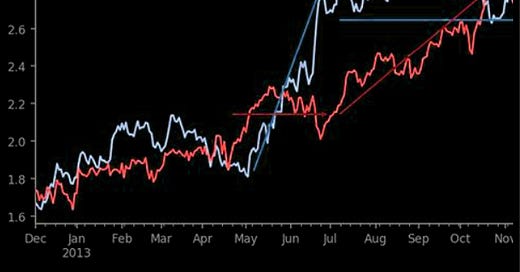

Looking back, also, according to The Market Ear, even during the so-called Taper Tantrum, in the early 2010s, rates settled in a wide range, and equities rallied big.

To add, technically speaking, after testing into a composite low volume area (LVNode), the S&P 500 rejected lower prices and quickly traded back to the valuable $4,177.25 high volume area (HVNode).

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low-volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low-volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

This volatility was expected; coming into the May 13 reversal, stock indexes were positioning for a vicious rebound as near-term downside discovery reached a potential limit, based on market liquidity metrics and the inventory positioning of participants. According to SqueezeMetrics, the steepness of the GammaVol (GXV) curve suggested there was more risk to the upside than the downside.

More On Gamma: In the simplest way, gamma is the sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades to hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to the $4,177.25 HVNode pivot.

That said, participants can trade from the following frameworks.

In the best case, the index trades sideways or higher; activity above the $4,177.25 HVNode may reach as high as the $4,227.00 POC. Initiative trade beyond the POC could reach as high as $4,238.00 overnight high (ONH) and $4,294.75 Fibonacci price extension, a typical recovery target.

POCs: POCs (like HVNodes described above) are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

Overnight Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

In the worst case, the index trades lower; activity below the $4,177.25 HVNode has the potential to reach the $4,136.25 HVNode. Beyond that level, of interest is the $4,122.25 HVNode, the $4,104.75 LVNode, and the $4,069.25 HVNode.

Trading below the $4,029.25 overnight low (ONL) suggests a continuation of the bear trend. Caution longs.

News And Analysis

Markets | Rates remain resilient after the recent inflation scare. (MND)

Markets | Caught-short strategists are a stealth market accelerant. (BBG)

Ratings | Out-of-court restructurings may lead to repeat defaults. (S&P)

Energy | Oil, and gas benefiting from rising crude, value rotation. (BBG)

Energy | Colonial Pipeline resumes normal operations after hack. (Axios)

Markets | Selected indicators – global automotive manufacturing. (REU)

Ratings | Risk of supply chain financing, partial asset sell-downs. (S&P)

Economy | U.K.’s worse recession to turn into a stronger recovery. (S&P)

Economy | Don’t you dare say stagflation; safeguards are slipping. (BBG)

What People Are Saying

Innovation And Emerging Trends

Working | Reimagining the workplace – adapting to new normals. (S&P)

Banking | US banks could cut nearly 200K jobs over the next decade. (FT)

Space | China has made history with its successful Mars landing. (Axios)

FinTech | Cryptocurrency, and blockchain must lead in sustainability. (TC)

Energy | California Governor proposes a $3.2B EV investment plan. (TC)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.