Market Commentary

Key Takeaways: Equity index futures spike lower in their attempt to discover fair prices for two-sided trade.

COVID, waning stimulus cloud outlook.

Ahead: Housing and employment data.

Indices diverge; breadth, inflows lower.

What Happened: U.S. stock index futures auctioned sideways to lower.

The drop wasn’t entirely uncalled for.

Into the seasonally-aligned price rise led by the Nasdaq 100 and S&P 500, inflows decelerated and breadth weakened.

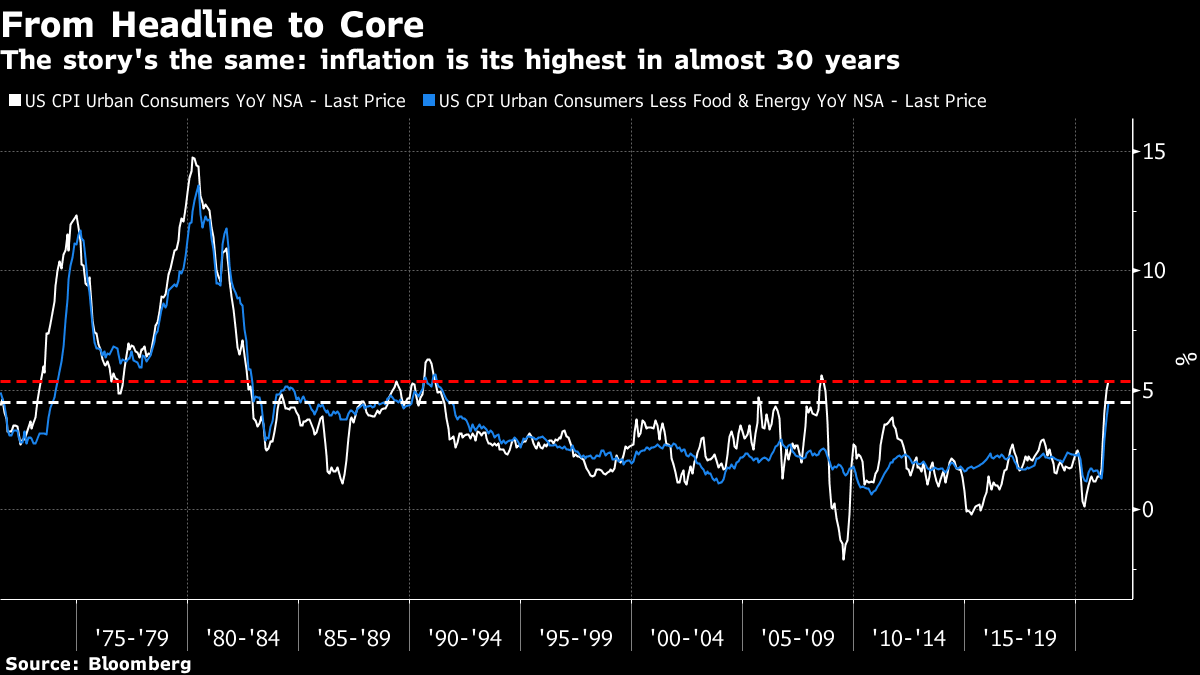

At the same time, a measure of inflation – via the Consumer Price Index (CPI) – rose the largest since the Global Financial Crisis. In response, the 5s30s curve resumed its flattening and the 10-year U.S. Treasury yield ended little changed.

Simply put, it’s likely that bond market participants shrugged off the data and an acceleration in inflation will be temporary.

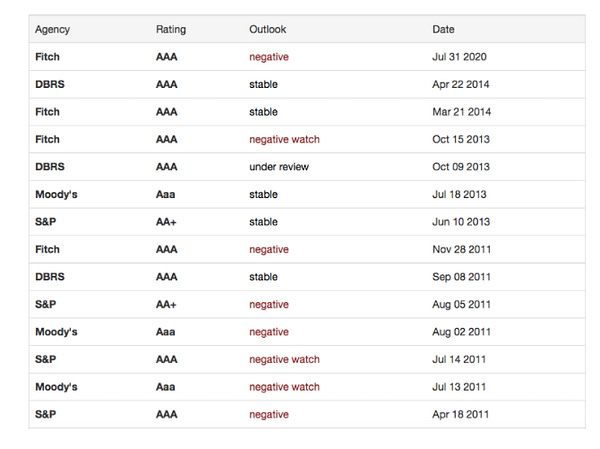

Still, yields could become further depressed due in part to fundamental and technical factors – issuance, short coverings, a fading reflation trade, peak growth – as well as the August 1 reinstatement of the U.S. debt limit.

“[I]f Congress idly stands by, the Treasury will eventually hit the debt limit on October 18. The consequences would be severe,” Moody’s strategists believe. Michael A. Gayed of the Lead-Lag Report adds the odds of a rating downgrade increase, as a result, also.

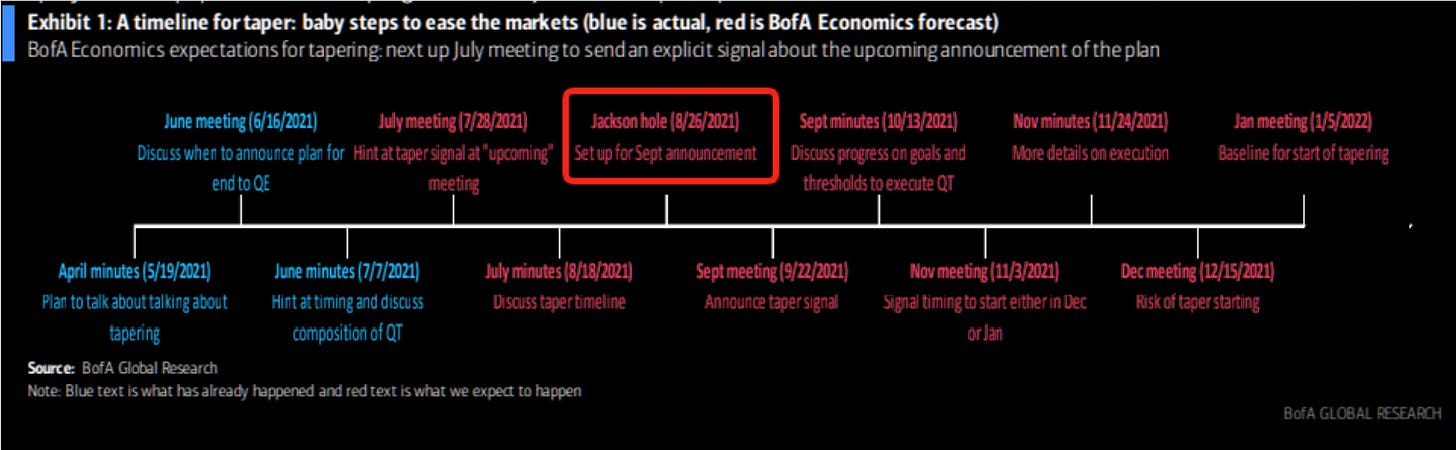

Moody’s concludes: “[T]apering earlier than the markets are pricing would risk causing yields to jump when some of the technical drags are easing.”

Adding, since inflation and rates move inversely to each other, a mistimed bump in rates – alongside increased nervousness over a COVID-19 resurgence and fading fiscal stimulus – would potentially take away from the commitment to keep inflation expectations closer to the Federal Reserve’s 2%-plus target.

In all, in support of the Fed’s target, COVID-19 must not become a problem, and the Biden administration, alongside Congress, must come to terms on another fiscal package – a few trillion in size – that looks to extend the Treasury debt ceiling.

As unemployment declines and labor force participation increases, expectations of rate normalization will solidify. This is a boon for beta sectors, according to JPMorgan Chase & Co’s (NYSE: JPM) Marko Kolanovic.

Considerations: Investment bank and financial services company Morgan Stanley (NYSE: MS) believes downside risks are compounded by equity and bond positioning, low short interest, and the involvement of systemic strategies which could intensify a sell-off.

MS says CTAs are still short bonds which, according to CityWire, could continue the bond rally, pressuring stocks as investors “fear the bond market may know[] something they don’t.”

Add the passage of the July options expiration (OPEX), the window for the aforementioned dynamics (alongside a shift in preferences from saving and investing to spending, monetary tightening, seasonality, as well as a COVID-19 resurgence) to take over is opened.

After OPEX, according to SpotGamma, “the market tends to experience its largest intraday volatility which corresponds to the reduction in large options positions, and the hedging associated with them.”

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to the $4,334.25 spike base.

Spikes: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike).

In the best case, the S&P 500 trades sideways or higher; activity above $4,334.25 puts in play the $4343.00 VPOC. Trade beyond that signposts may then put in play the $4,346.75 HVNode – which corresponds with two anchored Volume Weighted Average Prices (VWAPs).

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

More On Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

If higher, entry into an overhead supply area, above the $4,357.75 low volume area (LVNode), portends continuation to the $4,371.00 VPOC and $4,384.50 RTH High.

In the worst case, the S&P 500 trades lower; activity below $4,334.25 puts in play the $4,314.75 high volume area (HVNode). Initiative trade beyond $4,314.75 could reach as low as the $4,297.00 HVNode. Closeby is the $4,291.00 VPOC and $4,285.00 composite HVNode.

News And Analysis

When VIX hits an extreme, options traders look to volatility arbitrage. (tasty)

Identifying gamma squeezes with SpotGamma’s options modeling. (BZ)

U.S. banks see loan, revenue pressure despite consumer spending. (Fitch)

The U.S. economy continued to strengthen as mobility trended up. (S&P)

‘A free put on the market’: Ambrus CIO talking volatility dislocations. (BZ)

OPEC+ agrees oil supply boost after UAE, Saudi reach compromise. (REU)

An unexpected tightening in policy would generate market volatility. (Moody’s)

Semiconductor supply shortage, inflation, and technology regulation. (S&P)

Frenzied retail investing boom has been cooling off in recent weeks. (Fortune)

Delta Air is seeing positive growth in business travel as offices open. (S&P)

What People Are Saying

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets. Additionally, Capelj is a finance and technology reporter. Some of his biggest works include interviews with leaders such as John Chambers, founder and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.