Market Commentary

Index futures exit balance, discover higher prices.

The calm before the storm (FOMC).

Ahead: Production, PPI, retail sales.

Indices trade higher, then sideways.

What Happened: U.S. stock index futures traded higher ahead of key releases on U.S. industrial production, producer prices, and retail sales. Tomorrow, of bigger concern, is Wednesday’s Federal Open Market Committee (FOMC) rate decision.

As stated in Monday’s commentary, the FOMC will likely not change its forward guidance on interest rates or asset purchases. That’s according to Moody’s which noted: “The statement will likely strengthen the FOMC’s assessment of the acceleration in inflation and possibly mention the central bank has the tools to address inflation if needed. This would be an effort to keep long-term inflation expectations in check.”

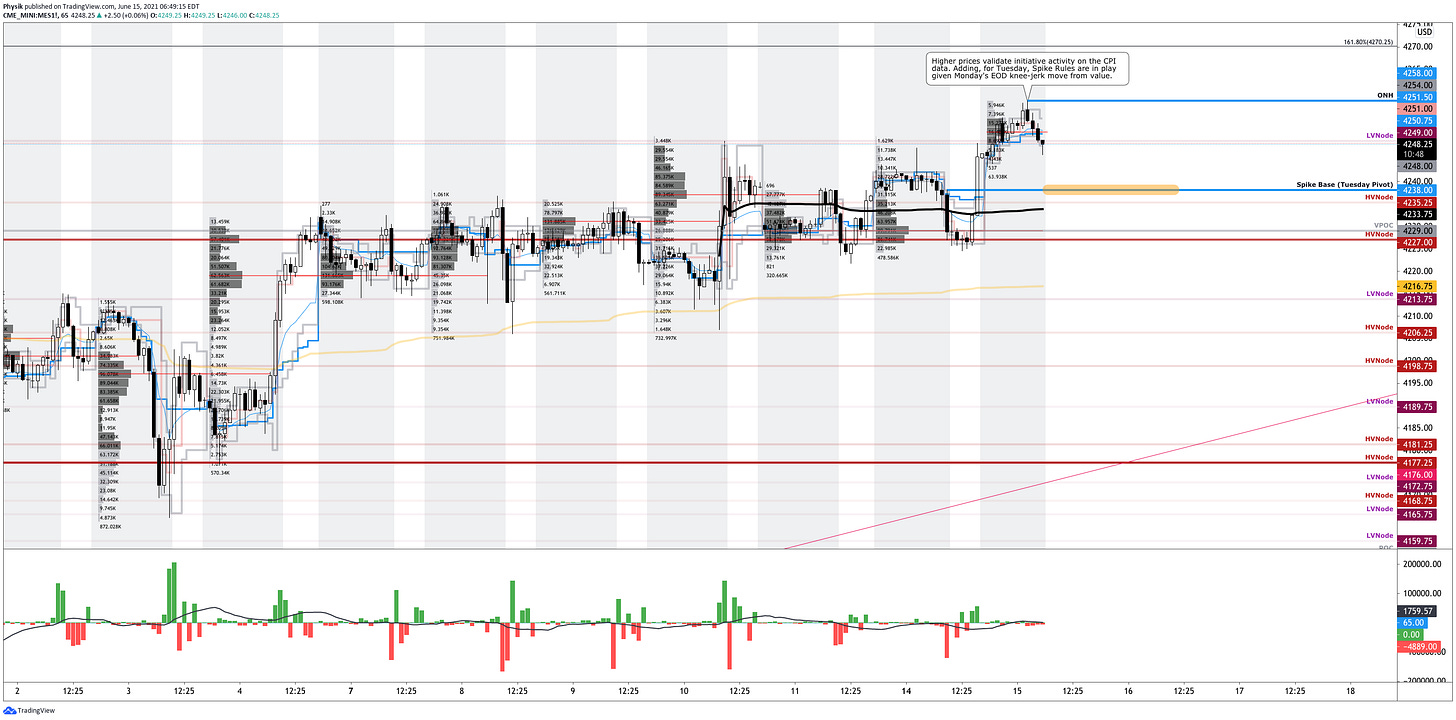

What To Expect: Tuesday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 may open just outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

Adding, during the prior day’s regular trade, the best case outcome occurred, evidenced by initiative trade above the $4,249.00 minimal excess high.

Initiative Buying: Buying within or above the previous day’s value area.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

This move higher, across the broad market, comes as participants attempt to jack up prices in accordance with their views on issues like inflation, COVID-19, employment, supply chains, and more. Adding, measures of breadth indicate index constituents are participating.

On the other hand, metrics, such as S&P 500 skew – a measure of perceived tail risk and the chances of a black swan event – suggest participants are pricing the slope of implied volatility higher. At the same time, sentiment cooled and individual stock volatility rose.

Further, for today, participants can trade from the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,238.00 spike base puts in play the $4,249.00 low volume area (LVNode). Initiative trade beyond the LVNode could reach as high as the $4,258.00 overnight high (ONH) and $4,270.25 Fibonacci price extension.

Spikes: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike).

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

In the worst case, the S&P 500 trades lower; activity below the $4,238.00 spike base puts in play the $4,229.00 point of control (POC). Thereafter, if lower than the $4,227.00 composite high volume area (HVNode), the $4,213.75 balance area low (BAL) comes into play.

POCs: POCs (like HVNodes described above) are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

News And Analysis

Politics | China calling U.S. ill after Biden rallies G-7 against Beijing. (BBG)

Politics | EU, U.S. agree to a five-year truce on Boeing-Airbus trade. (BBG)

Economy | EU is set to lift travel curbs for U.S. residents this week. (BBG)

Politics | House antitrust bills taking a tight aim at technology giants. (Axios)

Economy | Dimon said JPMorgan hoarding cash due to inflation. (CNBC)

What People Are Saying

Innovation And Emerging Trends

Politics | White House releases national strategy for domestic terror. (Axios)

FinTech | Mark Cuban suggesting ‘banks should be scared’ of DeFi. (CNBC)

Economy | The bubbliest housing markets flash 2008-type warnings. (BBG)

FinTech | Bitcoin’s most significant code improvement was approved. (Axios)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.