Market Commentary

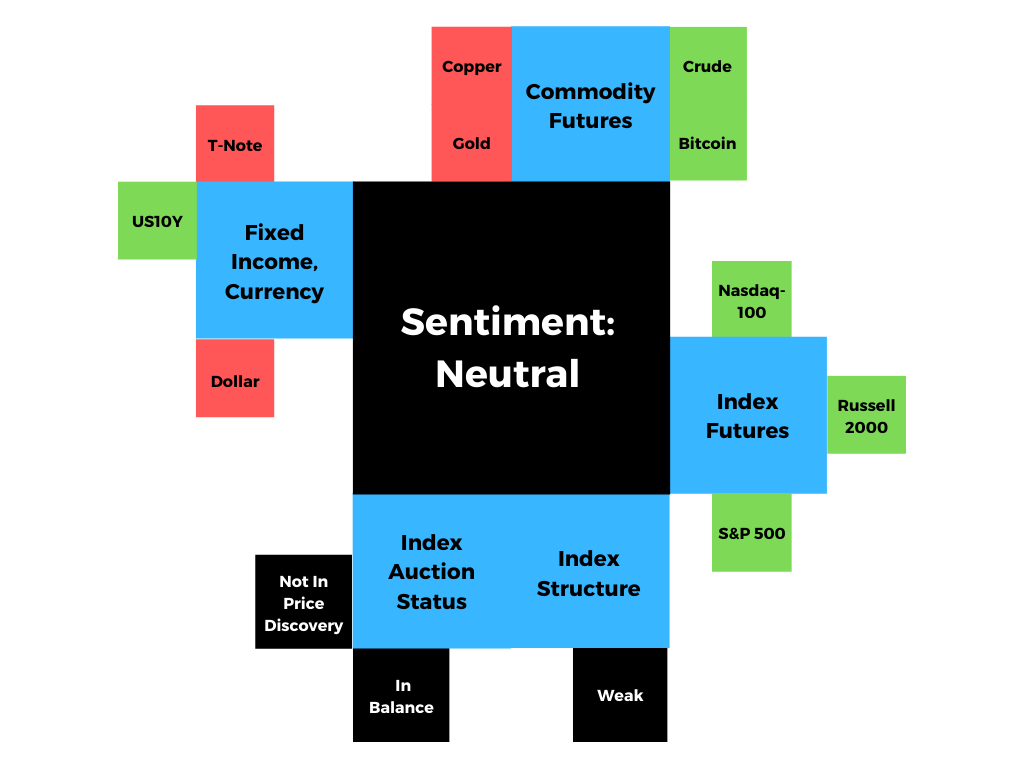

Index futures balance and attempt to discover higher prices.

Ahead: Fed 2-day policy meeting.

Indexes trade sideways to higher.

What Happened: U.S. stock index futures auctioned sideways-to-higher, ahead of an impactful Federal Reserve policy meeting.

Further, it is likely that cost-push inflation will be the main driver of inflation into next year. That is according to Moody’s which suggests the Fed is betting on this, too. If wrong, however, it would be due to a wage-price spiral which is still unlikely to occur given that the economy is not near full employment.

Adding, the Federal Open Market Committee (FOMC) will likely not change its forward guidance on interest rates or asset purchases; “The statement will likely strengthen the FOMC’s assessment of the acceleration in inflation and possibly mention the central bank has the tools to address inflation if needed. This would be an effort to keep long-term inflation expectations in check.”

What To Expect: Monday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 may open just outside of prior-range and -value, suggesting the potential for immediate directional opportunity.

Adding, during the prior day’s regular trade, the best case outcome occurred, evidenced by initiative trade above the $4,227.00 high volume area (HVNode). This is significant because that particular level marks a pivot (i.e., above = bullish, below = bearish) on the composite profile.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

Further, for today, participants can trade from the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,239.50 regular trade high puts in play the $4,249.00 minimal excess high. Initiative trade beyond that figure could reach as high as the $4,270.00 161.80% Fibonacci price extension and $4,294.75 127.20% extension.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

In the worst case, the S&P 500 trades sideways or lower; activity below the $4,239.50 puts in play the HVNode pivot at $4,227.00. If lower, the $4,213.75 low volume area (LVNode) comes into play first. Thereafter, participants ought to look for responses at the $4,206.25, $4,198.75, and $4,177.25 HVNodes.

News And Analysis

Economy | Goldman: ‘Too big to fail’ may not apply in China anymore. (BBG)

Economy | U.K.’s Johnson set to announce a delay to end restrictions. (REU)

Markets | Reasons to question retail-driven meme stock craze narrative. (SG)

Markets | SEC plans market structure review amid meme stock frenzy. (WSJ)

Markets | Russell index rebalancing bringing meme stocks mainstream. (BBG)

Markets | Bitcoin higher on news Tesla will use when mining is cheaper. (BBG)

What People Are Saying

Innovation And Emerging Trends

Economy | Americans hoarded money to survive during the pandemic. (BBG)

Markets | Market veterans are mourning the slow death of historic pits. (FT)

FinTech | Investors are craving more of the payments company Stripe. (WSJ)

Economy | A great resignation wave could be coming for companies. (Axios)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.