Editor’s Note: Thanks for subscribing to The Daily Brief, a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products.

In the coming week, commentaries are set to pause as I go on vacation. Look forward to providing valuable market color when I return, on February 7, 2022.

Talk to you soon!

What Happened

Despite certain index heavy-weights trading higher in light of earnings announcements, equity index futures remain weak, trading sideways to lower overnight with bonds.

Measures of implied volatility (IV) remain bid while certain metrics continue to show buying support. Given the way counterparties to customer options trades hedge, a compression in volatility may bolster a move higher.

Though the odds point to a counter-trend rally, continued selling is not out of the question. A break of multi-session support levels, combined with rising IV, would pressure indices further.

Ahead is data on PCE Inflation, incomes, spending, and the Employment Cost Index (8:30 AM ET). After is University of Michigan data on sentiment and inflation expectations (10:00 AM ET).

What To Expect

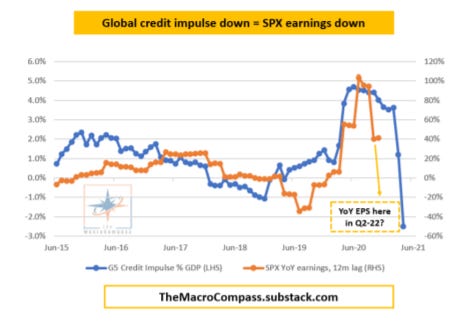

Fundamental: Equity indices are struggling to catch a bid amidst a more hawkish Fed, persistent geopolitical tensions, and data showing slowing growth at home and abroad.

This is in the face of heavyweights, like Apple Inc (NASDAQ: AAPL) which posted its highest-ever quarterly earnings after sales climbed 11% to a record $124 billion, trading higher.

Coming back to comments from yesterday, the Federal Open Market Committee (FOMC) revealed asset purchases would stop in March. Then, in the face of an economy that’s much stronger than at the start of the last hiking cycle, the window for higher rates would be opened.

What spooked markets was Fed Chair Jerome Powell “saying that the Fed has plenty of room to raise interest rates without harming the labor market,” according to an analysis by Moody’s Corporation (NYSE: MCO).

“Powell didn’t push back against market expectations for three to four rate hikes this year, but he signaled the central bank will have zero tolerance for any upside surprises in inflation.”

According to a write-up by Nasdaq Inc’s (NASDAQ: NDAQ) Phil Mackintosh, “some economists are already worrying whether the Fed can engineer a ‘soft landing’ for the economy, which is where rate hikes slow the economy and inflation but don’t cause a recession.”

Based on the data, though, “selloffs in rate hike cycles, especially since 1975, are mostly much smaller corrections,” Mackintosh adds.

“So, it seems we should worry much more about a recession than hikes.”

Complicating the Fed’s job, per Nasdaq, are outside influences such as waning fiscal stimulus and further supply shocks (the good and bad ones).

However, “annualized returns for the S&P 500 during rate hike cycles are mostly positive, … [as] rising rates usually equals a strong economy, which is usually good for companies, leading to earnings growth.”

“That earnings growth more than offsets the valuation impact of higher rates.”

To assuage some fears, Goldman Sachs Group Inc (NYSE: GS) thinks that the “interplay of Fed policy, financial conditions, and the growth outlook could make it hard for the Fed to actually deliver consecutive hikes, even if they feel like a natural forecast along the way."

Positioning: A short-gamma environment (wherein an options delta falls with stock price rises and rises when stock prices fall) portends increased two-way volatility.

This is as the counterparties to customer options trades hedge in a manner that exacerbates movement (i.e., buying strength and selling weakness).

As noted in past commentaries, the removal of put-heavy exposure, after the January monthly options expiration (OPEX), as well as the reduction in event premiums tied to FOMC, opened a window of strength, wherein dealers would have less positive delta to sell against.

In other words, as measures of implied volatility were to compress, as is the case when there is less demand (or more supply) of downside put protection (a positive-delta trade for the dealers), the dealer’s exposure to positive delta declines.

However, the failure to expand range is punishing toward highly demanded protection with a shorter time to maturity. These options, which are more “convex” and sensitive to changes in direction and volatility, have the most to lose as markets settle and “decay returns with vengeance,” according to SpotGamma, an options modeling and data service.

“As time and volatility trend to zero (as all options expire), given the current market environment, dealers’ exposure to the risk of out-of-the-money protection will decline.”

That solicits the dealers’ unwind of “short-delta hedges to decaying positive-delta protection.”

Those delta hedging flows with respect to time (charm) and volatility (vanna) are to reinforce the strong buying support (as measured by liquidity provision on the market-making side).

At present, in putting it simply, markets would really have to (1) fall out of bed or (2) demand for protection to explode for options counterparties, at least, to pressure markets much further.

As SpotGamma (which you can check out by clicking here) puts well:

“In other words, the frantic hedging that destabilizes markets as customers reach for protection en masse has already happened. There would have to be an addition of macro flows for sale and/or new put buying for dealers to sell.”

Technical: As of 6:55 AM ET, Friday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the lower part of a negatively skewed overnight inventory, outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

Gap Scenarios: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

In the best case, the S&P 500 trades higher; activity above the $4,332.25 high volume area (HVNode) puts in play the $4,370.25 low volume area (LVNode). Initiative trade beyond the LVNode could reach as high as the $4,393.75 HVNode and $4,421.50 regular trade high (RTH High), or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,332.25 HVNode puts in play the $4,299.25 RTH Low. Initiative trade beyond the RTH Low could reach as low as the $4,263.25 overnight low (ONL) and $4,212.50 RTH Low, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Gamma: Gamma is the sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

Vanna: The rate at which the delta of an option changes with respect to volatility.

Charm: The rate at which the delta of an option changes with respect to time.

Options Expiration (OPEX): Traditionally, option expiries mark an end to pinning (i.e, the theory that market makers and institutions short options move stocks to the point where the greatest dollar value of contracts will expire) and the reduction dealer gamma exposure.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj is also a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, FTX’s Sam Bankman-Fried, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor developing insights around impactful options market dynamics.

Disclaimer

Physik Invest does not carry the right to provide advice.

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.