The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

Overnight, equity index futures explored lower before later recovering the prior day’s weak close after hawkish statements from the Federal Reserve (Fed).

This is as some metrics continue to show buying support and any compression in volatility may serve to bolster a move higher.

Ahead is data on jobless claims, gross domestic product, durable goods orders, and core capital equipment orders (8:30 AM ET), as well as pending home sales (10:00 AM ET).

What To Expect

Fundamental: Comments shared by the Federal Open Market Committee (FOMC) revealed asset purchases would stop in March.

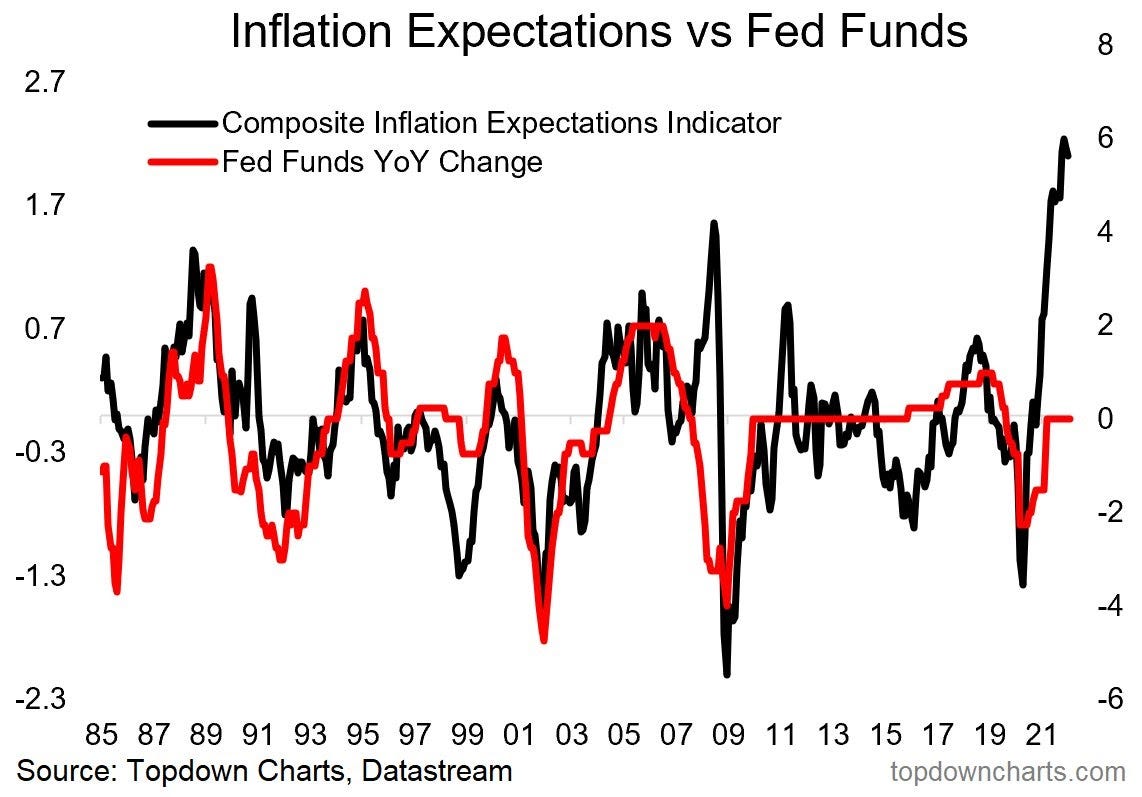

After, the Fed is likely to hike the fed funds rate, but this is in the face of an economy that’s stronger than at the start of the last hiking cycle.

Still, despite expectations being met, the hawkish tone was enough to tip the equity market.

This wasn’t unexpected.

On average, under Chair Jerome Powell, the market tends to give up its intraday gains after an FOMC announcement.

With the flatter yield curve (spread of 10-year over two-year Treasury yields), per Bloomberg, this implies that “rates will need to rise in the short term but won’t have to stay high.”

“In other words, the bond market still thinks that the Fed will beat inflation without breaking anything, … and the words at the press conference were enough to engineer a noticeable tightening of financial conditions while still leaving stock markets close to their all-time high.”

Adding, per Goldman Sachs Group Inc (NYSE: GS), rate hikes are set to occur in March, June, September, and December with the balance sheet runoff starting July.

As noted yesterday, an “abundance of excess liquidity could provide a cushion as the Fed drains liquidity, a cushion that did not exist in 2018.”

Perspectives: Interactive Brokers Group Inc’s (NASDAQ: IBKR) Chief Strategist Steve Sosnick suggests the following:

“Even when we saw relatively higher short-term rates and a flattish curve, equities were able to push to what were then all-time highs. The risk of course is that those highs were about 30% below current levels.”

Also, per Grit Capital, opportunity in growth equities may occur as follows:

“(1) Investing in free-cash-flow generative names that pull cash flows forward, shortening their duration (i.e., Microsoft Corporation [NASDAQ: MSFT] now trades at a lower P/E multiple than Retail Chain Costco Wholesale Corporation [NASDAQ: COST]). (2) Once the rebound takes hold, invest in high-growth companies that dominate their niche and are positioned in industries with rapid market expansion.”

Positioning: Expectations are for heightened volatility so long implied volatility is bid and markets continue to trade in a negative-gamma environment (wherein an options delta falls with stock price rises and rises when stock prices fall).

Factors that ought to support a counter-trend rally include the compression in volatility and strong buying support (measured by liquidity provision on the market-making side), after, as SpotGamma suggests, “markets have hit a ‘lower bound.’”

According to comments made by SqueezeMetrics, “traders (professional) bought tons of E-minis, and dealers facilitated.”

A compression in volatility marks down the positive delta (directional exposure) of options counterparties are short. The positive vanna flow – “covering” of short-delta stock/futures hedges – is what could drive markets higher.

Conversely, volatility could expand and that would have the opposite effect.

We shall watch the CBOE Volatility Index (INDEX: VIX) and VIX term structure for clues. Backwardation (inversion) in the term structure points to continued fear, instability.

Technical: As of 6:00 AM ET, Thursday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the upper part of a negatively skewed overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Spikes: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike).

The spike base is at $4,381.00 /ES. Above, bullish. Below, bearish.

In the best case, the S&P 500 trades higher; activity above the $4,346.75 high volume area (HVNode) puts in play the $4,415.00 untested point of control (VPOC). Initiative trade beyond the $4,415.00 VPOC could reach as high as the $4,449.00 VPOC and $4,486.75 regular trade high (RTH High), or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,346.75 HVNode puts in play the $4,263.25 overnight low (ONL). Initiative trade beyond the ONL could reach as low as the $4,212.50 RTH Low and $4,177.25 HVNode, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

What People Are Saying

Definitions

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Gamma: Gamma is the sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

Vanna: The rate at which the delta of an option changes with respect to volatility.

Charm: The rate at which the delta of an option changes with respect to time.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

Inversion Of VIX Futures Term Structure: Longer-dated VIX expiries are less expensive; is a warning of elevated near-term risks for equity market stability.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj is also a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, FTX’s Sam Bankman-Fried, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor developing insights around impactful options market dynamics.

Disclaimer

Physik Invest does not carry the right to provide advice.

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.