Market Commentary

Key Takeaways: Index futures in price discovery.

JPMorgan puts emphasis on reflation.

Earnings were great. NFP not so much.

Indices diverge. S&P 500, Dow higher.

What Happened: Last week, U.S. stock index futures were divergent with the Nasdaq 100 and Russell 2000 lagging behind the S&P 500 and Dow Jones Industrial Average.

The push-pull between equity indices comes as market participants doubled down on the so-called “reflation” trade. JPMorgan Chase & Co (NYSE: JPM) strategists, led by Marko Kolanovic, warned many managers will “need to quickly switch gears from their deflationary playbook or risk an ‘inflation shock,’” according to Bloomberg.

“We expect a strong pickup in inflation this year, which the market will likely be slow to recognize and is poorly positioned for,” Kolanovic and his colleagues said. “A combination of boomy global growth and significant bottleneck price pressures should keep inflation on an upward trajectory while most central banks remain committed to their very accommodative stances and are looking through the inflation pickups.”

Kolanovic recommends participants cut cash and credit to increase their allocations to cyclical and value assets.

In parallel, while companies look to cut costs and boost prices, the April jobs report failed to meet expectations as people who increasingly looked for jobs had a difficult time getting hired.

“We still think growth will be historically strong this year, but today’s jobs report is a reminder that there’s still work to be done,” Ally Inc-owned Ally Invest strategist Callie Cox said. “It’s a big data point for the inflation worries, too. If hiring slows for the next few months, businesses may not be able to pass on higher costs to consumers.”

Adding, though the April payroll miss was big enough to likely limit the Federal Reserve’s taper or rate hike discussions, traders signaled otherwise.

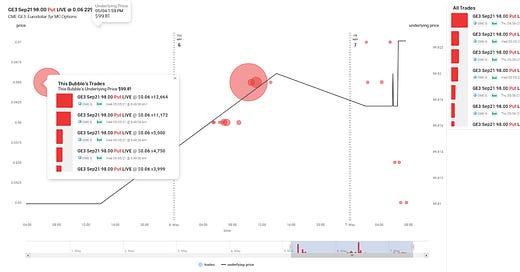

Earlier this week, Bloomberg reported on a large option bet over quicker rate hikes by the Federal Reserve. The Eurodollar bet carries a notional value of $40 billion and is focused on a potential surprise at the Jackson Hole symposium, used in the past to signal policy changes.

Moving on, technically speaking, equity indexes are at an interesting juncture.

The Dow Jones Industrial Average and S&P 500 resolved their multi-week consolidations, to the upside, while the Russell 2000 is rotating within prior range and Nasdaq 100 is relatively weak, losing support and auctioning into a low-volume area.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low-volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low-volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

Further, the strong break in the S&P 500, which targets the Fibonacci-derived price extension near $4,300, has thus far been validated by numerous hours of trade outside of the consolidation zone (i.e., balance area). To note, though, the structure left behind Friday’s price discovery was very poor, opening the door for potential repair.

Balance (Two-Timeframe Or Bracket): Rotational trade that denotes current prices offer favorable entry and exit. Balance-areas make it easy to spot a change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend).

Participants ought to be cautiously optimistic given the weakness in heavily-weighted sectors like technology. Should weakness accelerate, the S&P 500 may succumb.

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to the balance area it just broke from.

That said, participants can trade from the following frameworks.

In the best case, the index trades sideways or higher; activity above the $4,210.75 boundary targets the $4,235.25 price extension. Initiative trade beyond the price extension could reach as high as the $4,266.50-$4,272.75 confluence of Fibonacci-derived price targets.

In the worst case, the index trades lower; activity below $4,210.75 puts in play the $4,179.50 spike base. Trading below the spike base negates end-of-week bullishness.

Spikes: Spike’s mark the beginning of a break from value. Spikes higher (lower) are validated by trade at or above (below) the spike base (i.e., the origin of the spike).

News And Analysis

Economy | Forbearance exits soar as more plans expire last week. (MND)

Economy | Demand decline fuels price wars across mortgage industry. (WSJ)

Markets | Focus shifts to U.S. prices after the jobs disappointment. (BBG)

Politics | Infrastructure talks could set course of Biden spending plans. (WSJ)

Markets | New SEC chairman sets sights on firms Citadel and Virtu. (WSJ)

Markets | Pipeline hack may push pump rices to $3, ahead of holiday. (BBG)

Recovery | Fauci says ‘no doubt’ the U.S. undercounted virus deaths. (BBG)

What People Are Saying

Innovation And Emerging Trends

Crypto | German, U.S. regulators tighten focus on the crypto market. (FT)

Space | China’s ambitions in space: national pride or taking on U.S. (FT)

Crypto | Crypto startup Dfinity set to launch a blockchain AWS rival. (FT)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.