Market Commentary

Key Takeaways: Index futures exit balance, attempt to discover higher prices.

One big thing: Inflation temporary.

Ahead: FOMC 2-day rate meeting.

Indices were divergent but higher.

What Happened: Last week, the movement was both volatile and mechanical, halting short of key visual references.

This technically-driven trade denotes a lack of interest by institutional participants, at record highs; supply chain uncertainties and rising inflation, fiscal and monetary tightening, COVID-19 concerns, political risks, employment, and the like, are some of the concerns larger participants have been looking to price in.

Further, on Thursday, participants were provided more clarity on the hot topic of inflation.

Why is inflation such a hot topic? In short, as described in prior commentaries, inflation and rates move inversely to each other. Low rates stimulate demand for loans (i.e., borrowing money is more attractive). With the rapid recovery, though, market participants were fearful that rates would rise to protect the economy from overheating.

Higher rates have the potential to reduce the present value of future earnings, making stocks, especially those that are high growth, less attractive.

Further, despite hot prices, consumer price index (CPI) data, Thursday, suggested inflation would be temporary. Thereafter, U.S. stock index futures broke balance, and rates on the 10 Year T-Note went lower as participants now thought it was more likely the Federal Reserve would maintain its easy monetary policy.

Coinciding with that breakdown in yields, the Nasdaq 100 and Russell 2000 ended the week strong while the S&P 500 and Dow Jones Industrial Average traded relatively weak, taking back Thursday’s vertical price rise on the CPI number.

Notwithstanding, there has been an inclination to talk taper.

This was evidenced by some big option bets, earlier this year; of interest was one Eurodollar bet – carrying a notional value of $40 billion – focused on a potential surprise at the Jackson Hole symposium, used in the past to signal policy changes.

In a statement, Grant Thornton chief economist Diane Swonk said that despite investors not fearing an immediate change in course on monetary policy, inflation has surprised and will likely be the basis for taper talk at Jackson Hole, later this year.

“I always expected tapering talk to begin more openly at the Jackson Hole meeting. It hasn’t changed my view. Some people thought the Fed would get closer to full employment before they did liftoff on tapering,” Swonk said.

In terms of the impact on equities, looking back, according to The Market Ear, even during the so-called Taper Tantrum, in the early 2010s, rates settled in a wide range, and equities rallied big.

Moreover, next week is a large monthly options expiration (OPEX). This is noteworthy because option expiries mark an end to pinning (i.e, the theory that market makers and institutions short options move stocks to the point where the greatest dollar value of contracts will expire worthless) and the reduction dealer gamma exposure.

Options: If an option buyer was short (long) stock, he or she would buy a call (put) to hedge upside (downside) exposure. Option buyers can also use options as an efficient way to gain directional exposure.

Gamma: The sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

Aside from the Fed meeting and OPEX, some outlier risks remain; with VIX spreads at their lows, S&P 500 skew – a measure of perceived tail risk and the chances of a black swan event – rose dramatically over the past few weeks. At the same time, sentiment cooled considerably, while individual stock volatility increased the potential for another meme stock de-risking event.

What To Expect: In the coming sessions, participants will want to focus their attention on where the S&P 500 trades in relation to the $4,227.00 high volume area (HVNode), a pivot on the composite profile.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

Given the minimal excess high at $4,249.00, as well as the subsequent liquidation – a typical response – and lower value, participants can trade from the following frameworks.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

Like Friday, in the best case, the S&P 500 trades sideways or higher; activity above the $4,227.00 high volume area (HVNode) puts in play the $4,249.00 minimal excess high. Initiative trade beyond that figure could reach as high as the $4,270.00 161.80% Fibonacci price extension and $4,294.75 127.20% extension.

In the worst case, the S&P 500 trades lower; activity below the $4,227.00 HVNode confirms a failed balance-area breakout. In such a case, the $4,213.75 low volume area (LVNode) comes into play first. Thereafter, if lower, participants ought to look for responses at the $4,206.25, $4,198.75, and $4,177.25 HVNodes.

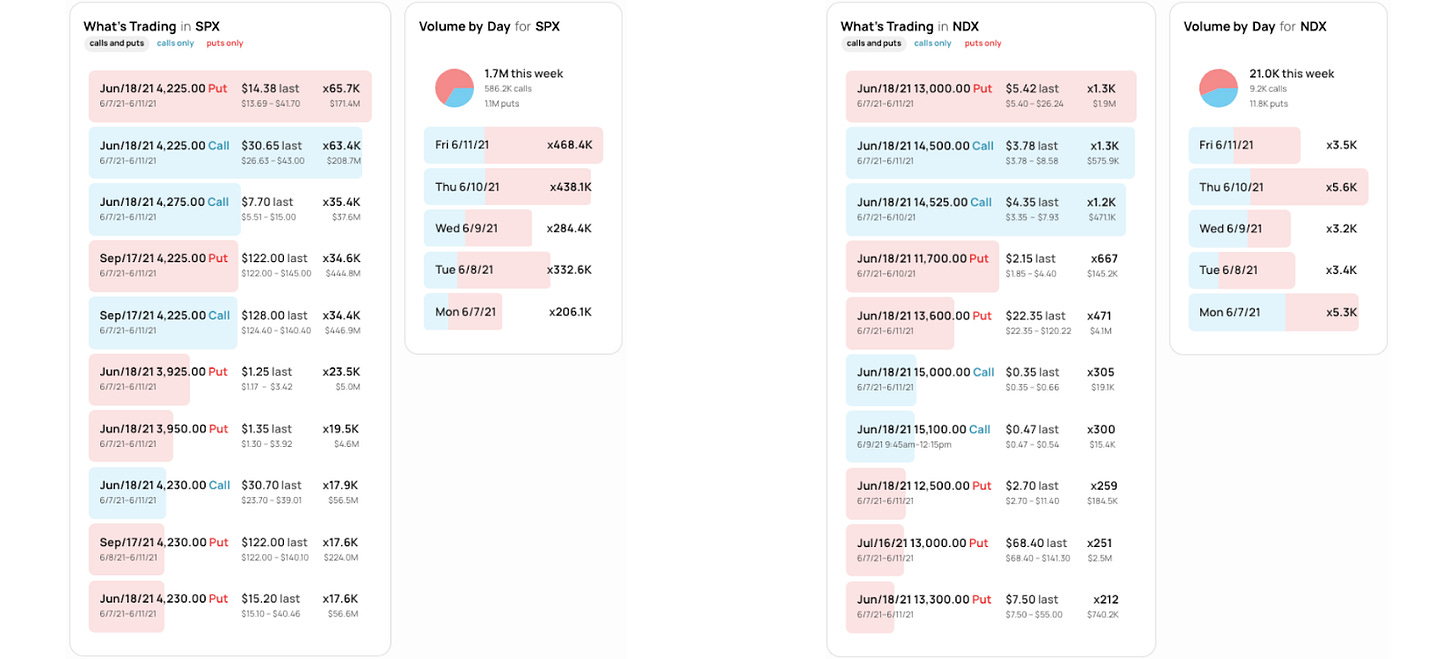

Graphic: SHIFT search suggests participants were most interested in put strikes at and below current prices in the larger cash-settled S&P 500 Index (INDEX: SPX) and Nasdaq 100 Index (INDEX: NDX), last week.

News And Analysis

Markets | Shorts squeezed; Fed (kind of) buys cryptocurrency bonds. (BBG)

Economy | Fed to announce taper in August or September on inflation. (REU)

Energy | OPEC sees more demand for oil with H2 growth quickening. (S&P)

Economy | The U.S. is experiencing temporary cost-push inflation. (Moody’s)

Economy | Pent-up demand, supply shortages improve credit recovery. (S&P)

Politics | Biden’s China policy emerging – and it looks like Trump’s. (WSJ)

What People Are Saying

Innovation And Emerging Trends

Venture | Funding, new unicorns, exits continue at a strong pace. (CB)

FinTech | G-7 dialogue on crypto to hasten the disintermediation. (Moody’s)

Trading | How to keep the gamma squeeze going with put sales. (SG)

Aviation | In aviation, the revolution likely will not be supersonic. (WSJ)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.