Happy Sunday! Markets were choppy, ending the week unchanged. This came alongside talk of central bank tapering and an evolution in fiscal policy.

The following commentary on U.S. broad market equity indices will discuss what happened, why it matters, what to expect, and how participants can position themselves for the coming week.

But first, here’s a quote from Adam Funds CEO, Mark E. Stoeckle:

“To try to guess that this is the right time to be out of the market, you may as well go to Las Vegas.”

Market Commentary

What Happened: The S&P 500, Nasdaq 100, Russell 2000, and Dow Jones Industrial Average closed the week out basing, pricing in new information for the next directional move.

All talk and no action from policy leaders, creators.

Ahead: Fed meeting, GDP and Sentiment, earnings.

Markets balancing, position for directional resolve.

Why It Matters: The sideways action during last week’s trade came after a lengthy run, higher.

The S&P 500, in particular, from its March 4 low, is up nearly 13%.

Moreover, just because something is high, doesn’t mean it must come crashing down. To put this into perspective, here’s a quote from Jeff deGraaf, co-founder at Renaissance Macro Research: “Overbought/oversold conditions are useless without first defining the underlying trend of the market.”

So, with that, in maintaining objectivity, we zoom out and ask a few questions:

Where are we in relation to the prior week’s range? Overlapping, but slightly higher.

Is the market’s attempt to go in a certain direction supported? Yes, value, defined by the area where 70% of prior trade (i.e., 1 standard deviation) is conducted, is following price.

Is the technical and fundamental narrative supportive of current prices? Technically, the market is in an extended uptrend, but recent activity suggests a validation of higher prices. Fundamentally, the topics of monetary and fiscal tightening have investors worried.

Now, in determining whether to change equity market exposure, we zoom closer in and analyze the risks at hand.

The Bank of Canada, ahead of other central banks, in light of increased growth and inflation forecasts, cut its bond-purchase target and suggested an increased potential to hike rates earlier than expected.

This is an interesting development. The Federal Reserve, too, last week announced the U.S. economy would see higher inflation, but Chair Jerome Powell expressed the institution’s commitment to limiting any overshoot.

Why the change in tone? Here’s Janus Henderson’s portfolio manager Jay Sivapalan’s take.

“We've got inflated asset prices in equities, house prices, and infrastructure, how do you normalize that? You need revenue growth and you need inflation … [b]ut at some point in the future, growth may need to be traded off for financial stability.”

In simpler terms, with prolonged periods of low interest rates and debt expansion, market participants are incentivized to take risks. This is how destabilizing factors begin to brew.

“The growth of structured products, passive investing, the regulatory standpoint that’s been implemented with Dodd-Frank and dealers needing to hedge off their risk more frequently than not” are all part of a regime change that’s affected the stability of markets, said Sidial Kris Sidial, a former institutional trader and the co-chief investment officer of The Ambrus Group, a volatility arbitrage fund that looks to exploit changing market structure dynamics.

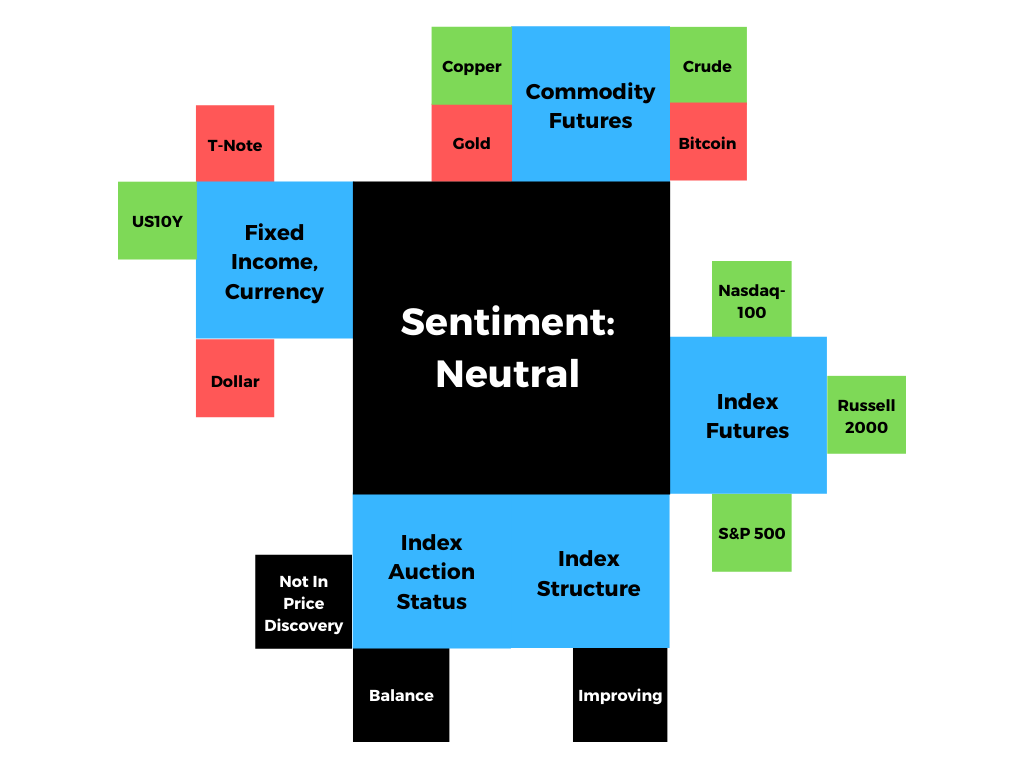

Here’s an image to help visualize some of what Sidial is referring to.

Also, this week, the White House expressed its desire to raise the federal capital gains tax (CGT) rate to 43.4% for wealthy individuals. Despite the market selling on the news, all losses were recouped prior to the end of the week. Why? As Goldman Sachs Group (NYSE: GS) sees it, Congress is likely to settle on a more modest increase, less than 30%.

Adding, as Bloomberg’s John Authers notes: “The way the market handled the last major CGT increase, at the end of 2012, is instructive. As it grew clear that higher capital gains taxes were coming, the S&P 500 languished and went sideways for the last few months of the year, closing roughly where it had been in March. Then 2013 turned out to be a great year; stocks started their rally at the beginning of January and never really stopped.”

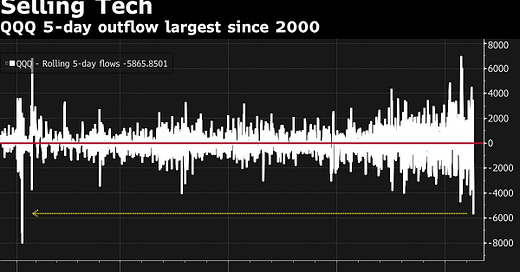

So, if a CGT hike is already being discounted by the market, given Friday’s rapid recovery — which also has something to do with how participants are positioned, but that conversation is beyond the scope of this commentary — then why are some of the largest exchange-traded funds seeing outflows?

In particular, the Invesco QQQ Trust Series 1 (NASDAQ: QQQ) bled nearly $6 billion over the last week, the worst exodus since the dot-com era of 2000.

One explanation: “With earning season starting to heat up, especially for the tech sector next week, it is likely that the expectations for technology companies may be too high,” said James Pillow, managing director at Moors & Cabot Inc. “It’s early still, but just look where the earnings surprises are coming from: materials, energy, and financials, all about 80% or higher. Money will follow performance — and the performance is coming from those sectors.”

So, in summarizing this section, technically, the market is bullish, supported by a healthy rotation.

Fundamentally, though, clouds are forming. Participants are adding shifts in tone, by policymakers, into their narrative. Should fundamental conditions change markedly, odds of a technical breakdown in momentum increase substantially.

Till then, the market is flashing green lights. Any correction may offer participants favorable entry.

What To Expect: An increased potential to correct in time, rather than price.

In addition, metrics, like market liquidity and speculative derivatives activity, confirm participants' bullishness and opportunistic hedging ahead of an acceleration in the global restart and a turn in flows, the result of an increasingly apparent shift in consumer preferences, from saving and investing to spending.

What To Do: In the coming sessions, participants will want to pay attention to where the S&P 500 trades in relation to its $4,186.75-$4,110.50 balance area.

Balance (Two-Timeframe Or Bracket): Rotational trade that denotes current prices offer favorable entry and exit. Balance-areas make it easy to spot change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend).

Any activity above (below) the balance-area high suggests participants are interested in discovering higher (lower) prices. Any activity within the balance area suggests participants are looking for more information to base their next move; in such case, responsive buying and selling is the course of action.

Responsive Buying (Selling): Buying (selling) in response to prices below (above) area of recent price acceptance.

Initiative trade below the balance-area low suggests an inclination by participants to revert to the mean and repair some of the poor structure left behind prior discovery. Initiative trade above the balance area puts in play the cluster of price extensions at and above $4,200.00, typical price targets based on Fibonacci principles.

Initiative Buying (Selling): Buying (selling) within or above (below) previous price acceptance.

So, in the best case, the S&P 500 makes an attempt to balance or discover prices as high as $4,300.00. In the worst case, participants look to auction the S&P 500 into prior poor structures and low-volume areas (LVNodes) that ought to offer little-to-no support.

More On Volume Areas: A structurally sound market will build on past areas of high-volume (HVNode). Should the market trend for long periods of time, it will lack sound structure (identified as a low-volume area (LVNode) which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low-volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

News And Analysis

Politics | Joe Biden will deliver a ‘joint session of Congress’ this week. (ABC)

Market | The Rise of Carry returns; stock buybacks are kicking into gear. (Axios)

Recovery | The end of U.S. mass vaccination coming sooner than later. (BBG)

Commodities | OPEC says NOPEC bill could put U.S. overseas assets at risk. (REU)

Markets | SPAC deals are far below peaks but are still generously valued. (CB)

Economy | The MBA is forecasting record purchase volume this year. (MND)

Banking | Goldman, JPM talk with the U.K. over business travel corridor. (FN)

Climate | Leaking landfill contributes to world’s mystery methane hotspot. (BBG)

Trade | Beijing hopes U.S. companies will push to scrap China tariffs. (BBG)

Economy | Existing home sales suffer second straight monthly decline. (CNBC)

Markets | Taxes and inflation key themes for markets in the week ahead. (CNBC)

What People Are Saying

Innovation And Emerging Trends

FinTech | On blockchain- and smart contract-based financial markets. (FED)

FinTech | U.K. banks speed plans to ax branches, switch to digital focus. (S&P)

Health | What are all those constant video calls doing to your brain? (TC)

FinTech | Participants identify key operational areas for improvement. (TM)

FinTech | Alpaca intros API that lets you build your own Robinhood. (BZ)

FinTech | Public.com app connects users with public company leaders. (BZ)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, Canadian businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.