The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 900+ that read this report daily, below!

Fundamental

Today, traders get inflation updates. These will help drive perceptions regarding monetary policy.

Expected is an 8.1% rise year-over-year (YoY) and 0.1% fall month-over-month (MoM). In July, these numbers were 8.5% and 0.0%, respectively.

Core CPI (which excludes food and energy) is expected to rise by a rate higher than in July, 6.1% YoY and 0.3% MoM, respectively.

Mattering most is core inflation, which the Fed has more control over. If lower than expected, that may warrant some appetite for risk.

Notwithstanding, prior to July’s release, the average movement in the S&P 500, after CPI, was -1.27%. Still, though, the expectation is that August data will show improvement.

“The market has concluded that both the ECB and even the Fed, despite their protestations otherwise, are both being viewed as data-dependent,” Peter Tchir of Academy Securities said.

“I cannot see any scenario where the market doesn’t decide that CPI is heading the right direction and … [this] should allow markets to continue to enjoy the strength.”

At this point, in spite of the prospects of inflation continuing to cool, expectations regarding Fed (Federal Reserve) action remain sticky with the fed funds futures pricing a peak in rates of 4%.

Unchanged, all else equal, this means markets have accounted for the rise in interest rates and their impact on valuations. From hereon, further de-rating is not out of the question, particularly if inflation continues to rise and/or growth fears materialize, as some like Fitch Ratings believe.

According to Fitch, a decline in corporate profits is likely to speed up in the coming quarters, and this will highlight economic slowing (below-trend GDP growth) that leads to a 2023 recession.

To quote CFO Dive, “Downward revisions to consensus expectations for earnings next year ‘will likely accelerate as monetary tightening continues to reduce inflation and growth slows.’”

Thus far, the economy has shrunk 0.6% in the second quarter, after slumping 1.6% in the first, which is “the common definition of a recession” despite the continued growth of the economy as shown by other metrics like “nonfarm employment, consumer spending, industrial production, and weekly hours worked.”

Positioning

As of 7:45 AM ET, Tuesday’s expected volatility, via the Cboe Volatility Index (INDEX: VIX), sits at ~1.24%. Net gamma exposures increasing may promote some market stability.

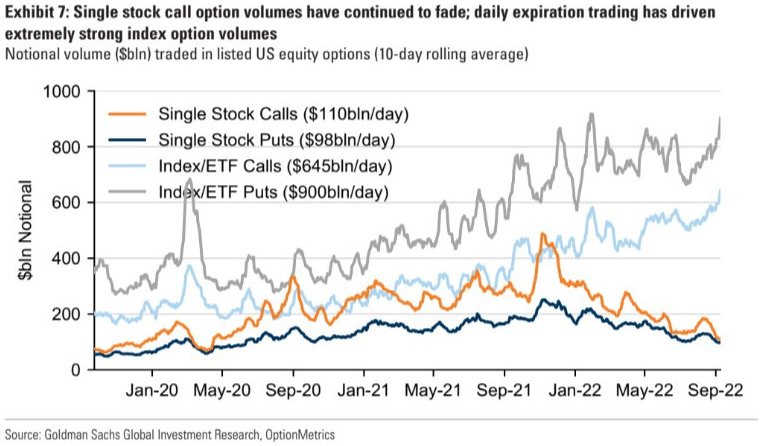

It’s the case that there is this trend in demand for equity downside put options protection. This is evidenced by figures of open interest, volume, as well as bid implied volatility (IVOL) metrics like the Cboe Volatility Index (INDEX: VIX).

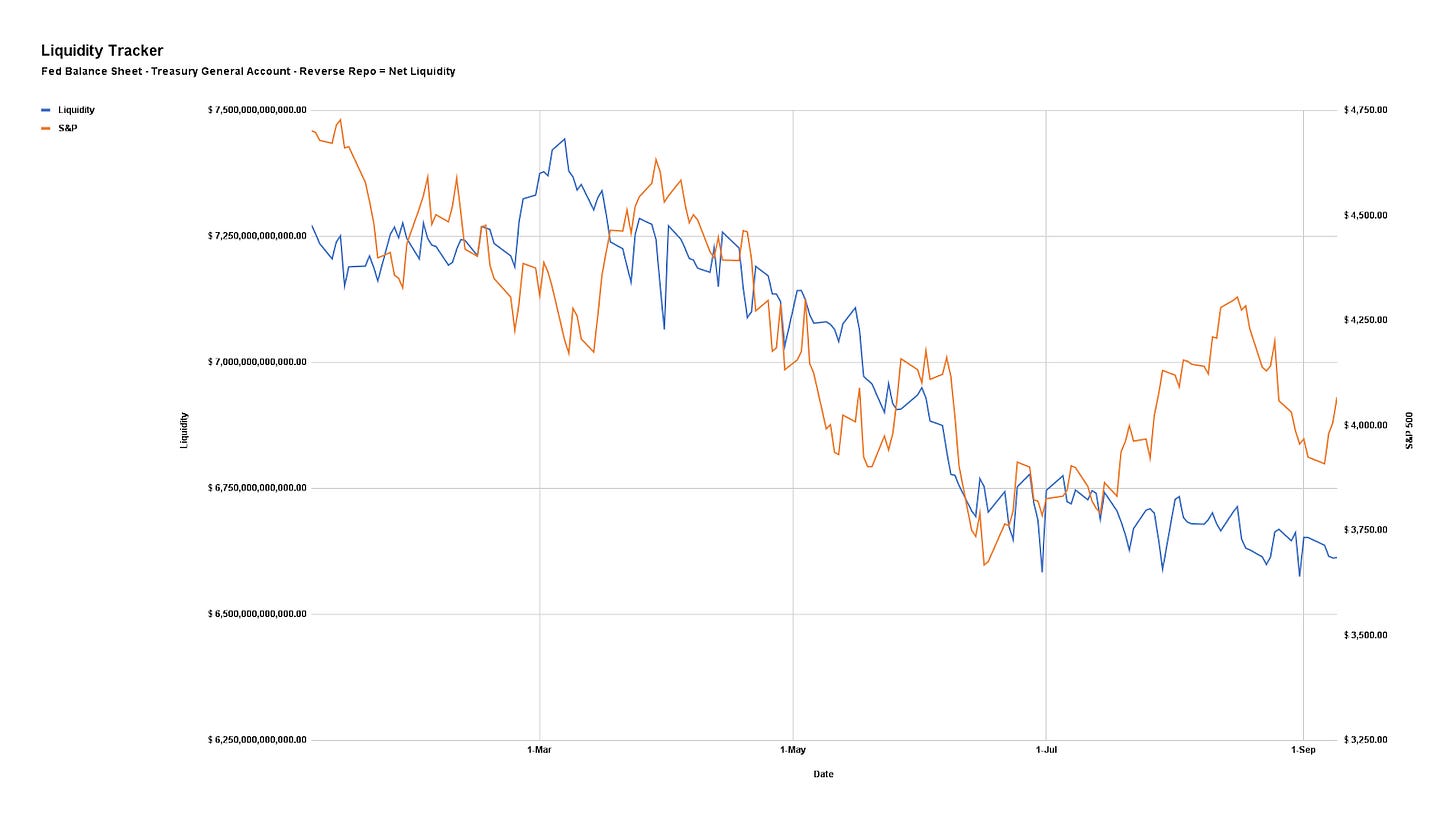

“They’re buying protection against a crash at a pace unlike anything the market has ever seen,” said Jason Goepfert, chief research officer at Sundial. This is as Nomura Holdings Inc’s (NYSE: NMR) Charlie McElligott says more traders are taking shots amid “hawkish global central bank escalations,” and tightening measures of liquidity, among other things.

Goepfert adds that the “massive hedging activity” feels “unsettling.” That has to do with what the reaction to that protection entails should markets drop lower and IVOL increase, accordingly.

Notwithstanding, should nothing bad happen, the activity, which is structured in soon-to-expire options, will quickly fall out of favor (as will the probability of those options paying out). Liquidity providers, on the other side of those trades, will reduce their negative Delta (short futures and stock) hedges which may further add support to markets.

The concern is that soon after this big options expiration passes, new fear and demand for protection may feed into another bout of weakness as traders rush to re-protect and liquidity providers add pressure in their hedging, accordingly.

Technical

As of 7:00 AM ET, Tuesday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, is likely to open in the upper part of a positively skewed overnight inventory, outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

In the best case, the S&P 500 trades higher.

Any activity above the $4,127.00 VPOC puts into play the $4,189.25 LVNode. Initiative trade beyond the LVNode could reach as high as the $4,231.00 VPOC and $4,253.25 HVNode, or higher.

In the worst case, the S&P 500 trades lower.

Any activity below the $4,127.00 VPOC puts into play the $4,071.00 VPOC. Initiative trade beyond the VPOC could reach as low as the $4,018.75 HVNode and $3,991.00 VPOC, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also develops insights around impactful options market dynamics at SpotGamma and is a Benzinga reporter.

Some of his works include conversations with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, FTX’s Sam Bankman-Fried, ex-Bridgewater Associate Andy Constan, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, among many others.

Disclaimer

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.