Editor’s Note: Sorry for the delay, everyone. I’m back in action, today, after traveling!

Market Commentary

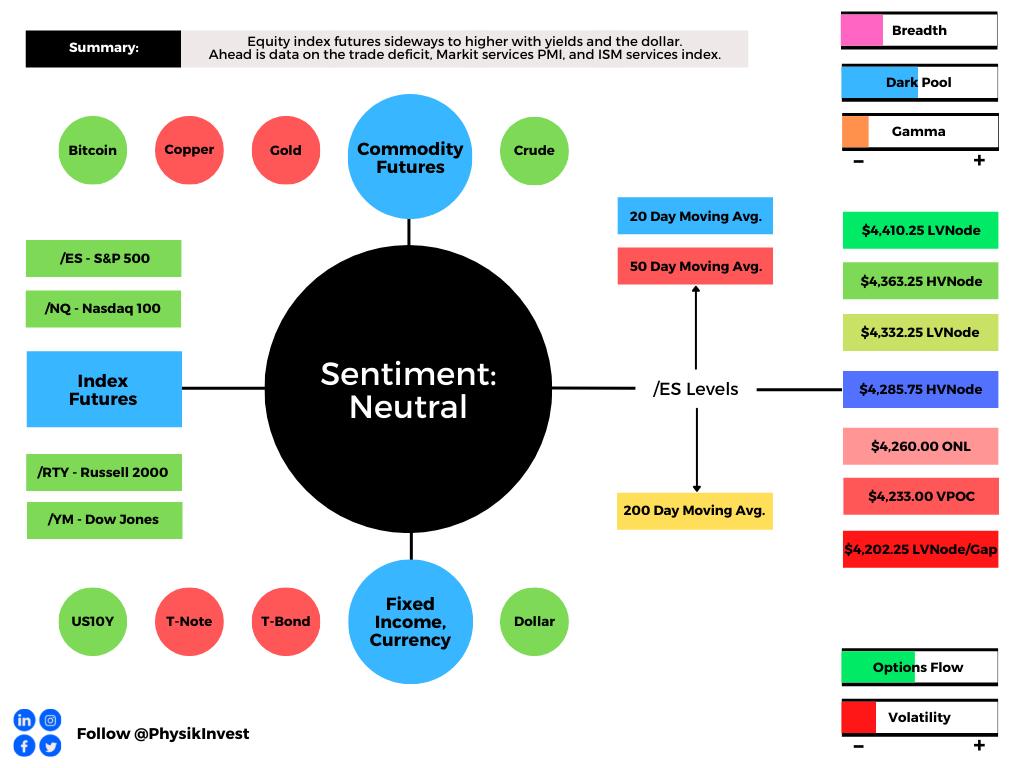

Equity index futures trade higher with yields and the dollar. Commodities were mixed.

Positioning: Some risks weigh to the upside.

Ahead is data on the trade deficit, PMI, ISM.

Fundamental narratives are reducing clarity.

What Happened: U.S. stock index futures sideways to higher overnight alongside narratives surrounding a taper to Federal Reserve asset purchases and debt ceiling complications.

Ahead is data on the trade deficit (8:30 AM ET), Markit services PMI (9:45 AM ET), and ISM services index (10:00 AM ET).

What To Expect: As of 7:50 AM ET, Tuesday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 will likely open inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

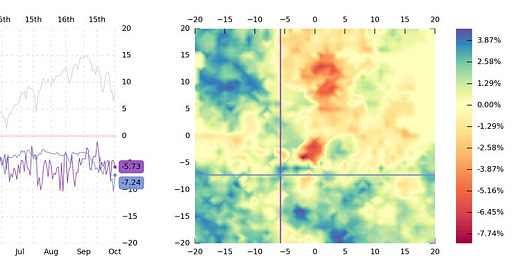

Adding, during the prior day’s regular trade, on weak intraday breadth and divergent market liquidity metrics, the worst-case outcome occurred, evidenced by a liquidation into the bulk of last Friday’s value, the area where about 70% of the volume took place.

In the process, participants left a letter b-shaped profile which suggests participants were “too” long and had poor location; Friday’s advance away from the value area, on a taper of volume, left poor structure – lacking commitment – that gave during Monday’s move lower alongside fundamental drivers, putting in play the S&P 500’s October 1 $4,260.00 overnight low (ONL).

Further, the aforementioned trade is happening in the context of a traditionally volatile October, as well as narratives surrounding a taper to Federal Reserve asset purchases and debt ceiling complications.

These themes are supportive of fear and uncertainty.

To elaborate, on one hand, according to Bloomberg, “the bond market thinks the Fed is going to make a hawkish mistake, and stamp out the life in the economy when previously there had been a belief that the Fed would be easy and let inflation move higher.”

On the other hand, in reference to default on a failure to raise or suspend the debt limit, “The consensus (from clients to whom we speak) is that it just will not happen,” Barclays Plc (NYCE: BCS) analysts explained. “But political schisms in Congress are stronger than they have been in a long time and battle lines more hardened.”

In addition, according to The Market Ear, Morgan Stanley’s (NYSE: MS) Mike Wilson sees the inability of companies to pass on pricing, margin risk related to higher wages, and a reversion to trend in goods consumption, coupled with near term risks on supply chain issues, weighing earnings into early next year.

“In short, higher real rates should mean lower equity prices. Secondarily, they may also mean value over growth even as the overall equity market goes lower. This makes for a doubly difficult investment environment given how most investors are positioned,” Wilson said in a discussion that also touched on a fraying in the buy-the-dip psychology.

In opposition, JPMorgan Chase & Co (NYSE: JPM) sales believe liquidity will remain ample while a capital return and consumer balance sheet health make the recent dip a buy.

In terms of positioning, there is more risk to the upside than the downside; indices are best positioned for a vicious rebound as near-term downside discovery has likely reached a limit.

Moreover, for today, participants may make use of the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,285.75 high volume area (HVNode) puts in play the $4,332.25 low volume area (LVNode). Initiative trade beyond the LVNode could reach as high as the $4,363.25 HVNode and $4,410.25 LVNode, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,285.75 HVNode puts in play the $4,260.00 overnight low (ONL). Initiative trade beyond the ONL could reach as low as the $4,233.00 VPOC and $4,202.25 gap zone, or lower.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

News And Analysis

Stagflation fear is having a British renaissance.

Global energy crisis is first of many in transition.

Buy the dip has failed. Here’s what you do next.

What People Are Saying

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a finance and technology reporter. Some of his biggest works include interviews with leaders such as John Chambers, founder and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.