Physik Invest’s Daily Brief is read by over 1,200 people. To join this community and learn about the fundamental and technical drivers of markets, subscribe below.

Administrative

There will be no Daily Brief published on Thursday, November 17, 2022.

Positioning

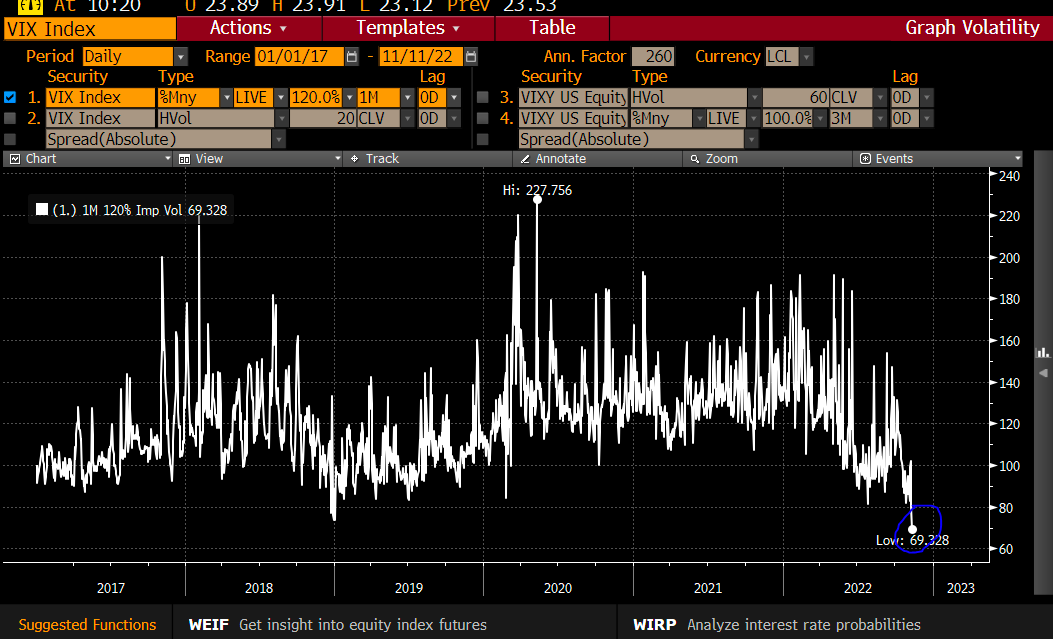

Given where realized (RVOL) and implied (IVOL) volatility measures are, as well as skew, it is beneficial to enter into such trades including protective collars (i.e., sell call, buy put), as stated in yesterday’s letter and explicitly discussed by the likes of Nomura Holdings Inc’s (NYSE: NMR) Charlie McElligott.

To quote McElligott: The “legacy ‘short skew’ trade that’s been the key US equities vol theme of 2022 is now at risk of its own ‘regime change’ reversal, too. This is, then, especially interesting when considering that ongoing VIX call [or] call spread buying … generally some pretty ‘tail-y’ stuff that is beginning to get loaded into.”

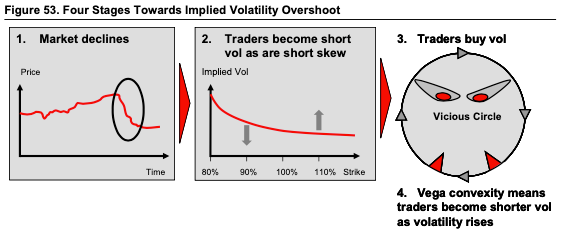

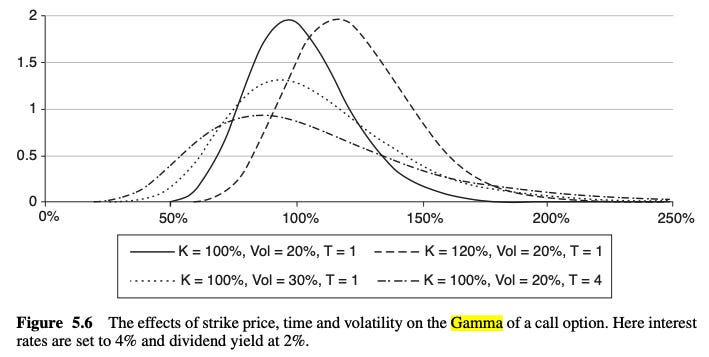

Entering trades that change non-linearly with respect to changes in implied volatility (IVOL) and direction (Delta) exposes participants to convexity (Gamma).

A simple way to think about this is if the market was to shock lower by one, all else equal, the derivative’s value would change in excess of that. On the other hand, if one was short static (not dynamic) Delta, meaning they profit from that movement lower, profits realized would be one for one with the change in the underlying.

So, given the flat skew we mentioned earlier, it is attractive in price to hedge against the downside. Whether that downside materializes, is another story.

Food For Thought:

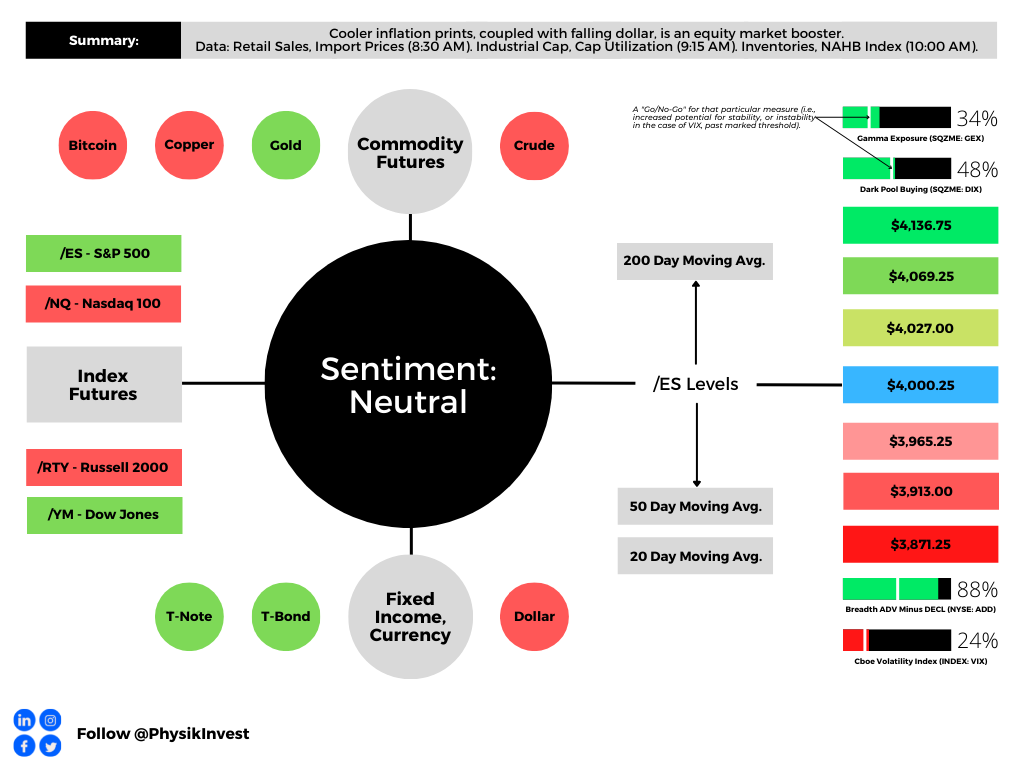

This is amidst the responsiveness near key technical areas provided in past letters. It suggests traders with short time horizons are very active and anchoring to key areas, such as $4,000.00 in the S&P 500. These same participants will often lack the wherewithal to defend retests, and big participants (some of whom move by committee) seldom respond to those technical inflections.

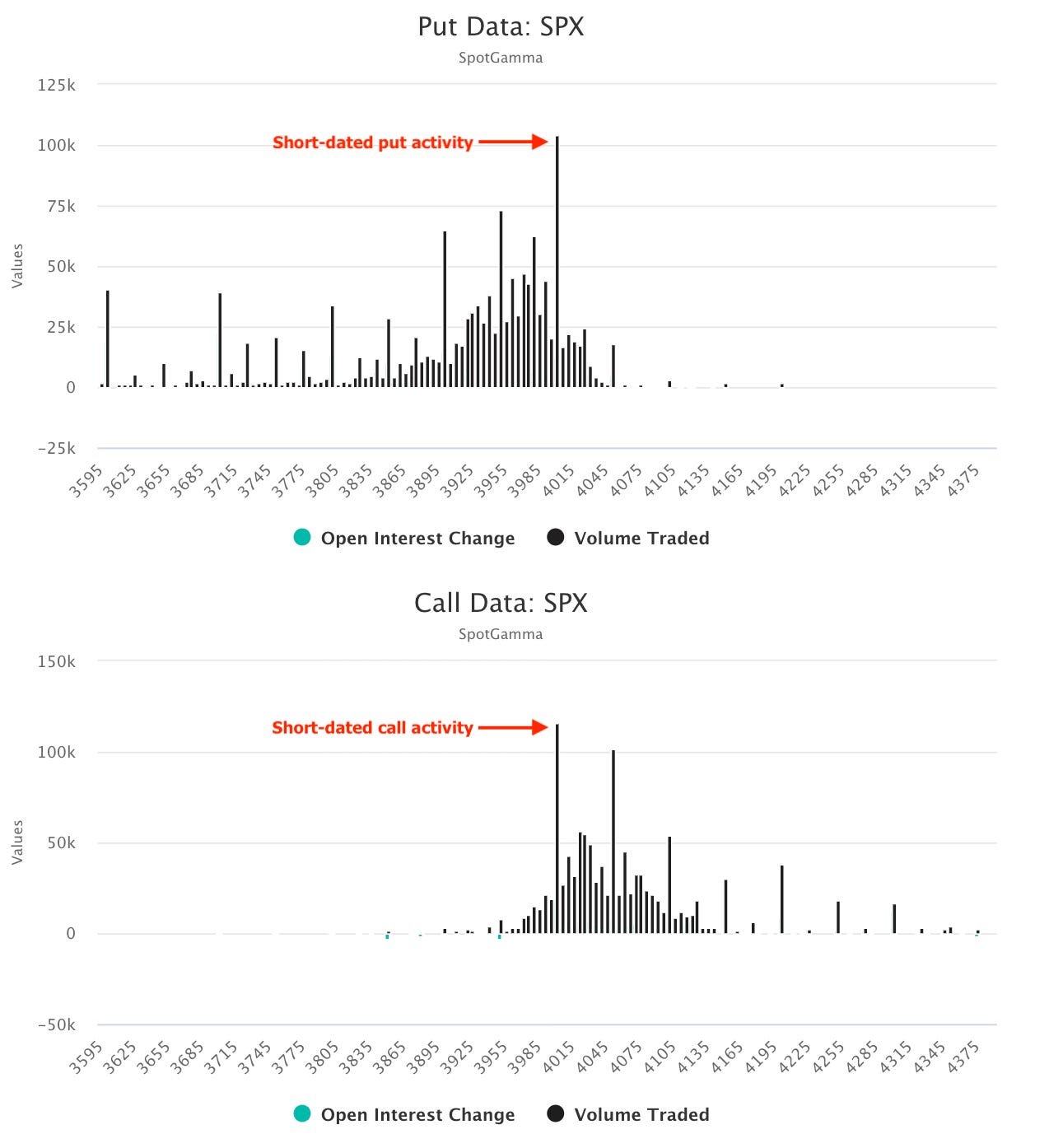

According to SpotGamma, a provider of data and written analyses on the options market, data shows the “$4,000.00 strike continu[ing] to dominate both in terms of position sizing” with calls, at that level most likely “being sold, which has helped maintain $4,000.00 resistance.”

The sale of IVOL leaves counterparties with long (+Delta) exposure to be hedged through sales (-Delta) of the underlying. As the market trades higher, these options, which are very close to current market prices, have a lot of Gamma, meaning they are very sensitive to changes in the price of the underlying (or convex and non-linear to direction). That means these options can go from having little value to a lot of value, quickly.

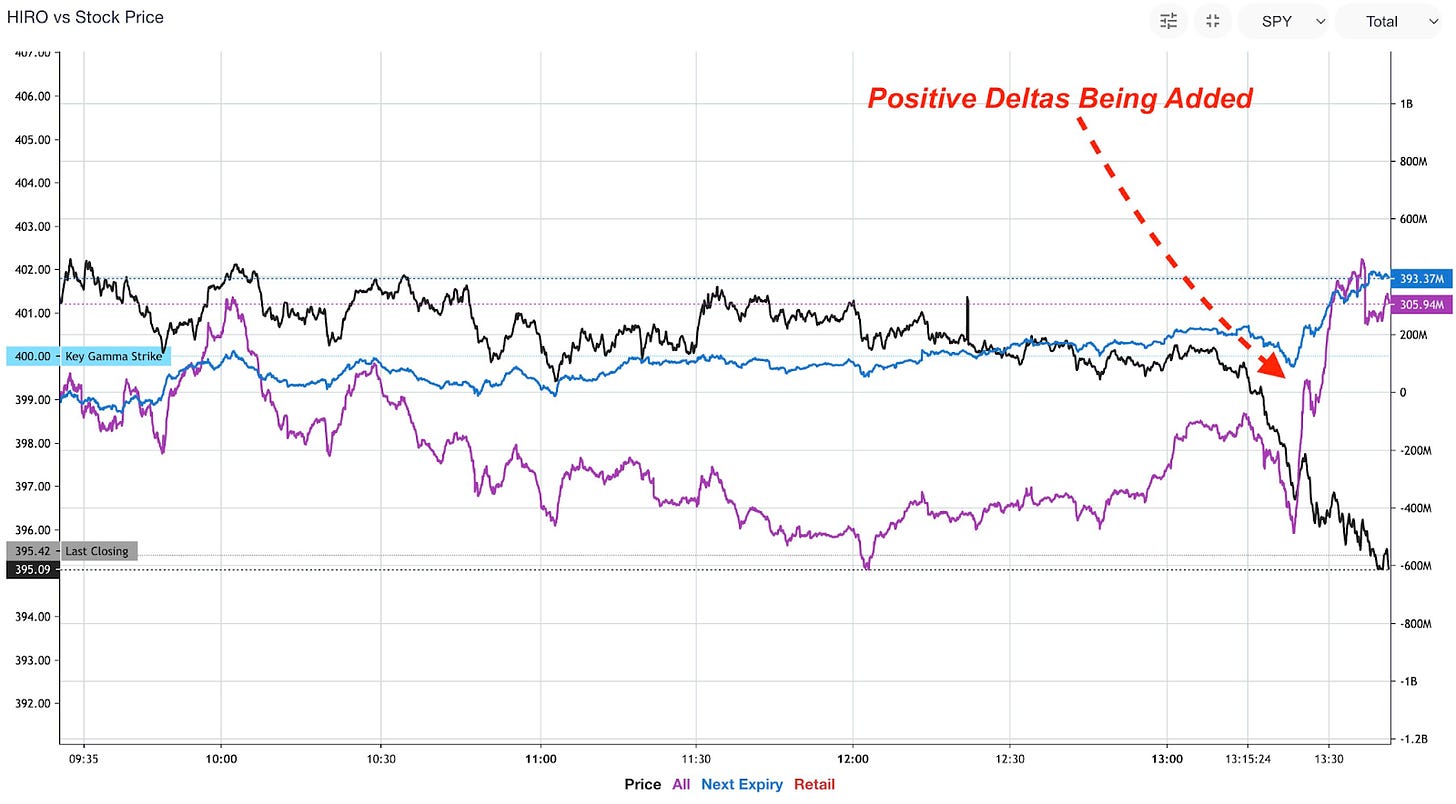

If the market is below $4,000.00 and trading higher, while at $4,000.00 there is a lot of this trade going on, then the counterparty will sell the underlying to offset gains in their options while the reverse happens if the market is trading down, as SpotGamma data showed, yesterday. When the market traded lower, positive Delta was firing off, which is supportive, hence the mean-reversion back to $4,000.00 into the close.

A quick check of how sticky these areas may be, look at the level of positive Gamma.

As traders bet against the market movement, counterparties take on more exposure to positive Gamma. In hedging this positive Gamma, the counterparty does more to reduce market movement.

Couple this mean-reversion-type activity with the structural Delta buyback linked to the passage of time (Charm) and compression of volatility (Vanna), these conditions do more to bolster continued relief, as put forth by Goldman Sachs Group Inc.

Another consequence, as picked up by individuals online including Darrin John, the S&P 500’s realized volatility (RVOL) “is so high” with “a basket of 500 of the ‘best’ stocks in the US [wildly] swing[ing] +5% in a single day,” while the S&P 500 is relatively mute, as your letter writer sees it.

In general, something has to give. If there are forces that are pinning the S&P 500, all the while there are arbitrage constraints connecting the components and all, then correlation must break and dispersion must increase. In short, this is a trader's market; data shows managers tend to “outperform the worst by more during periods of lower correlation,” as does “higher dispersion.”

Should traders continue to hone in on key areas, and add to the interest and volume near those areas, then the market is likely prone to more of the same. Expect pinning and sideways to up. If there were to be a decrease in positive Gamma exposures, that likely opens the door to more movement. Likewise, if traders' bets are concentrated elsewhere (higher or lower), that can open the door to relief. A catalyst for that may be something fundamental.

The Key Takeaway:

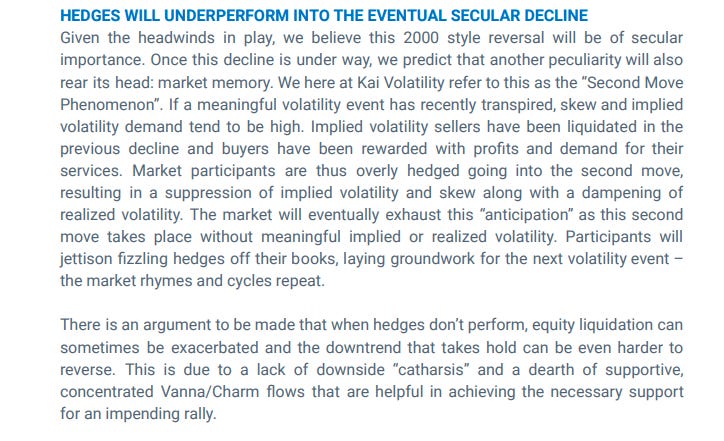

Recent happenings mimic that of the Global Financial Crisis when, according to The Ambrus Group’s Kris Sidial, “vol slowly [ground] until the eventual October 2008 move (i.e., Lehman).”

“The markets were understanding that there was a change going on, especially in credit. But that risk was discounted until it was forced into realization.”

Simple trades to protect (or capitalize on this) include collars, as stated earlier, as well as calendars. If you expect RVOL on the index level, at least, to be mute, then sell short-dated exposure and use those proceeds to purchase farther-dated exposure (e.g., sell weekly put to buy monthly put).

Why?

When you think there is to be an outsized move in the underlying, relative to what is priced, you buy options (+Gamma). When you think there is to be an outsized move in the implied volatility, relative to what is priced, you buy options (+Volga). If there’s a large change in direction (RVOL) or IVOL repricing, you may make money.

Ultimately, “liquidity providers’ response to demand for protection (en masse) would, then, likely exacerbate the move and aid in the repricing of IVOL to levels where there would be more stored energy to catalyze a rally,” as we saw after elections and CPI …

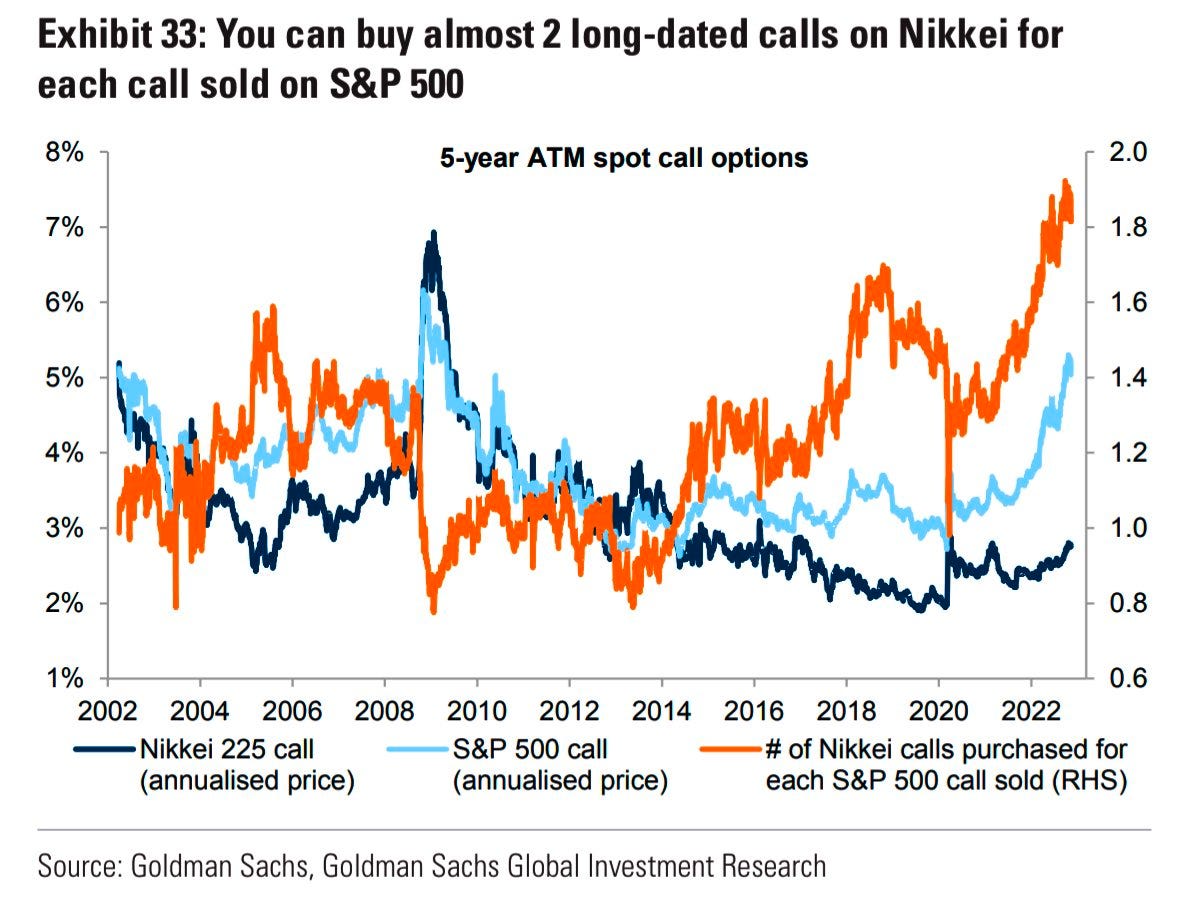

… alongside the Dollar’s (INDEX: DXY) weakness which is easing the burden on margins and global funding.

Per Morgan Stanley (NYSE: MS), "simple math on S&P 500 earnings from currency is that for every percentage point increase on a YoY basis, it’s [] a 0.5 hit to EPS growth.”

Technical

As of 7:15 AM ET, Wednesday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, is likely to open in the middle part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Our S&P 500 pivot for today is $4,000.25.

Key levels to the upside include $4,027.00, $4,069.25, and $4,136.75.

Key levels to the downside include $3,965.25, $3,913.00, and $3,871.25.

Click here to load today’s key levels into the web-based TradingView platform. All levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj also writes options market analyses at SpotGamma and is a Benzinga journalist.

His past works include private discussions with ARK Invest’s Catherine Wood, investors Kevin O’Leary and John Chambers, the infamous Sam Bankman-Fried of FTX, former Bridgewater Associate Andy Constan, Kai Volatility’s Cem Karsan, The Ambrus Group’s Kris Sidial, the Lithuanian Delegation’s Aušrinė Armonaitė, among many others.

Contact

Direct queries to renato@physikinvest.com or Renato Capelj#8625 on Discord.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes.