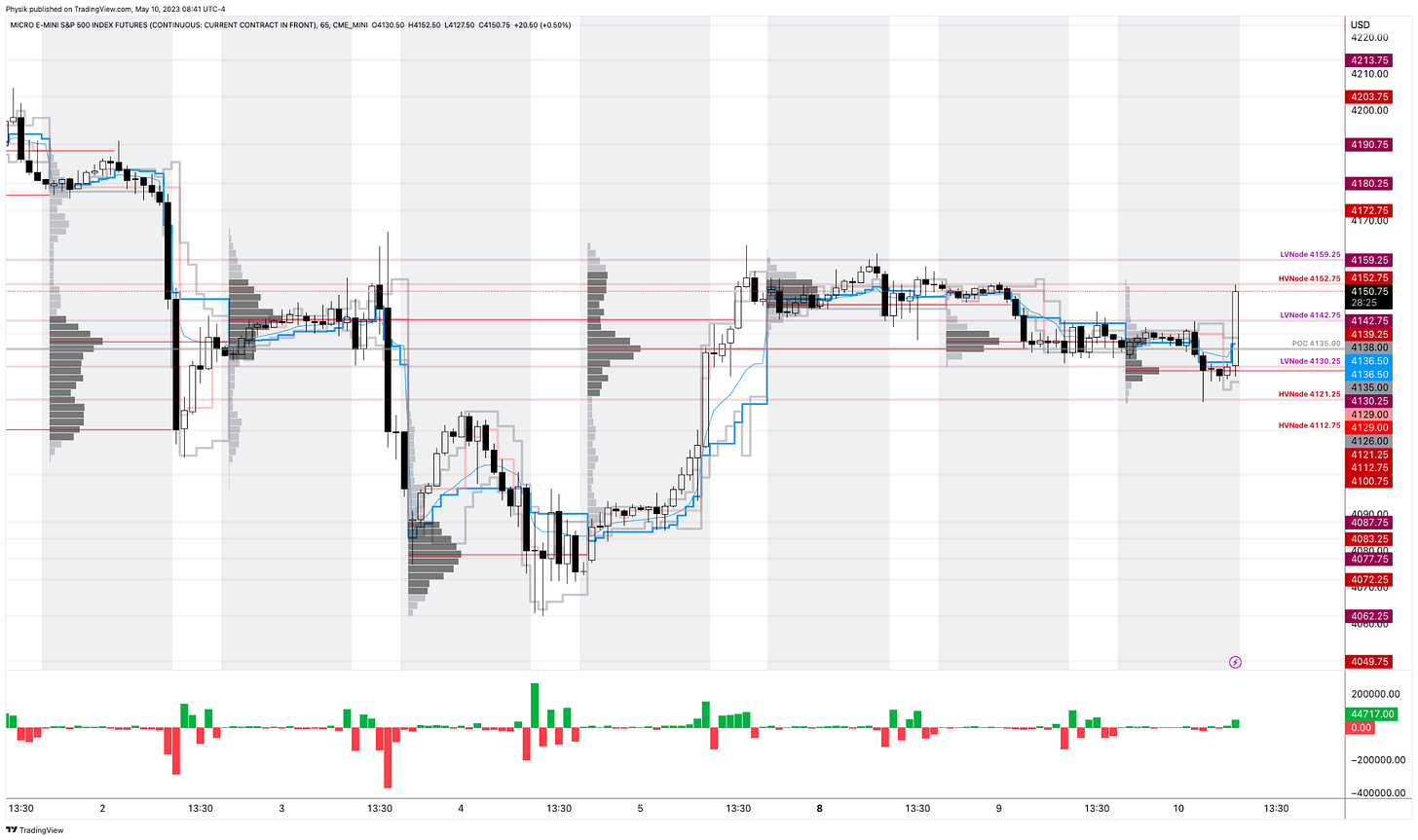

Our levels have been working. For instance, as shown below, yesterday’s Daily Brief levels were key response areas for the Micro E-mini S&P 500 Index (FUTURE: /MES).

Some of the levels overlap centers of options activity; falling volatility coincides with increased sensitivity among those options, lending to reversion and responsiveness.

“This continues to suggest that our theoretical framework of ‘options dominance’ is indeed the driver. In 2017 when the XIV (inverted VIX ETF) was king of the hill, that 44bps high-low range would have been the 47%ile,” reports Tier1Alpha. “If you think these markets are boring, try 2017. Our suspicion is that similar forces are at work, just concentrated in 0dte options. The 2017 bear market in vol came to an end with Volmaggedon. The cycle will end this time as well, but the catalyst remains to be seen.”

Consequently, per SpotGamma, “there is little room for error.”

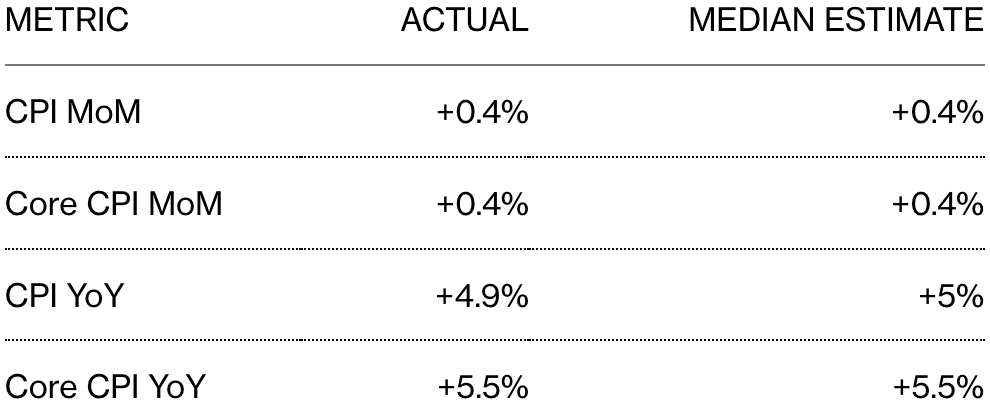

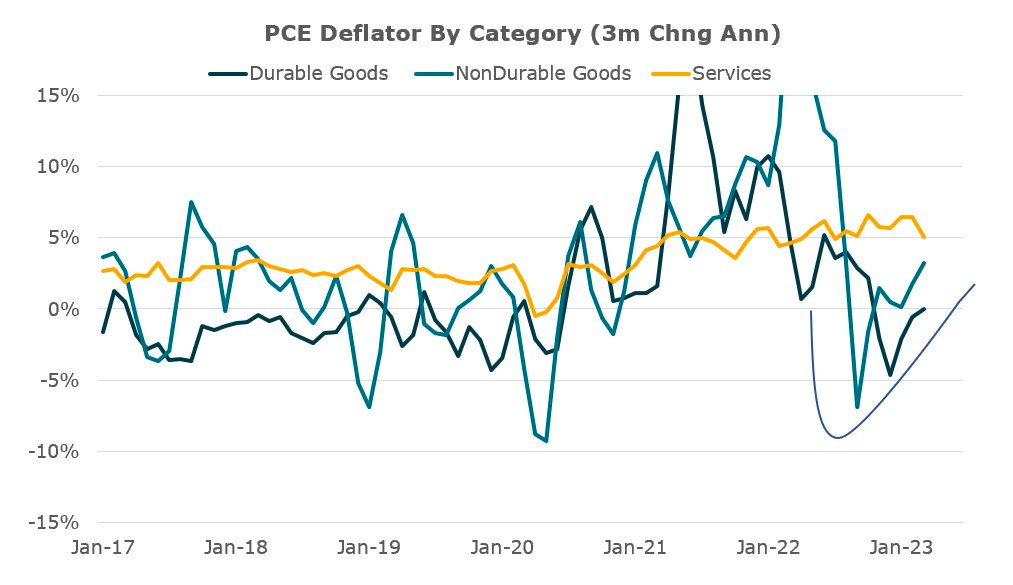

From an options positioning perspective, for volatility to reprice lower and boost the market, “we need a change in [the] volatility regime,” SpotGamma previously added. The likelihood of that happening is low since many expect the Federal Reserve (Fed) to stick to its message of higher rates for longer, notwithstanding the consumer price index rising by a below-forecast 4.9%, the first sub-5% reading in two years. Overall prices remain hot, and the job market remains robust. Policymakers need more than one month of data to be confident that prices are on a sustained downward path, Bloomberg reports.

“Inflation is higher than the Fed's mandate and not on a path to get to that mandate soon. The CPI report is one data point, and most measures show elevated inflation. Areas that had been disinflationary are reverting. And the stickiest parts of inflation remain elevated.”

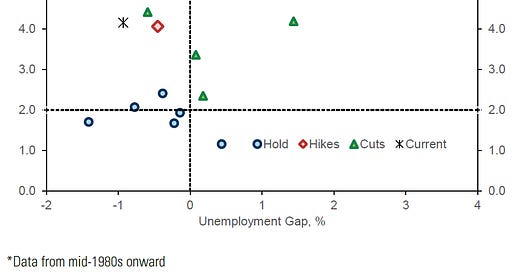

So, support for a pause or hold is the more likely scenario.

“When pauses have occurred against the backdrop of tight labor markets, the Fed has rarely eased in the subsequent six months — the most common outcome has been an on-hold Fed,” explained Praveen Korapaty of Goldman Sachs Group Inc (NYSE: GS). “In contrast, periods with material deterioration in the labor market have more reliably resulted in easing. At least during this period, the inflation backdrop at the time of the pause does not appear to have had a material influence on policy actions.”

Moreover, heading into price updates this morning, the expectation was for a smaller move in the S&P 500. However, with volatility very low, we’ve maintained that selling options blindly is dangerous. When you least expect significant movement, it often happens; just before the opening, the market has moved over 1.0%.

Check out our detailed trade structuring report for more on how to better manage a portfolio in this enviornment.

About

Welcome to the Daily Brief by Physik Invest, a soon-to-launch research, consulting, trading, and asset management solutions provider. Learn about our origin story here, and consider subscribing for daily updates on the critical contexts that could lend to future market movement.

Separately, please don’t use this free letter as advice; all content is for informational purposes, and derivatives carry a substantial risk of loss. At this time, Capelj and Physik Invest, non-professional advisors, will never solicit others for capital or collect fees and disbursements. Separately, you may view this letter’s content calendar at this link.