Physik Invest’s Daily Brief is read free by thousands of subscribers. Join this community to learn about the fundamental and technical drivers of markets.

Fundamental

Higher asset prices boosted household wealth and demand; consumers’ increased ability to spend more wealth pushed up inflation. If policymakers use their tools to lower household wealth and demand, this should cut down on inflation.

Kai Volatility’s Cem Karsan says the latter was a policy objective and recent financial institution failures are a sign of follow-through; excesses and speculation are being removed, as policymakers desired.

Policymakers don’t want liquidations, however. They want lower asset prices. Recent events put policymakers in an odd position after raising rates non-stop. In the Federal Reserve’s (Fed) case, and we paraphrase Karsan, policy/rates moved very quickly with little pause. With there being a lag, the Fed may want to pause and assess. However, they have to telegraph this carefully so that the market does not read it as a pivot. If the market rallies, that “makes things hotter,” Karsan says.

There’s already been an overreaction in the bond market, he adds, which is not ideal. The Fed does not want the long end of the yield curve to fall, as it has on the back of the turmoil and intervention, as well as data including housing starts which show more supply coming onto the market, likely a mortgage application booster in the near term.

Even at the front end, there’s been lots of movement. This has “forc[ed] widespread risk liquidation,” Bloomberg says. Take a look at the Three-Month SOFR (FUTURE: /SR3), a tool used to hedge USD short-term interest rates.

The consensus, which Karsan agrees with, is that the Fed moves forward with a 25 basis point hike while telegraphing it wants the long end of the curve to rise or higher for longer as it is colloquially referred to.

It is possible for the US policymakers to adopt a meeting-by-meeting stance, as their counterparts have in Europe, letting uncertainties regarding the likes of Credit Suisse Group AG (which just received a ~$54 billion or so liquidity backstop and is mulling a combination with other lenders), SVB Financial Group (NASDAQ: SVB) and First Republic Bank (NYSE: FRC) pan out.

Pausing, or intending to pause explicitly, could raise inflation expectations or “boost the odds of a recession by spooking consumers and companies into believing that the economy is worse off than they thought,” Bloomberg explains, noting: “All told, the emergency loans reversed around half of the balance-sheet shrinkage that the Fed has achieved since it began so-called quantitative tightening — allowing its portfolio of assets to run down — in June last year.”

Positioning

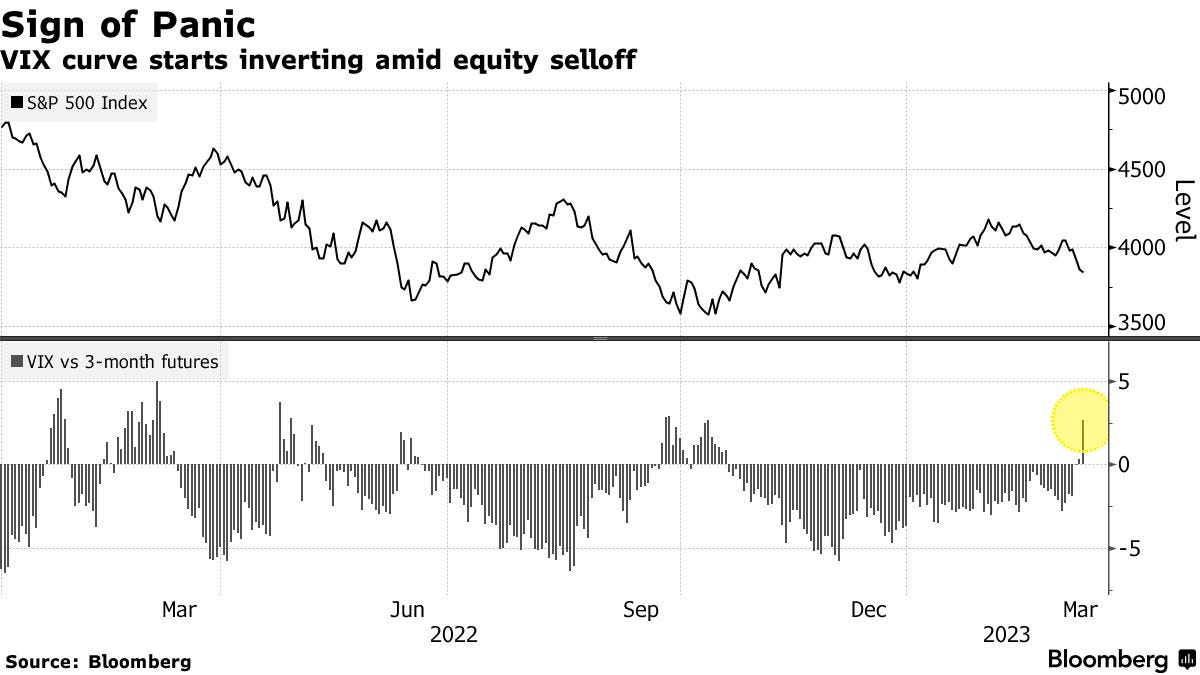

Heading into this most recent market decline, investors foresaw increased volatility and were positioned for it as indicated by the pricing of tail risk and performance of implied volatility or IVOL (as investors continued to demand protection during this window of non-strength), said Laya Royer of Citadel Securities.

Recall that Kris Sidial warned us of this. Options, colloquially referred to as volatility, would serve as the only hedge in an environment wherein commodities, stocks, and bonds don’t combine or balance each other as well as they did in 2022.

Now, there are options expirations (OpEx) nearing (March 16 and 31); monetization of profitable options structures, as well as volatility compression and options decay, have counterparties buying back their short stock and/or futures hedges (to the short put positions they have on), boosting the market (particularly the depressed and rate-sensitive Nasdaq 100) through this OpEx/triple witching window.

Following this period, the “rollover” of existing positions may result in “price swings” that last, Bloomberg puts forth. “This quarterly expiry may help unpin the market.”

Structures proposed in the Daily Brief for March 14 may work in reducing portfolio downside while allowing you to participate directionally at less cost.

Technical

As of 8:50 AM ET, Friday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, is likely to open in the lower part of a negatively skewed overnight inventory, inside of the prior day’s range, suggesting a limited potential for immediate directional opportunity.

The S&P 500 pivot for today is $3,970.75.

Key levels to the upside include $4,004.75, $4,037.00, and $4,059.25.

Key levels to the downside include $3,946.75, $3,921.25, and $3,891.00.

Disclaimer: Click here to load the updated key levels via the web-based TradingView platform. New links are produced daily. Quoted levels likely hold barring an exogenous development.

Definitions

Volume Areas: Markets will build on areas of high-volume (HVNodes). Should the market trend for a period of time, this will be identified by a low-volume area (LVNodes). The LVNodes denote directional conviction and ought to offer support on any test.

If participants auction and find acceptance in an area of a prior LVNode, then future discovery ought to be volatile and quick as participants look to the nearest HVNodes for more favorable entry or exit.

POCs: Areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

The author, Renato Leonard Capelj, spends the bulk of his time at Physik Invest, an entity through which he invests and publishes free daily analyses to thousands of subscribers. The analyses offer him and his subscribers a way to stay on the right side of the market.

Separately, Capelj is an accredited journalist with past works including interviews with investor Kevin O’Leary, ARK Invest’s Catherine Wood, FTX’s Sam Bankman-Fried, North Dakota Governor Doug Burgum, Lithuania's Minister of Economy and Innovation Aušrinė Armonaitė, former Cisco chairman and CEO John Chambers, and persons at the Clinton Global Initiative.

Connect

Direct queries to renato@physikinvest.com. Find Physik Invest on Twitter, LinkedIn, Facebook, and Instagram. Find Capelj on Twitter, LinkedIn, and Instagram. Only follow the verified profiles.

Calendar

You may view this letter’s content calendar at this link.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes. Capelj and Physik Invest manage their own capital and will not solicit others for it.