The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

Stock index futures were higher after positive developments, abroad.

According to some reports, the talks between Russia and Ukraine are making progress. This is while China vows to stabilize markets with a promise “to ease a regulatory crackdown, support property, and technology companies and stimulate the economy.”

On the China news, the Hang Seng China Enterprises Index (INDEX: HSCEI) rose ~13% (in the context of a ~30% 1-month drawdown).

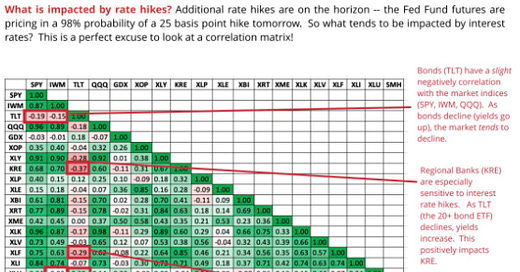

At home, in the U.S., the Federal Reserve is expected to increase rates by a quarter-point, the first since 2018. Markets are pricing up to seven hikes this year.

Ahead is data on retail sales and import prices (8:30 AM ET). The NAHB home builders index and business inventories (10:00 AM ET). As well as the Federal Open Market Committee (FOMC) announcement (2:00 PM ET) and press conference (2:30 PM ET).

What To Expect

Fundamental: The 60/40 portfolio is headed for its worst performance since the financial crisis of 2008 as assets are hurt by a mix of slowing economic growth and inflation.

Further, this letter has talked about the “bonds down, equities down” phenomenon before. To borrow from letters published over the past two months, in short, over the past 40 or so years, monetary policy was used as a crutch to support the economy.

This promoted deflation, innovation, and the subsequent rise in valuations.

With rates lifting, that’s a headwind; coupled with participants’ increased exposure to rate and equity market risk, which can play into cross-market hedging and de-leveraging cascades, 60/40 turns into somewhat of a poor hedge.

Why? Let’s back up for a moment.

For an investor to take on additional risk for return, they must receive in excess of the risk-free rate (as provided by the Treasury). This excess is the risk premium.

As Investopedia details well, therefore, “the total return on a stock is the sum of two parts: the risk-free rate and the risk premium.”

Moreover, higher rates and risk premiums increase the required rate of return.

Higher interest rates, basically, decrease the present value of future cash flows, making stocks, especially those that are high growth, less attractive.

So, at higher rates, shares should fall. At lower rates, shares should rise. Some strategists estimate that annual returns for 60/40 will be less than 5% over the next decade, as a result.

This conversation has me bringing up a conversation I had with Karan Sood, the CEO and Managing Director, Head of Product Development at Cboe Vest Financial LLC.

“Bonds have been giving you really good returns because interest rates have been going down since the 1970s when they peaked at about 11%,” Sood explained to me.

“That’s changing now; we’re at the zero bound, and it’s unlikely that will be as a strong of a tailwind. Worse, it could be a headwind if interest rates start to rise.”

In regards to the Federal Reserve’s balance sheet, Bloomberg explains that participants ought to receive updates on the pace of buying, as well as the sale of assets.

“That may include setting out caps on how many billions of dollars worth of Treasuries and mortgage-backed securities will be allowed to mature every month without reinvestment, something that Powell told Congress earlier this month would be discussed at this meeting.”

Positioning: Based on a comparison of present options positioning and buying metrics, the returns distribution remains skewed positive.

Pursuant to the buying support remark, JPMorgan Chase & Co (NYSE: JPM) strategists say pension and sovereign wealth funds, in rebuilding risk-on positions, may boost markets by as much as 10%.

“It’s the biggest rebalancing since 2020 in terms of buying equities,” JPMorgan strategist Nikolaos Panigirtzoglou said. An inflow of at least $100 billion and as much as $230 billion could trigger gains of between 5% and 10% to global stocks, he said.

At the same time, expected is further compression of volatility (via the passage of FOMC), as well as the removal of customer puts (and associated hedging pressures) via OPEX (options expiration).

To note, there is the potential, according to SpotGamma, for some “path dependency,” as “the expiration and/or covering of a large swath of these put hedges may place the market back into an ‘underhedged’ position.”

In such a case, new demand would add fuel to weakness.

Technical: As of 6:30 AM ET, Wednesday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the upper part of a positively skewed overnight inventory, outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

Gap Scenarios: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

In the best case, the S&P 500 trades higher; activity above the $4,285.25 high volume area (HVNode) puts in play the $4,326.25 overnight high (ONH). Initiative trade beyond the ONH could reach as high as the $4,346.75 HVNode and $4,375.00 untested point of control (VPOC), or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,285.25 HVNode puts in play the $4,249.25 low volume area (LVNode). Initiative trade beyond the LVNode could reach as low as the $4,219.00 VPOC and $4,177.25 HVNode, or lower.

Considerations: Push-and-pull, as well as responsiveness near key-technical areas (that are discernable visually on a chart), suggests technically-driven traders with short time horizons are very active.

Such traders often lack the wherewithal to defend retests and, additionally, the type of trade may be indicative of the other time frame participants waiting for more information to initiate trades.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj is also a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, FTX’s Sam Bankman-Fried, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor developing insights around impactful options market dynamics.

Disclaimer

Physik Invest does not carry the right to provide advice.

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.