Market Commentary

Index futures rotate as participants begin the bracketing process.

More delta variant fears. End to a slow quarter.

Ahead is employment, home sales, Fed speak.

Participants positioning for upcoming catalysts.

What Happened: U.S. stock index futures auctioned sideways to lower alongside fears surrounding COVID-19 variants.

To note, though, Moderna Inc (NASDAQ: MRNA) announced that its shot produced antibodies against the concerning delta variant. In other areas, cryptocurrencies took a hit ahead of the House Committee on Financial Services hearing on crypto.

Adding, tomorrow participants will get clarity on OPEC’s decision on crude supply.

Before the market opens, the latest ADP Employment report will be out. Thereafter, Chicago PMI, pending home sales data, some Fed speak, and earnings are on deck.

What To Expect: Wednesday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 will likely open inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

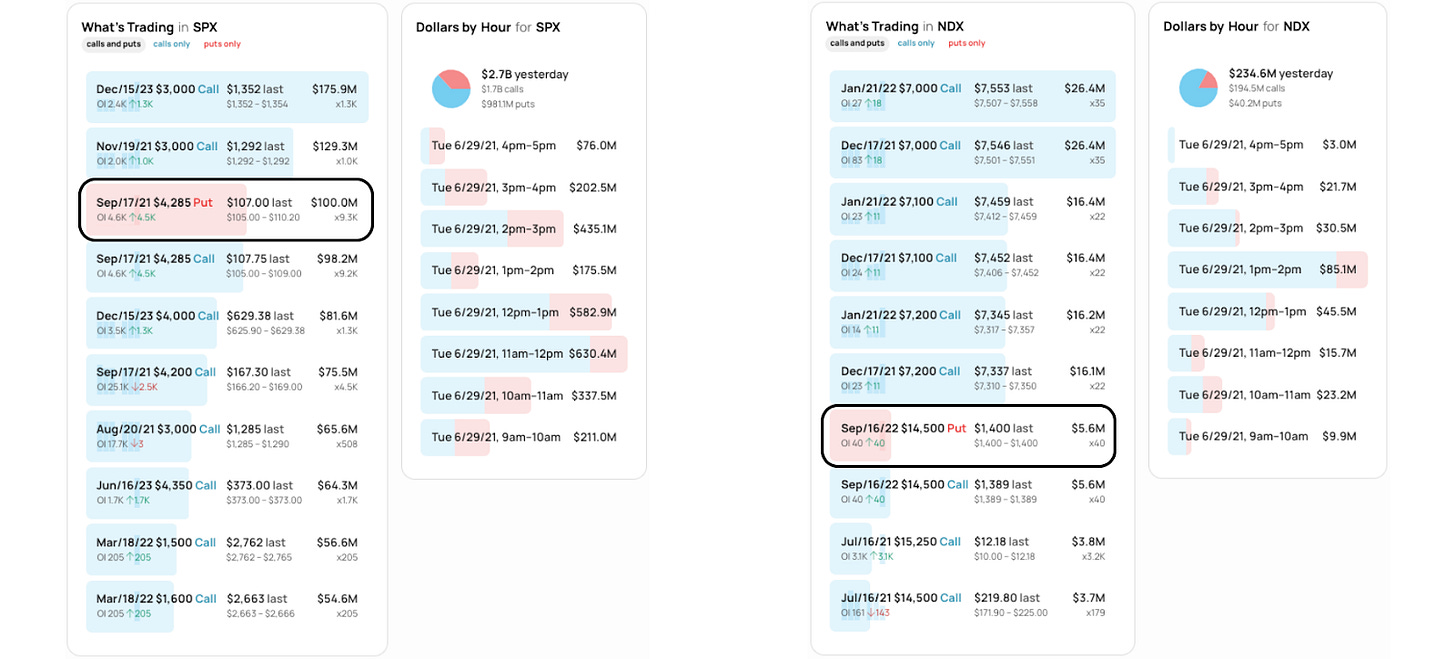

Adding, during the prior day’s regular trade, the best case outcome occurred, evidenced by sideways trade above the $4,271.00 Point of Control (POC), up to a new – likely secure – regular-trade high (RTH High) at $4,291.00.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

Coming into today’s session, the Nasdaq 100 remains relatively strong. Despite Tuesday’s corrective activity – as evidenced by a higher high and low in the S&P 500 – offering participants favorable entry and exit within the trend, signs of exhaustion are apparent. After strong buying by longer time frame participants, short-term traders took over; moves are mechanical, halting at key, visual references.

It’s likely that last night’s break is the start of bracketing (i.e., the trend ceases and the auction becomes volatile as participants, with similar views of value, look to position themselves for the next catalyst). At the same time, as stated in prior commentaries, markets are just days from breaking out of weak seasonality; July 4 marks the start of the best 2-week period going back to 1950.

Overall, the outlook is rather cloudy. Given seasonality metrics and a strong uptrend, participants should keep an open mind when assessing the implications of narrowing breadth and tapering volumes. The uptrend will end after (1) buyers are exhausted or (2) responsive sellers deem the price too far from perceived value.

Further, for today, participants can trade from the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the micro-composite POC at $4,273.25 puts in play the $4,285.25 high volume area (HVNode). Initiative trade beyond that HVNode could reach as high as the $4,291.00 RTH High and $4,294.75 Fibonacci-derived price target.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

In the worst case, the S&P 500 trades lower; activity below $4,285.25 puts in play the $4,256.75 HVNode. Thereafter, if lower, the poor, low volume structure surrounding the $4,239.75 HVNode comes into play. On an aggressive liquidation that finds acceptance (i.e., more than 1-hour of trade) past that $4,239.75 figure, participants ought to look out for responses at the $4,213.00 HVNode.

News And Analysis

Markets | China’s digital yuan a key risk for euro, ECB says. (BBG)

Economy | Private payrolls rise 692,000, topping projections. (CNBC)

Markets | Microsoft, Google end six-year truce on legal battles. (FT)

Economy | Unemployment lifeline disappears around country. (Axios)

Health | Heart inflammation after COVID shots is heightened. (REU)

Economy | If the Federal Reserve stopped buying mortgages. (Axios)

Economy | Supreme Court declines to lift eviction moratorium. (Axios)

What People Are Saying

Innovation And Emerging Trends

Space | Musk: SpaceX is prepared to spend $30B on Starlink. (FT)

FinTech | Coinbase rolling out high-yield USDC product offering. (Block)

FinTech | IG Group and tastytrade completed a $1B partnership. (BZ)

Media | Munger says he loves Zoom, thinks video trend will stay. (CNBC)

About

Renato founded Physik Invest after going through years of self-education, strategy development, and trial-and-error. His work reporting in the finance and technology space, interviewing leaders such as John Chambers, founder, and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others, afforded him the perspective and know-how very few come by.

Having worked in engineering and majored in economics, Renato is very detailed and analytical. His approach to the markets isn’t built on hope or guessing. Instead, he leverages the unique dynamics of time and volatility to efficiently act on opportunity.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.