The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

Overnight, equity index futures auctioned lower in light of an escalation of geopolitical tensions between Russia, Ukraine, and the rest of the world.

Western powers imposed harsh sanctions including the exclusion of some Russian lenders from the SWIFT messaging system “that underpins trillions of dollars worth of transactions,” globally.

As the Russian ruble lost ⅓ of its value and costs of insuring Russian government debt rose, the Bank of Russia (BoR) doubled its key interest rate to 20% and imposed some capital controls to take from the risk of a potential run on banks. Policymakers also banned foreign security sales.

The odds of an aggressive lift-off in interest rates by the Federal Reserve declined, accordingly. The market is now pricing in under six hikes for 2022 as crisis opens room for policy mistakes.

Ahead is data on trade in goods (8:30 AM ET), Chicago PMI (9:45 AM ET), and Fed-speak by Atlanta Fed President Raphael Bostic (10:30 AM ET).

What To Expect

Fundamental: As of February 27, 2022, there are reports that with its invasion of Ukraine, “Moscow was frustrated by the slow progress caused by an unexpectedly strong Ukrainian defense and failure to achieve complete air dominance.”

At present, Russia has only committed 50% of its available firepower to the war and solicited the involvement of neighboring allies. Still, even at 50%, it's rough.

Russian markets, to put it simply, are in turmoil as a result of this conflict. Its policymakers, to stem the bleed, have banned foreigners from selling assets.

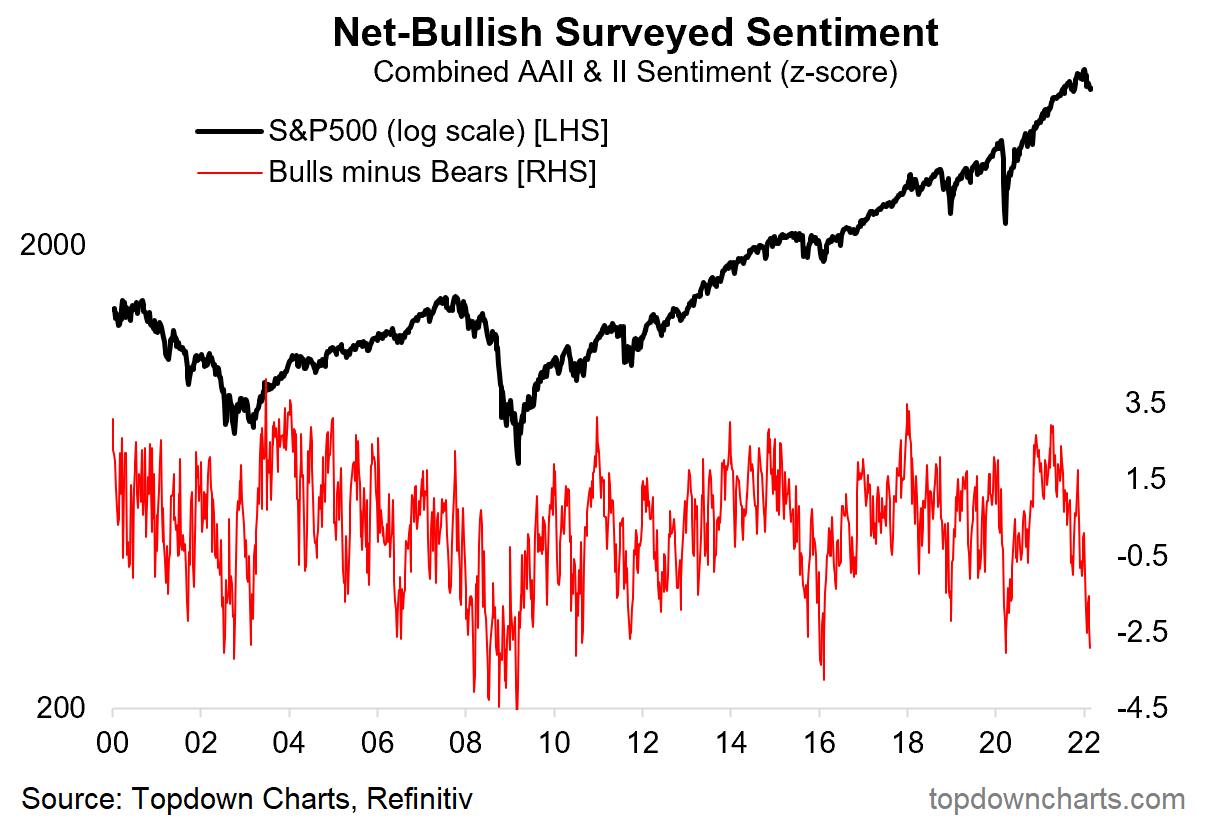

Accordingly, sentiment is as bad as it was in 2020, 2016, the period spanning 2008-2009, as well as the period just after the topping of the tech-and-telecom bubble.

In light of the world’s response to this conflict, Russia, too, has heightened its nuclear readiness.

Moreover, over the weekend, Credit Suisse Group AG’s (NYSE: CS) Zoltan Pozsar, in gauging the implications of conflict and sanctions, explained that excluding Russia from SWIFT may lead to missed payments and overdrafts similar to that experienced during March of 2020.

“Banks’ inability to make payments due to their exclusion from SWIFT is the same as Lehman’s inability to make payments due to its clearing bank’s unwillingness to send payments on its behalf,” he noted.

“The consequence of excluding banks from SWIFT is real, and so is the need for central banks to re-activate daily U.S. dollar funds supplying operations.”

In light of this, some have advanced a narrative around a potential run on Russian banks.

However, former BoR official Sergey Aleksashenko, in an alarmed yet less pessimistic take on CNBC, suggested a “low likelihood” of a run on the ruble.

Further, in light of the deceleration at home in the U.S., Pozsar concludes that “the Fed’s balance sheet might expand again before it contracts via QT (quantitative tightening).”

Interactive Brokers Group Inc’s (NASDAQ: IBKR) Chief Strategist Steve Sosnick adds: “The tide of money is still positive, and it should provide a cushion for nervous markets as long as that remains the case. But when we consider that monetary conditions are supposed to be changing, volatility should persist if the monetary tide actually ebbs as expected.”

Perspectives: “Geopolitical catastrophes tend to be worse than believed in the short term but less than believed in the long term,” Ophir Gottlieb of Capital Market Laboratories notes.

Similarly, JPMorgan Chase & Co’s (NYSE: JPM) head of global equity strategy Mislav Matejka says that “If one is selling on the back of the latest geopolitical developments now, the risk is of getting whipsawed.”

“Historically, [the] vast majority of military conflicts, especially if localized, did not tend to hurt investor confidence for too long, and would end up as buying opportunities.”

Positioning: Strong passive buying support persists in the face of a lower liquidity, negative-gamma, high-volatility regime.

Adding, in light of the liquidation into last Thursday’s open (after which there was a large reversal), the VIX futures term structure, though in backwardation, was not as steep as in past moments of true panic.

IBKR’s Sosnick explains that “Even though VIX futures [were higher on Thursday morning] across the board and the curve has further steepened, neither the spot level nor the curve are yet demonstrating panic.”

“I interpret the message of the market to be that we should continue to expect volatility – remember that volatility encompasses moves in both directions – but not to expect that a major bottom was put into place in recent sessions.”

With realized volatility heightened and implied volatility not performing, so to speak, @darjohn25 explains, try to avoid “any short gamma on all short-dated tenors—you want to own the short term stuff for the foreseeable future.”

Technical: As of 6:30 AM ET, Monday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the middle part of a negatively skewed overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Gap Scenarios Potentially In Play: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

In the best case, the S&P 500 trades higher; activity above the $4,285.50 high volume area (HVNode) puts in play the $4,345.75 untested point of control (VPOC). Initiative trade beyond the VPOC could reach as high as the $4,371.00 VPOC and $4,395.25 HVNode, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,285.50 HVNode puts in play the $4,227.75 HVNode and overnight low (ONL) area. Initiative trade beyond the HVNode/ONL could reach as low as the $4,177.25 HVNode and $4,137.00 VPOC, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

What People Are Saying

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj is also a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, FTX’s Sam Bankman-Fried, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor developing insights around impactful options market dynamics.

Disclaimer

Physik Invest does not carry the right to provide advice.

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.