The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

Overnight, equity index futures were range-bound inside of a larger developing balance area.

Volatility remains heightened in the face of conflicting narratives surrounding Russka-Ukraine and action by the Federal Reserve.

Ahead is data on jobless claims, building permits, housing starts, and the Philadelphia Fed Manufacturing Index (8:30 AM ET).

Fed-speak follows. James Bullard will speak at 11:00 AM ET and Loretta Mester at 5:00 PM ET.

Below we discuss the implications of unprecedented Fed action and a “new Volcker moment,” positioning, and more.

What To Expect

Fundamental: Minutes of the January 25-26 Federal Open Market Committee meeting were released, yesterday.

Per Bloomberg, “persistent real wage growth in excess of productivity growth that could trigger inflationary wage-price dynamics,” among other risks, participants responded positively to what seems to be overall “less-hawkish” narratives.

The yield curve steepened (i.e., the spread between long- and short-rates widened), shortly after, given sentiment that the Fed may be less inclined to raise rates than once priced in.

The minutes said, however, that “if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate. Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation.”

Moreover, Fed action today is in opposition to what has been done before.

In the past, “the Fed used rate hikes to engineer recessions that generated the slack needed to keep inflation in check (‘opportunistic disinflation’),” Credit Suisse Group AG’s (NYSE: CS) Zoltan Pozsar says.

“With the Fed’s ‘updated dual mandate’ of inclusive low unemployment and the political imperative of redistribution through firmer wage growth at the bottom of the income distribution, the Fed aiming to slow inflation via a recession is unimaginable. Hikes today then are meant to slow inflation without a recession … which is not something that the Fed has ever managed.”

With that, the Fed has “no control over goods prices unless they curb demand through a recession,” the note adds. However, “they have a lot of control over services inflation – which, unlike goods inflation, is mainly a function of domestic nominal factors.”

Components of services inflation include OER and “all other services,” with the former a function of house prices, the latter a function of labor supply.

Both respond to financial conditions which are driven by long-term interest rates or term premia and less so by short rates. Thus far, the market is pricing little impact on long-term interest and mortgage rates, as well as richly-valued equities.

“More is needed,” Pozsar explains. “To slow OER inflation, mortgage rates need to be higher and house prices flat or outright lower. To slow all other services – driven by a shortage of labor – we need more supply of labor, not less demand for it through a recession.”

“We need to slow services inflation by slowing, not killing, wage growth.”

With this policy talk of increasing labor supply with lower asset prices (cutting into the riches of those involved in the equity and alternative asset markets over the recent years), a Fed first, Pozsar thinks we need “a Volcker moment.”

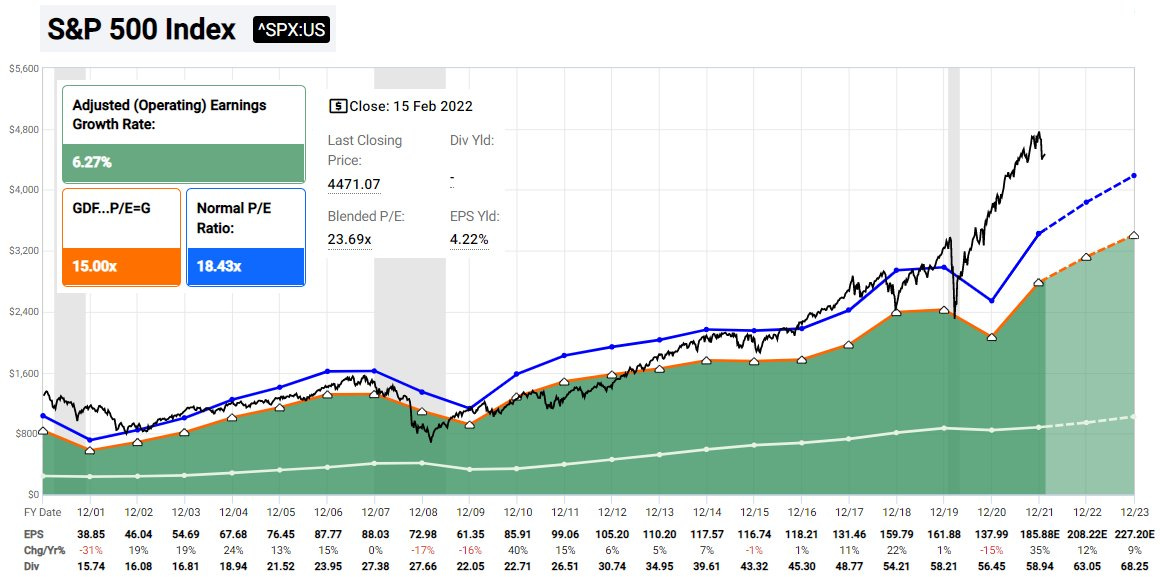

In other terms, as stated yesterday and before, prevailing monetary frameworks and max liquidity promoted a large divergence in price from fundamentals.

The growth in passive investing – the effect of increased moneyness among nonmonetary assets – and derivatives trading imply a lot of left-tail risks.

The (pending) removal of this liquidity cuts into “the processes that enforce these bubbles” found in the volatility market and beyond, therefore upping the judgment of valuations.

“A new Volcker moment should also mean a radical change in the Fed’s strategy and involve going from targeting rates to targeting quantities once again – not the quantity of reserves in the banking system, but the quantity of duration in the market-based shadow banking system to jolt all sorts or risk premia higher.”

Positioning: Pursuant to comments in prior newsletters regarding “accumulation” and the rotation out of money market funds, according to Barclays PLC (NYSE: BCS), retail poured $48 billion into U.S. Equity ETFs last week.

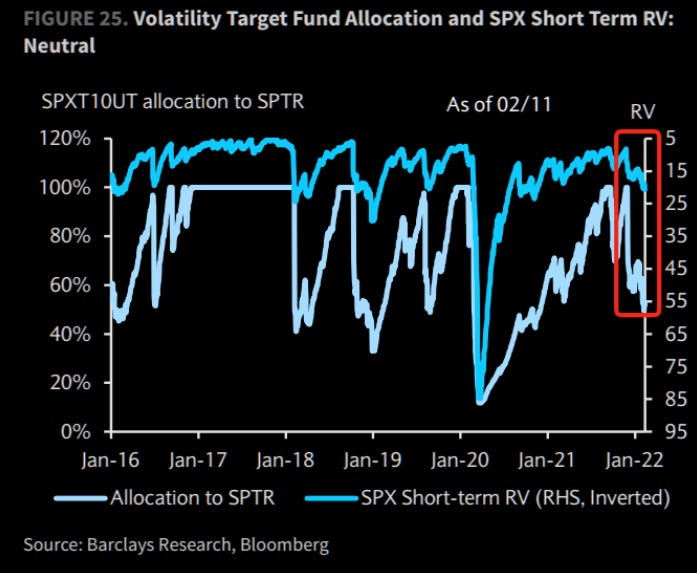

That is as, per The Market Ear, “vol[atility] targeting players, the crowd adjusting their positions as volatility is moving, have decreased their longs as [volatility has] moved higher.”

In the face of this accumulation and prospects of buying in cases where volatility compresses, per JPMorgan Chase & Co’s (NYSE: JPM) Nikolaos Panigirtzoglou, however, “There is a good chance that 2022, in terms of equity fund flows, will look like 2018.”

“As the Fed raises rates and other central banks are following the Fed, the risk is that at some point equity fund flows dissipate, or even turn negative,” he added. “I would not be surprised if we could have some sort of a repeat of 2018.”

On a micro level, in response to the FOMC minutes, participants sold puts and bought calls. Into the end-of-day, call buyers likely monetized their bets, while put selling continued.

The compression of volatility, coupled with that aforementioned trade, bolsters attempts higher.

Moreover, in the slightly bigger (week- and month-long picture), according to SpotGamma, “post-OPEX, the removal of linear short (-delta) hedges [to put-heavy exposures] may further bolster attempts higher.”

On the other hand, “The removal of downside (put) protection may also open the door for weakness in a case where some outside (fundamental) event solicits real-money selling and a new demand for protection.”

Technical: As of 6:30 AM ET, Thursday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the middle part of a negatively skewed overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Balance (Two-Timeframe Or Bracket): Rotational trade that denotes current prices offer favorable entry and exit. Balance-areas make it easy to spot a change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend).

Modus operandi is responsive trade (i.e., fade the edges), rather than initiative trade (i.e., play the break).

In the best case, the S&P 500 trades higher; activity above the $4,438.00 key response area (BAL/ONL/HVNode) puts in play the $4,485.00 regular trade high (RTH High). Initiative trade beyond the RTH High could reach as high as the $4,499.00 untested point of control (VPOC) and $4,526.25 high volume area (HVNode), or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,438.00 key response area (BAL/ONL/HVNode) puts in play the $4,421.75 low volume area (LVNode). Initiative trade beyond the LVNode could reach as low as the $4,393.75 HVNode and $4,365.00 POC, or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj is also a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, FTX’s Sam Bankman-Fried, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor developing insights around impactful options market dynamics.

Disclaimer

Physik Invest does not carry the right to provide advice.

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.