The Daily Brief is a free glimpse into the prevailing fundamental and technical drivers of U.S. equity market products. Join the 200+ that read this report daily, below!

What Happened

After auctioning up into a key supply area, overnight, equity indices were responsively sold.

Ahead is data on retail sales and import prices (8:30 AM ET), industrial production and capacity utilization (9:15 AM ET), business inventories, and the NAHB home builders’ index (10:00 AM ET), as well as the release of Federal Open Market Committee (FOMC) minutes (2:00 PM ET).

What To Expect

Fundamental: The market has de-rated substantially at the single-stock level.

“Stocks have been de-rating for almost a year now as investors began to anticipate the inevitable tightening from the Fed, given the robustness of the recovery and building imbalances,” Morgan Stanley’s (NYSE: MS) Michael Wilson says.

“We think this de-rating is about 80% done at the stock level with the S&P 500 P/E still about 10% too high (19.5x versus our 18x target). In other words, the de-rating is more complete at the stock level than at the index level, at least for the high-quality S&P 500.”

At the same time, the bond market’s pricing of risk – reflected by the Merrill Lynch Option Volatility Estimate (INDEX: MOVE) – is not in line with the pricing of equity market risk, via the CBOE Volatility Index (INDEX: VIX).

That said, fear in one market tends to feed into the fear of another; regardless of the cause, equity and bond market participants are not on the same page.

Moreover, prevailing monetary frameworks and max liquidity promoted a large divergence in price from fundamentals. Growth in passive investing – the effect of increased moneyness among nonmonetary assets – and derivatives trading imply a lot of left-tail risks.

The “provision of liquidity and the creation of wealth through higher asset prices are intimately connected over time,” John Authers of Bloomberg explains.

“Falling liquidity, while obviously necessary now that the emergency has passed and inflation is rising, could well signal problems ahead.”

To establish the point, these shifts in liquidity have large effects on bond markets, too, and that’s what participants are likely pricing in via MOVE.

A “flatter yield curve tends to be followed quite swiftly by rising credit spreads. While there is no great issue with solvency at present, this suggests that credit may already be causing problems by the end of this year.”

“The U.S. high yield OAS (option-adjusted spread) is breaking out above resistance to suggest a year-long risk-off bottom for this credit spread,” Bank of America explains.

“Deteriorating credit conditions are a bearish leading indicator, increasing the risk that the S&P 500 (INDEX: SPX) completes the head and shoulders top highlighted in the chart below.”

Taken together, it is the above-mentioned dynamics that will ultimately make it hard for the Fed to continue with rate hikes, Authers adds.

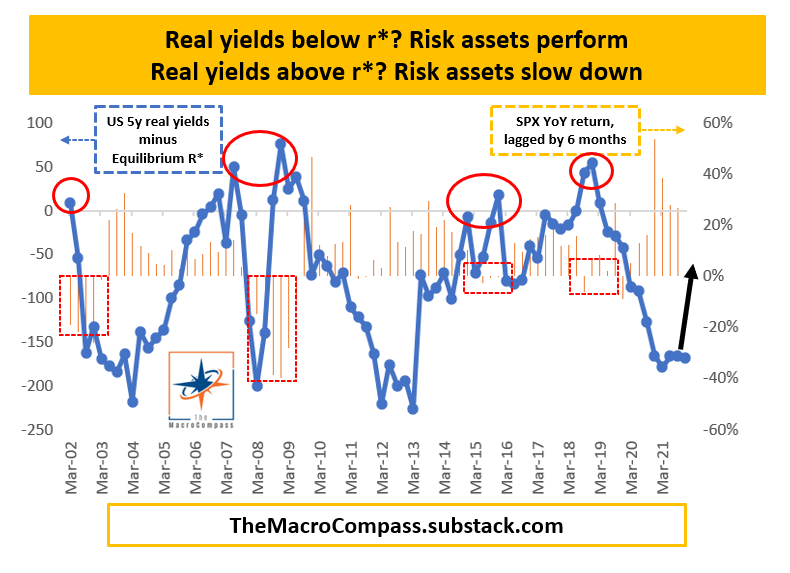

To conclude this section, I quote Alfonso Peccatiello, the former head of a $20 billion investment portfolio and author of The Macro Compass: “If the Fed pushes the hawkish narrative further, we might see deeper cracks in the walls.”

Positioning: In the past weeks this commentary expressed a more bullish tilt.

This tilt is not entirely incorrect. Indeed, there are (as pointed to in past commentaries) few metrics that suggest that there have been strong(er) levels of accumulation.

However, other positioning metrics point to an increased potential for instability, and implied volatility, though heightened, may not provide much of a boost if further compressed.

As options modeling and analysis provider SqueezeMetrics explains, “I don't see the upside catalyst in the data right now. VIX back at 25 isn't compelling from a vanna-rally perspective (back to 20 seems possible, but how much more?).”

“Have enough puts been bought to propel prices from vanna rally and subsequent vol rolldown? Mehhh.”

To put it in simpler terms, “it is a lot easier to knock [the market] down than it is to lift up.”

What’s known for sure is that this week’s put-heavy options expiration (OPEX) “may make gamma exposures less negative,” according to options analysis provider SpotGamma.

For context, delta is an options exposure to direction. Gamma is the rate of change in delta.

“In an environment characterized by negative gamma (wherein an options delta falls with stock price rises and rises when stock prices fall), options expiries ought to make gamma less negative.”

Therefore, with a reduction in negative gamma, “there will be a removal of [counterparties’] linear short (-delta) hedges which may further bolster attempts higher.”

Technical: As of 6:30 AM ET, Wednesday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the middle part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

In the best case, the S&P 500 trades higher; activity above the $4,438.00 key response area (balance boundary, high-volume area, and prior overnight low) puts in play the $4,483.00 overnight high (ONH). Initiative trade beyond the ONH could reach as high as the $4,499.00 untested point of control (VPOC) and $4,526.25 high volume area (HVNode), or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,438.00 key response area puts in play the $4,393.75 HVNode. Initiative trade beyond the HVNode could reach as low as the $4,365.00 POC and $4,332.25 HVNode, or lower.

Considerations: Tuesday’s trade built out areas of high volume via the cave-fill process in locations where prior discovery left weak structure – gaps and p-shaped emotional, multiple distribution profile structures (i.e., Friday’s knee-jerk liquidation of poorly positioned longs).

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

Cave-Fill Process: Widened the area deemed favorable to transact at by an increased share of participants. This is a good development.

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Vanna: The rate at which the delta of an option changes with respect to volatility.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

Options Expiration (OPEX): Traditionally, option expiries mark an end to pinning (i.e, the theory that market makers and institutions short options move stocks to the point where the greatest dollar value of contracts will expire) and the reduction dealer gamma exposure.

Volume-Weighted Average Prices (VWAPs): A metric highly regarded by chief investment officers, among other participants, for quality of trade. Additionally, liquidity algorithms are benchmarked and programmed to buy and sell around VWAPs.

About

After years of self-education, strategy development, mentorship, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Capelj is also a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, FTX’s Sam Bankman-Fried, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor developing insights around impactful options market dynamics.

Disclaimer

Physik Invest does not carry the right to provide advice.

In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.