What Happened

After the Federal Reserve (Fed) announced it would accelerate its taper to bond-buying, clearing the way for interest-rate hikes, the equity market rallied, broadly.

With all major U.S. equity index futures trading higher, overnight, it appears that participants’ fears regarding monetary policy have been assuaged.

As forecasted, a collapse in event-related implied volatility brought in positive flows that ought to support the market into this week’s weighty “quad-witching” derivatives expiry.

Ahead is data on jobless claims, building permits, housing starts, and manufacturing (8:30 AM ET). Then, there are releases on industrial production, capacity utilization (9:15 AM ET), as well as Markit manufacturing and services PMI (9:45 AM ET).

What To Expect

Market hammered out a low, yesterday.

This was after, to start the week, customers had been increasing their exposure to short-delta (call selling and put buying). The counterparty inventorying the opposite (long-delta) exposure sold (bought) futures into price discovery higher (lower).

This dynamic had the effect of pinning the market; was the S&P 500 to remain in consolidation, customers’ (dealers’) short-delta (long-delta) would have risen which would have made for even more pinning.

That didn’t happen, though.

Into Wednesday’s FOMC event, demand for protection expanded (as evidenced by a higher CBOE Volatility Index reading). That knocked most of the major indexes out of sideways trade.

However, as revealed Tuesday by SpotGamma’s (beta) Hedging Impact of Real-Time Options (HIRO) indicator, “participants saw lower prices as an opportunity to express their opinion of lower volatility into Wednesday’s Federal Open Market Committee (FOMC) update.”

From there on, as Ambrus Group’s Kris Sidial best explained, “vols were static in anticipation of the fed talk,” taking away from supportive flows (as a result of options sliding down their term structure [vanna]) and promoting sideways trade.

Context: Wednesday’s commentary really hit the nail on the head, so to speak.

Therefore, I offer some light updates.

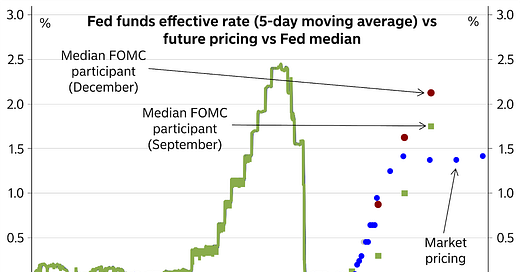

As expected, per Nordea, the Fed will “accelerate its tapering process, and is now set to conclude net purchases already by mid-March vs mid-June with the earlier pace.”

“The dot plot was revised significantly higher, and the plot now shows three hikes for next year, a further three for 2023 and another two for 2024.”

That said, today’s rates support validations better than in the ‘90s.

At the same time, equity markets tend to rally into the first hike; Moody’s Corporation’s (NYSE: MCO) forecast aligns with that – “the Dow Jones Industrial Average increases this quarter and peaks in early 2022, … [followed by] steady decline through 2022.”

This positive take is in the face of what has been markedly divergent breadth and extreme relative weakness, especially in rate-sensitive names.

Why? Rising rates, among other factors, have the potential to decrease the present value of future earnings, thereby making stocks, especially those that are high growth, less attractive.

With the equity market moving higher, here, into the end of the week, we ought to not discount participants’ increasing exposure to leveraged products.

This increases the speed with which volatility is realized and was cited as a risk in one of Moody’s recent commentaries.

So, despite having seasonally-aligned “passive buying support” and supportive positioning metrics, as well as expectations of “the strongest quarterly nominal [economic] growth in more than three decades,” offsides positioning ought to exacerbate underlying price movements.

So what? As stated, yesterday, the market is in a positive-gamma environment wherein the counterparties to customer options trades add market liquidity and temper realized volatility.

With participants’ fears surrounding monetary policy assuaged, there are positive flows that ought to support the market into this week’s weighty “quad-witching” derivatives expiry.

Into the end of the week, the expectation is that participants continue to step in and commit increased capital on lower directional volatility (as they had into this week).

With activity concentrated in shorter-dated tenors, counterparties will take on more exposure to positive gamma which they will offset by supplying the market with more liquidity, thereby pressuring the price discovery process.

Moreover, the decrease in dealer supply (short delta) post-OPEX, via the covering of short stock/futures hedges to put-heavy positioning, ought to bolster any attempt higher.

In anticipation of higher prices, low cost, complex options structures like call-side calendars, butterflies, and ratio spreads are top of mind.

Expectations: As of 6:15 AM ET, Thursday’s regular session (9:30 AM - 4:00 PM ET), in the S&P 500, will likely open in the upper part of a positively skewed overnight inventory, outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

Balance-Break + Gap Scenarios: A change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend) is occurring.

Monitor for acceptance (i.e., more than 1-hour of trade) outside of the balance area.

Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Rejection (i.e., return inside of balance) portends a move to the opposite end of the balance.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,712.00 balance area boundary (BAH) puts in play the $4,732.50 high volume area (HVNode). Initiative trade beyond the HVNode could reach as high as the $4,740.50 minimal excess high and $4,767.00 extension, or higher.

In the worst case, the S&P 500 trades lower; activity below the $4,712.00 BAH puts in play the $4,690.25 micro composite point of control (MCPOC). Initiative trade beyond the MCPOC could reach as low as the $4,674.25 HVNode and $4,657.00 balance low (BAL), or lower.

Click here to load today’s key levels into the web-based TradingView charting platform. Note that all levels are derived using the 65-minute timeframe. New links are produced, daily.

Definitions

V-Pattern: A pattern that forms after a market establishes a high, retests some support, and then breaks above said high. In most cases, this pattern portends continuation.

Volume Areas: A structurally sound market will build on areas of high volume (HVNodes). Should the market trend for long periods of time, it will lack sound structure, identified as low volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants were to auction and find acceptance into areas of prior low volume (LVNodes), then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

Gamma: Gamma is the sensitivity of an option to changes in the underlying price. Dealers that take the other side of options trades hedge their exposure to risk by buying and selling the underlying. When dealers are short-gamma, they hedge by buying into strength and selling into weakness. When dealers are long-gamma, they hedge by selling into strength and buying into weakness. The former exacerbates volatility. The latter calms volatility.

Vanna: The rate at which the delta of an option changes with respect to volatility.

Charm: The rate at which the delta of an option changes with respect to time.

MCPOCs: POCs are valuable as they denote areas where two-sided trade was most prevalent over numerous day sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

Price Discovery (One-Timeframe Or Trend): Elongation and range expansion denotes a market seeking new prices to establish value, or acceptance (i.e., more than 30-minutes of trade at a particular price level).

Excess: A proper end to price discovery; the market travels too far while advertising prices. Responsive, other-timeframe (OTF) participants aggressively enter the market, leaving tails or gaps which denote unfair prices.

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a Benzinga finance and technology reporter interviewing the likes of Shark Tank’s Kevin O’Leary, JC2 Ventures’ John Chambers, and ARK Invest’s Catherine Wood, as well as a SpotGamma contributor, helping develop insights around impactful options market dynamics.

Disclaimer

At this time, Physik Invest does not carry the right to provide advice. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.