Market Commentary

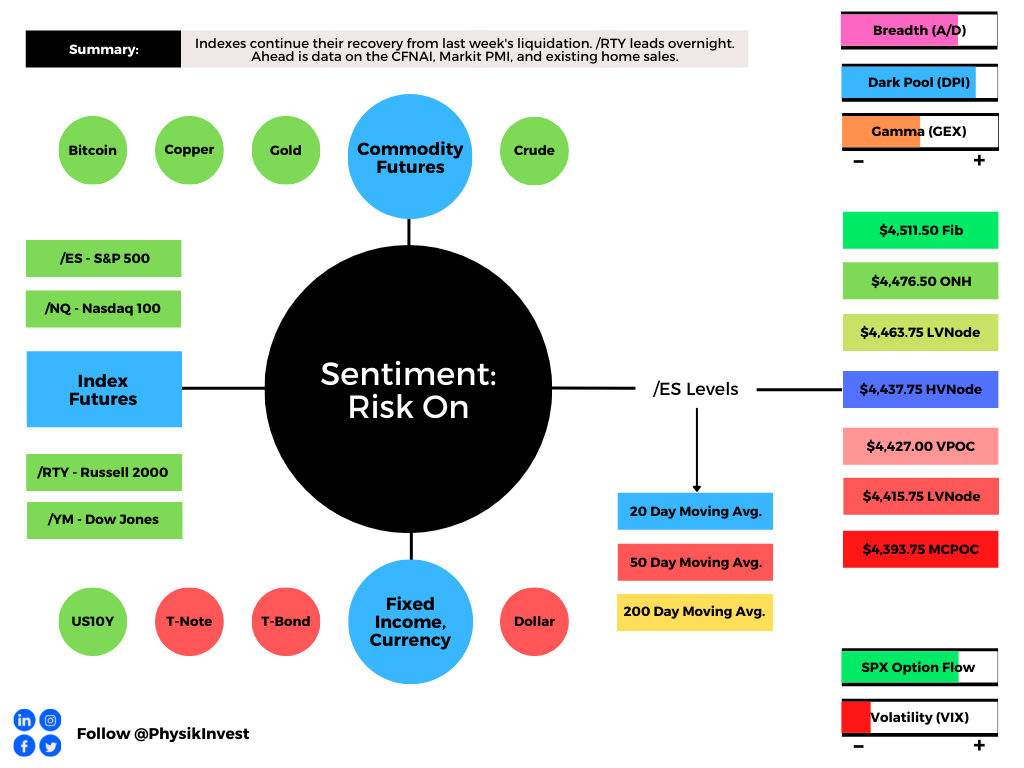

Equity index and commodity futures trade higher overnight. Yields and VIX are higher, too.

Post-FOMC minutes recovery continues.

Ahead: CFNAI, Markit PMI, home sales.

What Happened: U.S. stock index futures auctioned higher, continuing their recovery from last week’s liquidation that intensified after the release of Federal Open Market Committee (FOMC) minutes. Leading the overnight price rise is the Russell 2000, a laggard in recent trade.

Ahead is data on the Chicago Fed National Activity Index (8:30 AM ET), Markit manufacturing and services PMI (9:45 AM ET), as well as existing home sales (10:00 AM ET).

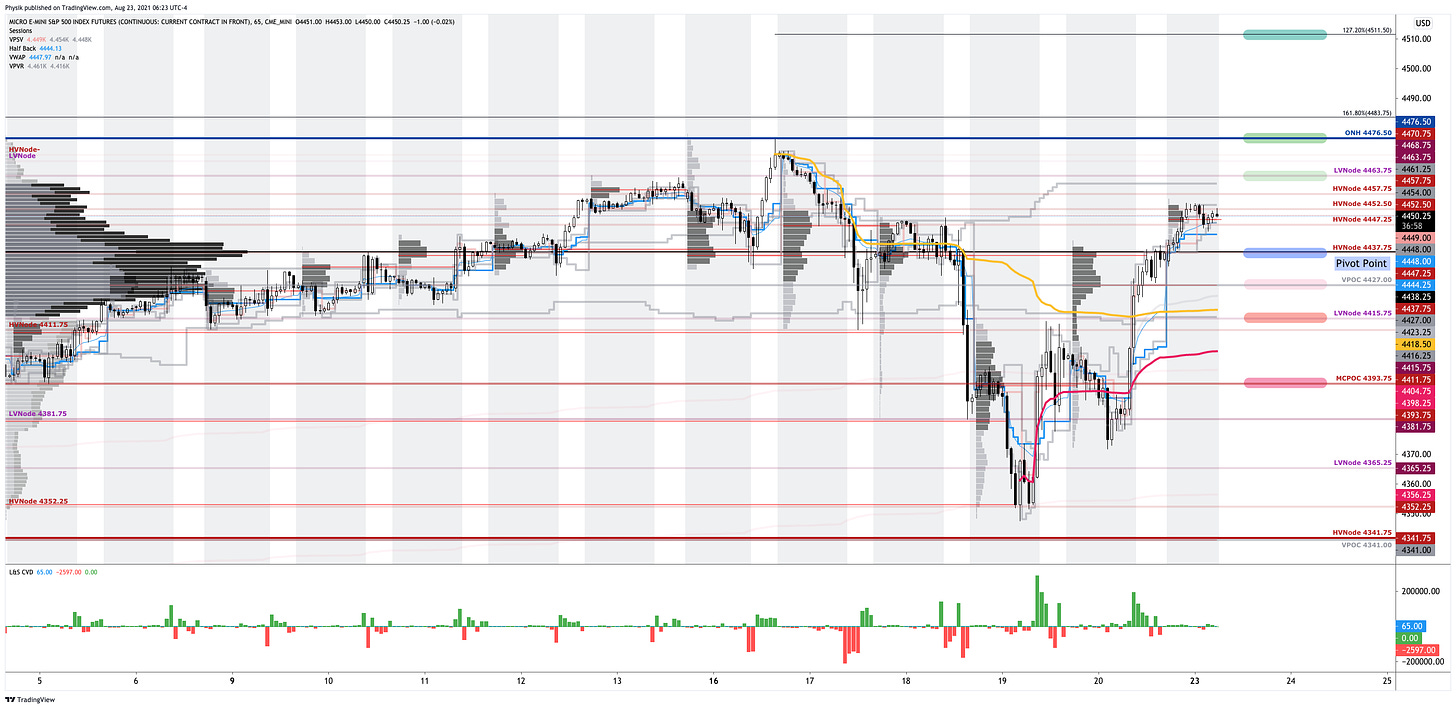

What To Expect: As of 6:20 AM ET, Monday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 will likely open just outside of prior-range and -value, suggesting a potential for immediate directional opportunity.

Adding, during Friday’s regular trade, on stronger intraday breadth and market liquidity metrics, the best-case outcome occurred, evidenced by trade above the spike base a few ticks below the $4,422.75 balance area high (BAH). This is significant because the post-FOMC minutes liquidation has been negated.

Gap Scenarios In Play: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

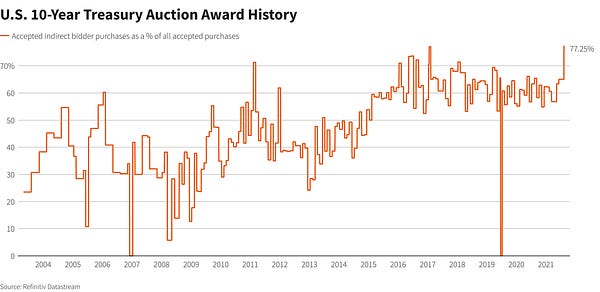

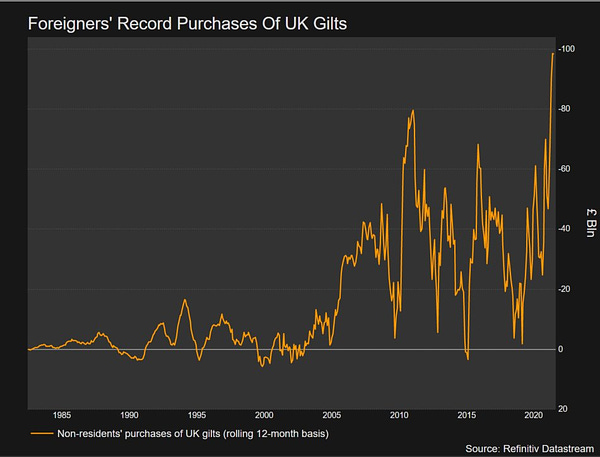

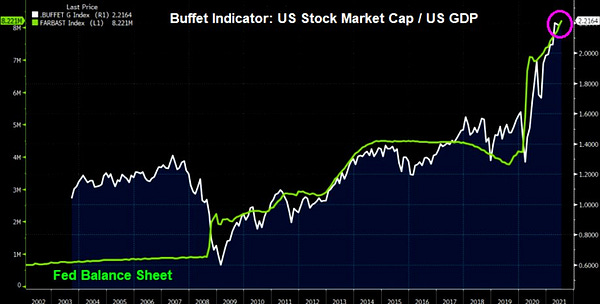

Further, the aforementioned trade is happening in the context of – most importantly – the Federal Reserve’s intent to taper asset purchases. This theme’s implications on price are contradictory; to elaborate, unemployment is falling rapidly, signaling to the Fed the need to reduce support.

“Bottom line, the critical element is inflation expectations,” former Fed Chairman Ben Bernanke says. “As long as they stay in the vicinity of 2%, the Fed’s strategy will achieve its goals. If inflation expectations were to move significantly higher, the Fed would be forced to tighten more quickly and probably slow the economy more than they would like.”

Ultimately, “[r]ising interest rates could be the kryptonite to the bubble in long-duration assets,” Rich Bernstein of Richard Bernstein Associates adds.

Moreover, for today, given expectations of heightened volatility and responsive trade into the Jackson Hole Economic Policy Symposium August 26-28, 2021, participants may make use of the following frameworks.

Responsive Buying (Selling): Buying (selling) in response to prices below (above) an area of recent price acceptance.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,437.75 high volume area (HVNode) puts in play the $4,463.75 low volume area (LVNode). Initiative trade beyond the LVNode could reach as high as the $4,476.50 overnight high (ONH) and $4,511.50 Fibonacci extension.

In the worst case, the S&P 500 trades lower; activity below the $4,437.75 HVNode puts in play the $4,427.00 untested point of control (VPOC). Initiative trade beyond the VPOC could reach as low as the $4,415.75 LVNode and $4,393.75 micro composite point of control (MCPOC).

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

News And Analysis

Jay Powell’s policy revolution was blindsided.

EM central banks’ responses reflect recovery.

The pace of recovery critical to debt reduction.

China adds to list of steel giants with merger.

ECB rate hike bets losing out to dim inflation.

Activity in Japan’s services sector is shrinking.

Harris looks to assure U.S. allies over chaos.

The European services sector outperforming.

What People Are Saying

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a finance and technology reporter. Some of his biggest works include interviews with leaders such as John Chambers, founder and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.