Market Commentary

Equity index futures traded lower overnight.

COVID-19, SEC, and political tension.

Ahead: Retail sales, NAHB, and more.

Indexes positioned for sideways trade.

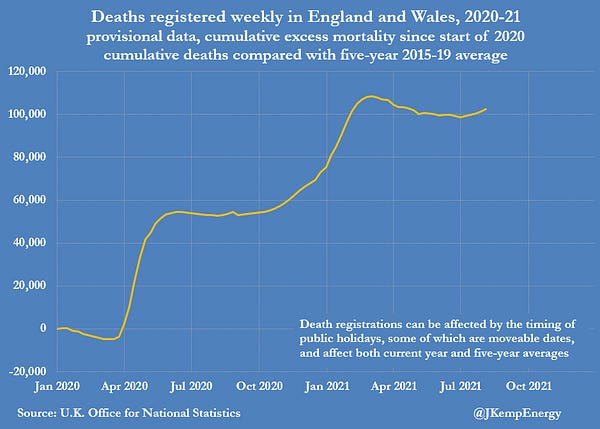

What Happened: U.S. stock index futures auctioned lower overnight alongside news of COVID-19 lockdowns, an SEC warning on Chinese company risks, and tensions in Afghanistan.

Ahead is data on retail sales (8:30 AM ET), industrial production (9:15 AM ET), capacity utilization (9:15 AM ET), business inventories (10:00 AM ET), and the NAHB home builders’ index (10:00 AM ET). Jerome Powell speaks at (1:00 PM ET) while Neel Kashkari is scheduled to speak at (3:45 PM ET).

What To Expect: As of 6:30 AM ET, Tuesday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 will likely open inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Adding, during the prior day’s regular trade, on weak intraday breadth and market liquidity metrics, the best case outcome occurred, evidenced by trade above the $4,447.75 high volume area (HVNode). This is significant because this initiative trade resulted in a new overnight all-time high (ONH) at $4,476.50. Typically, there is a low historical probability associated with overnight rally-highs ending the upside discovery process.

Gap Scenarios In Play: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

Further, the aforementioned trade is happening in the context of great earnings, pandemic-induced clampdowns on mobility, monetary and fiscal policy evolution, SEC comments against Chinese risks, as well as tension in Afghanistan.

With equities more so priced to perfection, the implications of the aforementioned themes on price would be thought of as contradictory; to elaborate, coming into potentially big fundamental catalysts like the Economic Policy Symposium in Jackson Hole, Wyoming, August 26-28, 2021, participants are positioned in such a manner that ought to dampen volatility.

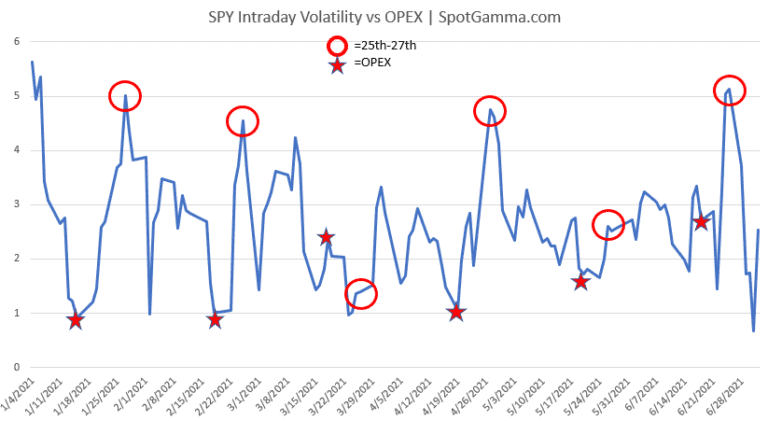

In light of the upcoming August options expiration (OPEX), we point to SpotGamma findings that suggest after OPEX, “the market tends to experience its largest intraday volatility which corresponds to the reduction in large options positions, and the hedging associated with them.”

Moreover, for today, given expectations of middling volatility and responsive trade, participants may make use of the following frameworks.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,456.75 low volume area (LVNode) puts in play the $4,463.75 LVNode. Initiative trade beyond the $4,463.75 LVNode could reach as high as the $4,476.50 overnight high (ONH) and $4,482.25 Fibonacci extension.

In the worst case, the S&P 500 trades lower; activity below the $4,456.75 LVNode likely puts in play the $4,447.25 HVNode. Initiative trade beyond the $4,447.25 HVNode could reach as low as the $4,437.00 untested point of control (VPOC) and $4,422.75 balance area high (BAH).

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

Balance (Two-Timeframe Or Bracket): Rotational trade that denotes current prices offer favorable entry and exit. Balance-areas make it easy to spot a change in the market (i.e., the transition from two-time frame trade, or balance, to one-time frame trade, or trend).

News And Analysis

Soros joined by D1, Soroban in the exit of Chinese stakes.

The White House attempts to balance climate, oil policies.

SPAC boom creates fresh target for short-sellers, activists.

Inflation cherry-pickers have trouble drowning out the noise.

The U.S. declared its first Western reservoir water shortage.

Michael Burry of ‘Big Short’ bet against Ark Invest’s ARKK.

President Joe Biden defended U.S. exits from Afghanistan.

Why Wood changed her ARKK ETF’s China exposure to 0.

What People Are Saying

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a finance and technology reporter. Some of his biggest works include interviews with leaders such as John Chambers, founder and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.