Editor’s Note: Happy Friday! If you found today’s note helpful, consider sharing!

Market Commentary

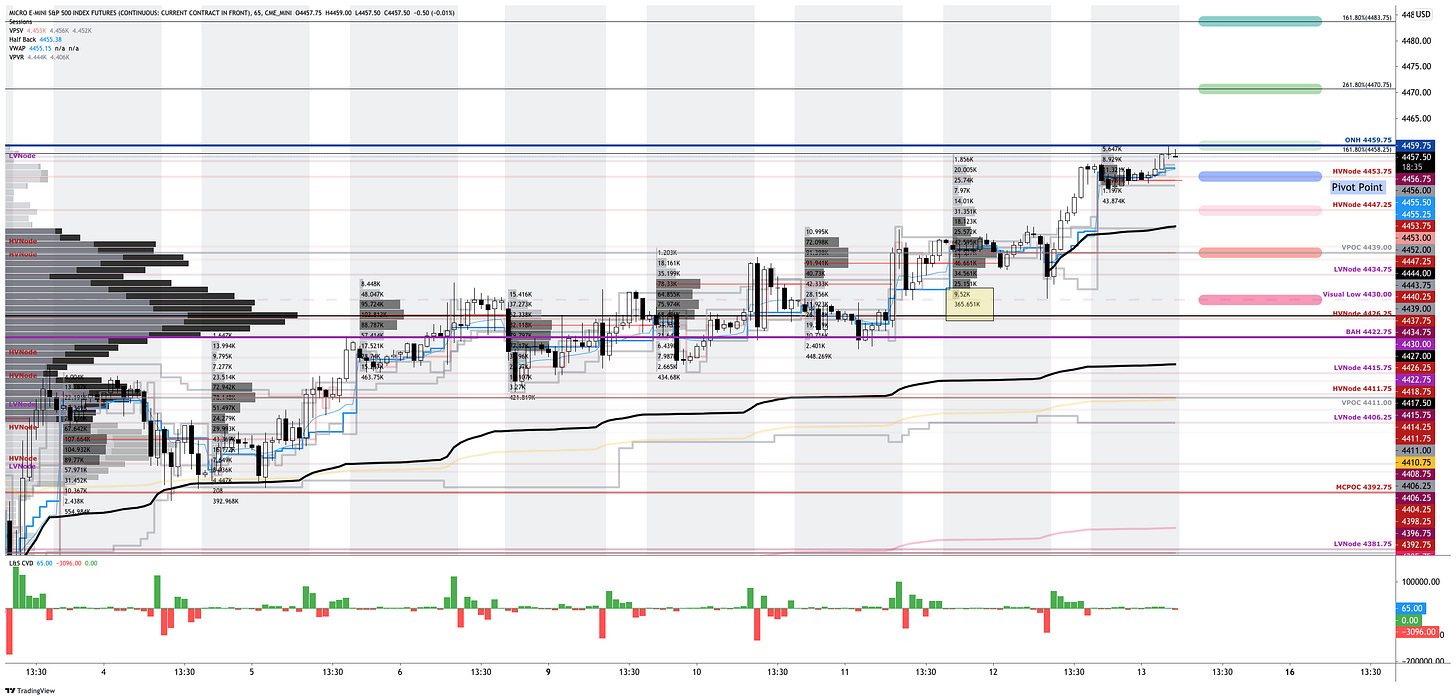

Equity index futures are sideways to higher on light volume and poor structure.

Themes of inflation, jobs, and liquidity.

Ahead: Import Price Index, Sentiment.

Yields drop; Nasdaq 100 strengthens.

What Happened: U.S. stock index futures auctioned sideways to higher alongside a dip in yields after data revealed persistence in business-related inflationary pressures and a drop in jobless claims.

“While inflation has been the overarching theme this week, U.S. jobless data from yesterday highlighted the improving employment backdrop as well,” said Jim Reid, a strategist at Deutsche Bank AG in London. “Yesterday’s U.S. producer prices surprised to the upside, highlighting the ongoing inflationary pressures from ever-rising commodity costs and supply chain bottlenecks.”

Ahead is data on the import price index (8:30 AM ET) and University of Michigan sentiment (10:00 AM ET).

What To Expect: As of 6:45 AM ET, Friday’s regular session (9:30 AM - 4:00 PM EST) in the S&P 500 will likely open outside of prior-range and -value, suggesting a higher potential for immediate directional opportunity.

Adding, during the prior day’s regular trade, on weak intraday breadth and market liquidity metrics, the best case outcome occurred, evidenced by trade above the $4,434.75 low volume area (LVNode). This is significant because the aforementioned advance and overnight gap occurred in the face of light volume, poor structure, and unsupportive breadth.

Gap Scenarios In Play: Gaps ought to fill quickly. Should they not, that’s a signal of strength; do not fade. Leaving value behind on a gap-fill or failing to fill a gap (i.e., remaining outside of the prior session’s range) is a go-with indicator.

Auctioning and spending at least 1-hour of trade back in the prior range suggests a lack of conviction; in such a case, do not follow the direction of the most recent initiative activity.

Further, the aforementioned trade is happening in the context of liquidity concerns. This theme’s implications on price are contradictory; to elaborate, the gap between the rates of growth in the supply of money and the gross domestic product turned negative for the first time since 2018.

“Put another way, the recovering economy is now drinking from a punch bowl that the stock market once had all to itself,” said Doug Ramsey, Leuthold Group’s chief investment officer.

Moreover, for today, given expectations of middling volatility and responsive trade, amid Friday’s options expiration (OPEX), participants may make use of the following frameworks.

Options Expiration (OPEX): Option expiries mark an end to pinning (i.e, the theory that market makers and institutions short options move stocks to the point where the greatest dollar value of contracts will expire worthless) and the reduction dealer gamma exposure.

Responsive Buying (Selling): Buying (selling) in response to prices below (above) an area of recent price acceptance.

In the best case, the S&P 500 trades sideways or higher; activity above the $4,453.75 high volume area (HVNode) pivot puts in play the $4,459.75 overnight high (ONH). Initiative trade beyond the ONH could reach as high as the $4,470.75 and $4,483.75 Fibonacci extensions.

In the worst case, the S&P 500 trades lower; activity below the $4,453.75 HVNode pivot puts in play the $4,447.25 HVNode. Initiative trade beyond the HVNode could reach as low as the $4,439.00 untested point of control (VPOC) and $4,430.00, a visual low likely generated by short-term (i.e., technically driven) participants who may be unable to defend retests.

Overnight Rally Highs (Lows): Typically, there is a low historical probability associated with overnight rally-highs (lows) ending the upside (downside) discovery process.

Volume Areas: A structurally sound market will build on past areas of high volume. Should the market trend for long periods of time, it will lack sound structure (identified as a low volume area which denotes directional conviction and ought to offer support on any test).

If participants were to auction and find acceptance into areas of prior low volume, then future discovery ought to be volatile and quick as participants look to areas of high volume for favorable entry or exit.

POCs: POCs are valuable as they denote areas where two-sided trade was most prevalent. Participants will respond to future tests of value as they offer favorable entry and exit.

Initiative Buying (Selling): Buying (selling) within or above (below) the previous day’s value area.

News And Analysis

Traders pile into tail-risk bets that Fed will not hike.

U.S. high yield default rate lowest start in 14 years.

The Treasury market keeps on humbling investors.

COVID downside risks are less than in prior waves.

What People Are Saying

About

After years of self-education, strategy development, and trial-and-error, Renato Leonard Capelj began trading full-time and founded Physik Invest to detail his methods, research, and performance in the markets.

Additionally, Capelj is a finance and technology reporter. Some of his biggest works include interviews with leaders such as John Chambers, founder and CEO, JC2 Ventures, Kevin O’Leary, businessman and Shark Tank host, Catherine Wood, CEO and CIO, ARK Invest, among others.

Disclaimer

At this time, Physik Invest does not manage outside capital and is not licensed. In no way should the materials herein be construed as advice. Derivatives carry a substantial risk of loss. All content is for informational purposes only.